POST MARKET

Indian benchmark indices Nifty and Sensex ended on a positive note in the volatile session on May 2. Nifty witnessed buying interest in the first half but faced profit booking in the latter part, settling on a flat note

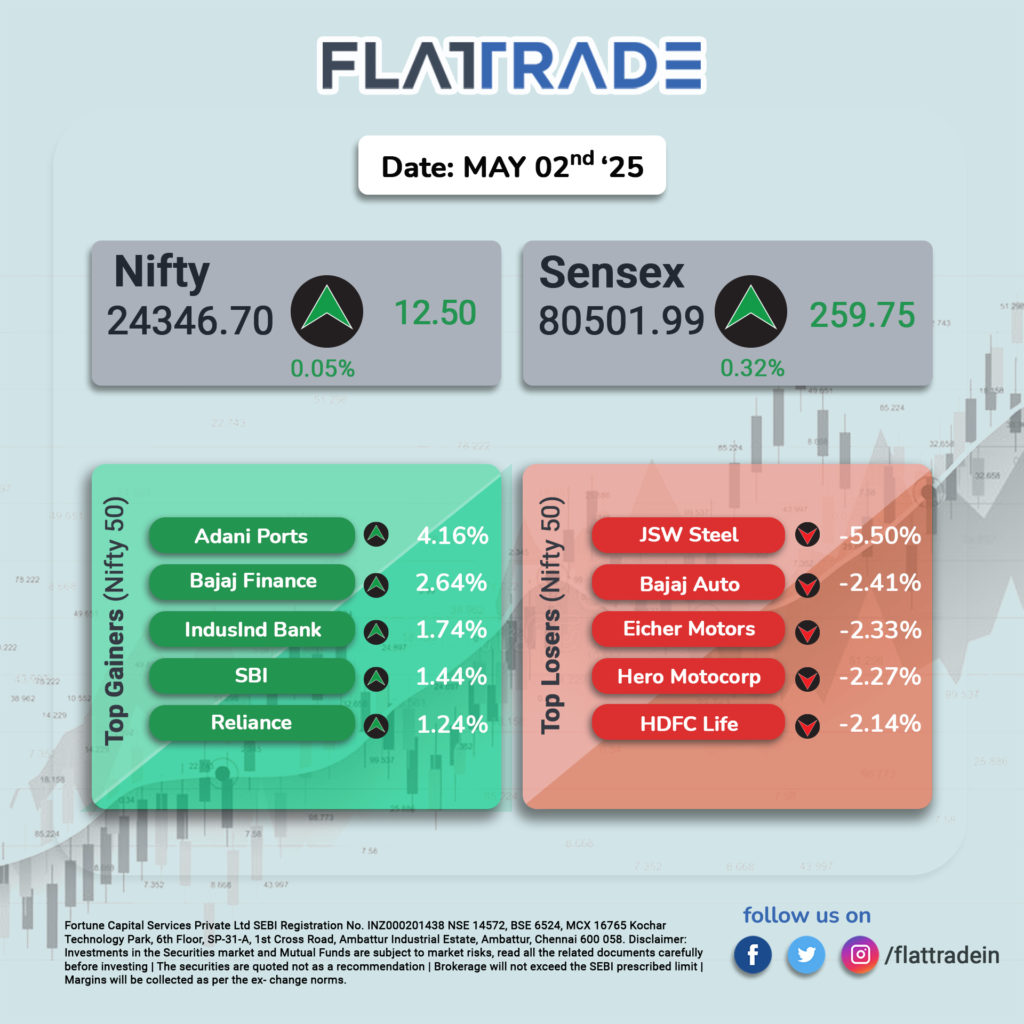

At close, the Sensex was up 259.75 points or 0.32 percent at 80,501.99, and the Nifty was up 12.50 points or 0.05 percent at 24,346.70. About 1672 shares advanced, 2122 shares declined, and 134 shares remained unchanged.

Adani Ports, IndusInd Bank, Bajaj Finance, Reliance Industries, SBI were among top gainers on the Nifty, while losers included JSW Steel, Eicher Motors, Bajaj Auto, Hero MotoCorp, HDFC Life.

On the sectoral front, media, energy, IT, oil & gas up 0.3-0.7 percent, while power, metal, telecom, pharma, realty, consumer durables down 0.5-2 percent.

The broader market indices perfomed weak as, BSE Midcap index was down 0.4 percent, while smallcap index ended flat.

STOCKS TODAY

Adani Ports

The shares surged over 5 percent following Q4FY25 results that reflected a 7.5x jump in net profit (including a one-time exceptional gain), to reach Rs 3,844.91 crore. Motilal Oswal has maintained a ‘Buy’ rating on the stock, signaling continued confidence in the company’s performance.

Mankind Pharma

Shares of the company dropped 4% after Macquarie downgraded the stock to ‘Underperform’. The international brokerage also slashed the pharma company’s earnings estimates for FY25, FY26, and FY27 by 17 percent, 24 percent, and 17 percent, respectively, citing earnings dilution following the BSV acquisition.

TVS Motors

The company’s shares rose by 3 percent intraday. This comes after the company reported a sales growth of 16 percent YoY to 4.44 lakh units in April 2025. Its EV sales grew 59 percent, while exports increased 45 percent. Three-wheeler sales also grew 50 percent to 13,566 units in the month.

Divi’s Labs

The Indian multinational pharmaceutical company faced a significant surge in trading volume with 24,583 shares exchanged on May 2. This caused the shares to increase by a 0.83% rise in price to reach Rs 6,138.00. The surge in volume suggests heightened investor interest in the stock.

Greenply Industries

The shares of the company fell by 2.3 percent in today’s session after the company’s consolidated quarterly numbers were released. Net Sales was up by 8.17 percent at Rs 648.77 crore. However, the firm’s EPS decreased to Rs. 1.33 in March 2025 from Rs. 2.63 in March 2024.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.