POST MARKET

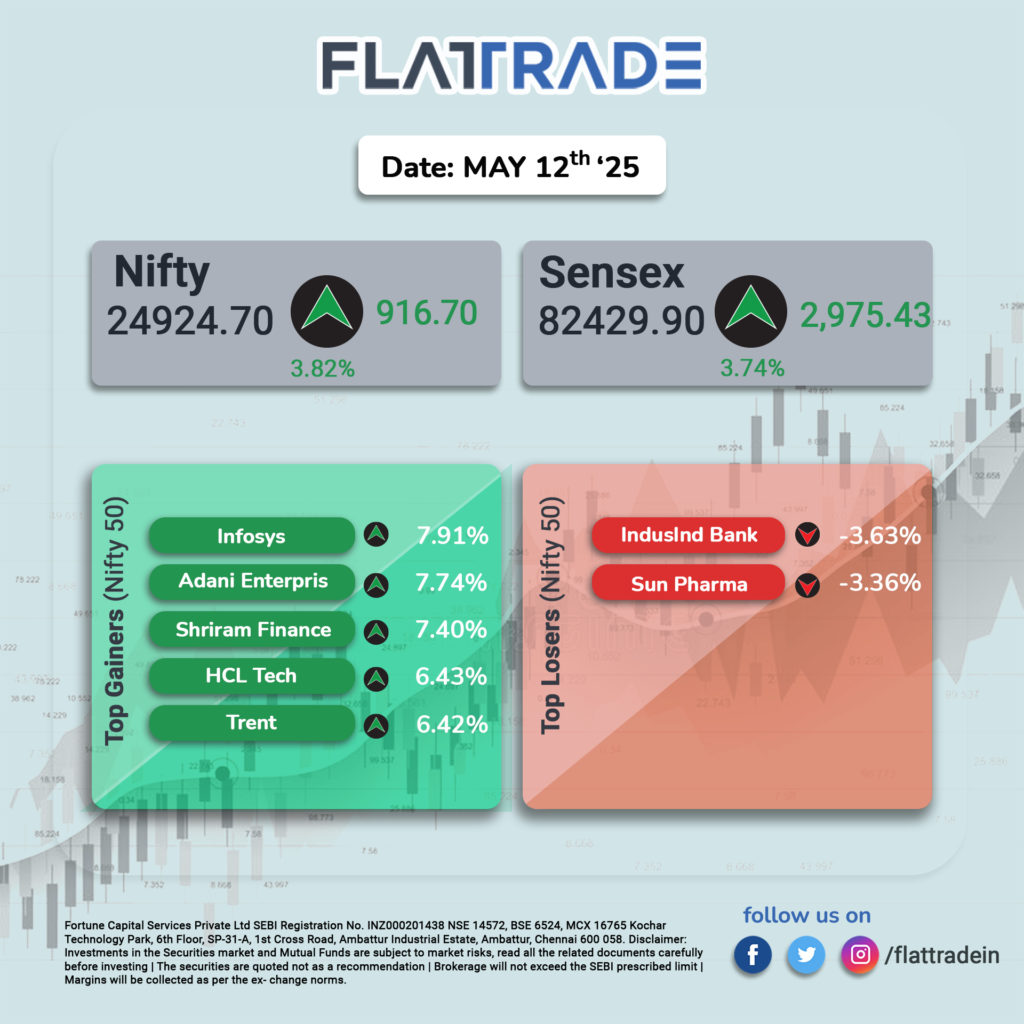

Indian equity indices ended on a strong note on May 12 and snapped a two-day losing streak to record their best day in four years in percentage terms.

At close, the Sensex was up 2,975.43 points or 3.74 percent at 82,429.90, and the Nifty was up 916.70 points or 3.82 percent at 24,924.70. About 3375 shares advanced, 585 shares declined, and 127 shares remained unchanged.

The biggest Nifty gainers included Infosys, Adani Enterprises, Shriram Finance, Trent, HCL Technologies, while losers were Sun Pharma and IndusInd Bank.

All the sectoral indices ended in the green with realty, power, IT, and energy up 4-6%.

The broader market indices performed strongly with the BSE Midcap index up by 3.8 percent and the smallcap index rose 4 percent.

STOKS TODAY

Birla Corporation

The company’s share price surged 20 percent on Monday, May 12, as investors cheered the earnings show for the quarter ended March. The firm reported a 32.8 percent year-on-year rise in net profit for Q4, with earnings climbing to Rs 256.6 crore for the quarter ended March 31, 2025, up from Rs 193.3 crore a year ago.

Pidilite Industries

Pidilite Industries shares rose over 3.3 percent to Rs 3,080 per share, after the adhesive conglomerate posted an upbeat Q4 report. Pidilite Industries reported consolidated revenue growth of 8 percent year-on-year for the quarter ended in March. Profits for the quarter stood at Rs 1,550.3 crore.

YES Bank

Private lender Yes Bank shares soared two percent in trade on Monday, May 12, after Japan’s Sumitomo Mitsui Banking Corporation (SMBC) agreed to acquire a 20 percent stake in Yes Bank, marking one of the largest foreign investments in an Indian private bank. SBI and the seven other banks had invested in the Bank as part of the Yes Bank Reconstruction Scheme in March 2020.

Cipla

During today’s trading session, the shares saw a slight decline of 0.5 percent, contributing to the negative side of NIFTY 50. But soon the stock came back on track, closing on a positive note. The shares closed at Rs 1507.30 per share with a 1.84 percent increase. This is possibly due to the company’s strong financials, consistent positive cash flow, and the overall bullish market sentiment.

BEML

Defence stock BEML’s share price surged nearly 4.5% after announcing the acquisition of land in Madhya Pradesh for a new construction project, boosting investor confidence in the company’s growth prospects. The rising confidence is also led by the expected demand surge from the armed forces.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.