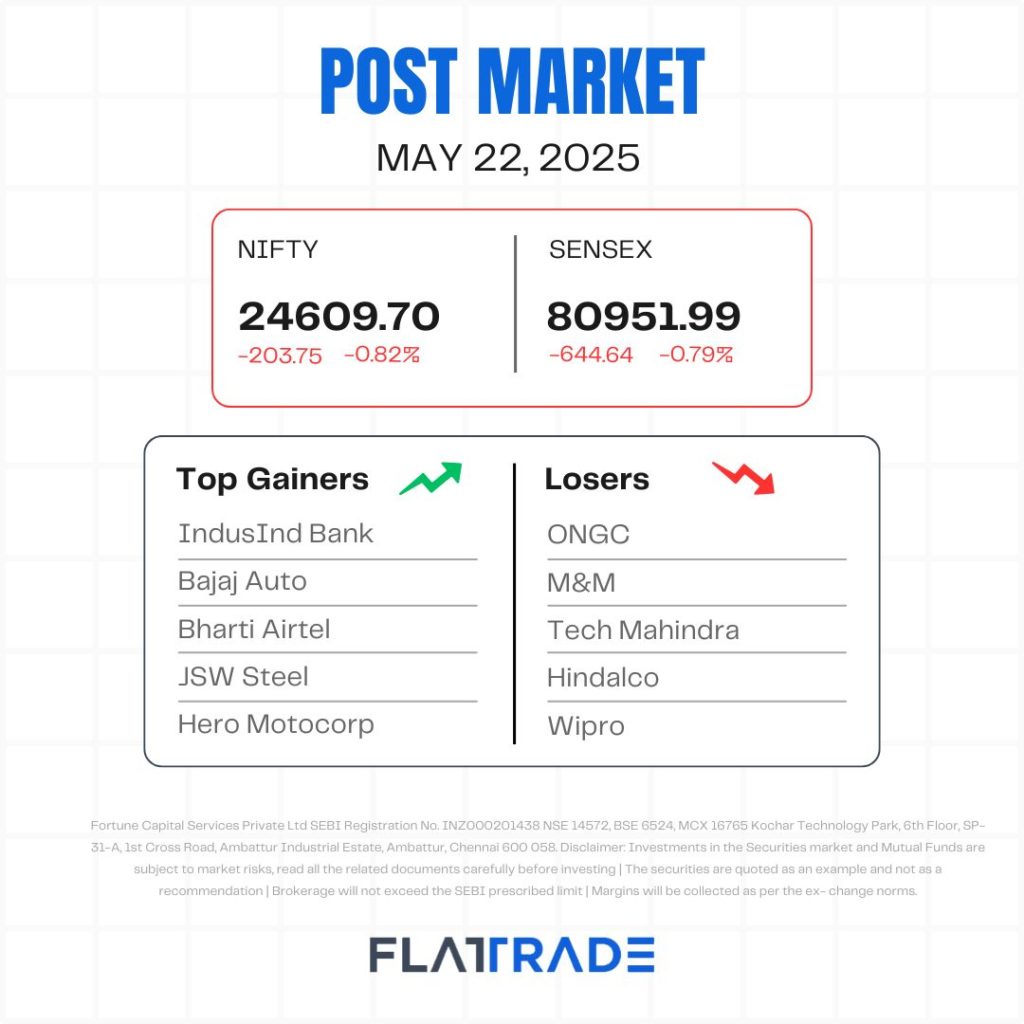

POST MARKET

Indian equity indices opened on a negative note due to weak global cues, remained under pressure throughout the day, and ultimately settled on a negative note.

At close, the Sensex was down 559.59 points or 0.69 percent at 81,037.04, and the Nifty was down 170.95 points or 0.69 percent at 24,642.50. About 1518 shares advanced, 1907 shares declined, and 128 shares remained unchanged.

IndusInd Bank, Bajaj Auto, Bharti Airtel, JSW Steel, and Hero Motocorp were among the major gainers on the Nifty, while losers were ONGC, M&M, Tech Mahindra, Hidalco, and Wipro.

Among sectoral gainers, Nifty Realty was the top performer, rising 1.7 percent, followed by Nifty Pharma and Nifty PSU Bank, which gained 1.3 percent and 0.7 percent, respectively. Other gainers included Nifty IT and Nifty Metal, which were up 0.7 percent and 0.4 percent, respectively. Among the losers, Nifty Consumer Durables declined 0.5 percent.

Broader markets also remained under pressure, although not at their lowest point, but the Midcap 100 and Smallcap 100 slipped 0.52 percent and 0.26 percent, respectively.

STOCKS TODAY

ONGC

The shares of Oil and Natural Gas Corporation (ONGC) dropped nearly 2 percent on May 22 after the company released its results for the fourth quarter of the financial year 2025. The shares of the company were hovering around Rs 244 apiece in the early trading hours. Q4 FY25 results of the Oil major were released in the post-market hours of May 21.

ABFRL

Shares of Aditya Birla Fashion and Retail (ABFRL) fell sharply by 67% to Rs 88.80 on the NSE in Thursday’s trade, marking the record date for the company’s previously approved demerger of its Madura Fashion & Lifestyle business into a separate listed entity. The 67% decline in the stock’s price is primarily due to the demerger ratio, under which shareholders of ABFRL will receive one equity share of Aditya Birla Lifestyle Brands Ltd (ABLBL) for every one equity share held in ABFRL.

Emcure Pharma

The company Emcure Pharma’s share price hit the 10 percent upper circuit after it reported a 64 percent jump in its consolidated net profit for the March quarter of 2025. The stock has been on the rise for the past two days. The company reported a 64.4 percent year-on-year (YoY) increase in net profit, which rose to Rs 189 crore in the Q4FY25, up from Rs 115 crore in the same period last year.

Colgate Palmolive

Shares of Colgate-Palmolive (India) fell over 5 percent after the company reported weaker-than-expected results for the March quarter, with both profit and sales declining year-on-year on softer urban demand and rising competition. The company posted a 6 percent drop in net profit to Rs 355 crore, compared to Rs 379.82 crore in the same period last year.

Interglobe Aviation

Shares of InterGlobe Aviation (Indigo Airlines) are higher in a weak market with an increase of around 1 percent, supported by a 62 percent on-year growth in net profit for the March quarter, with a range of brokerages raising price targets on the stock.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.