POST MARKET

The Indian equity indices rebounded on Wednesday, recovering from a three-day losing streak, supported by firm global cues and investor optimism around possible policy easing during the Reserve Bank of India (RBI) MPC meeting this Friday.

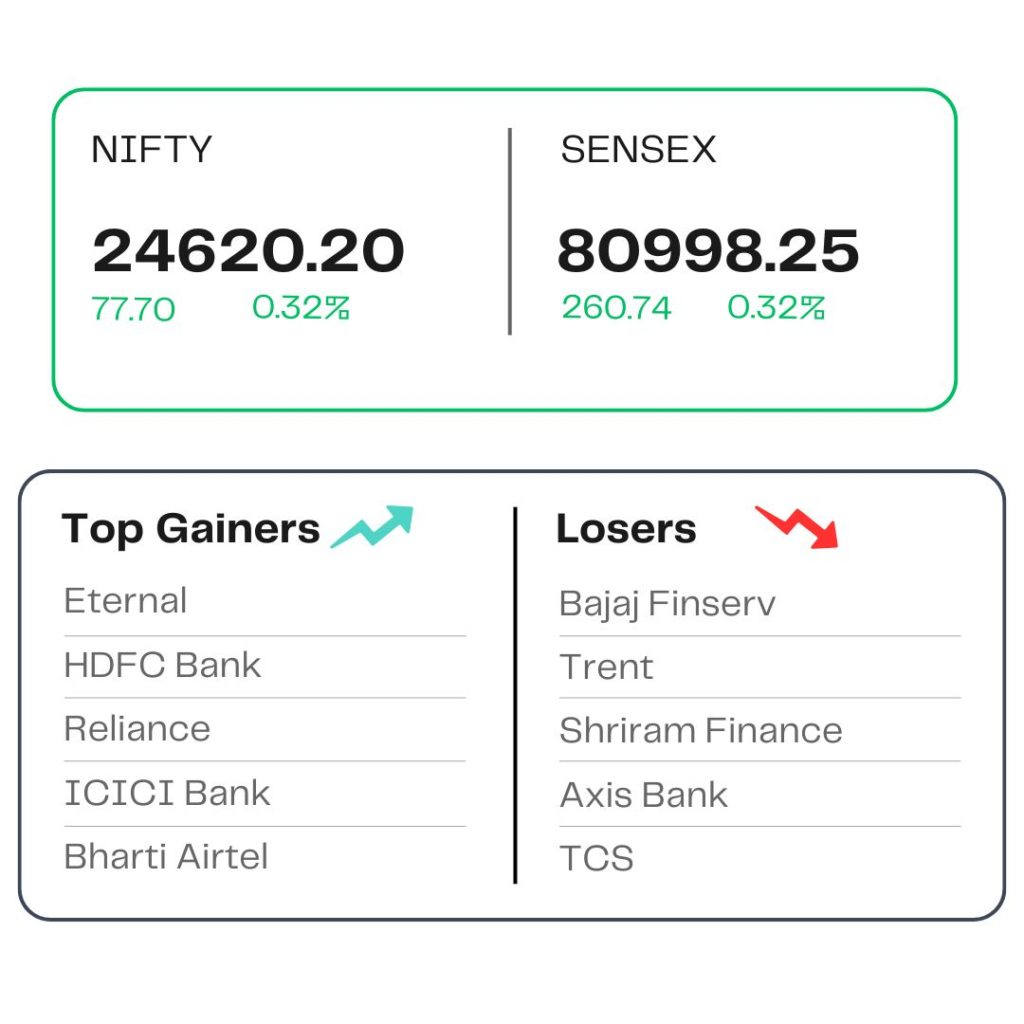

At close, the Sensex was up 260.74 points or 0.32 percent at 80,998.25, and the Nifty was up 77.70 points or 0.32 percent at 24,620.20. About 2017 shares advanced, 1835 shares declined, and 141 shares remained unchanged.

Eternal, Jio Financial, Bharti Airtel, IndusInd Bank, and Reliance Industries were among the major gainers on the Nifty, while losers were Trent, Bajaj Finserv, Shriram Finance, TCS, and Axis Bank.

On the sectoral front, the BSE Realty index was down 0.7 percent, while telecom, metal, oil & gas indices added 0.5-1 percent.

Among the broader market indices, BSE Midcap and smallcap indices rose 0.5 percent each.

STOCKS TODAY

Bharti Airtel

The stock rallied sharply as international brokerage Macquarie hiked its target price on the telecom player as the odds for the brokerage’s bull case on Airtel have improved. Macquarie lifted its one-year price target by 14 percent to Rs 2,050 per share, as the brokerage saw improving odds of its bull case, wherein shares can touch Rs 2,350.

Eternal

The stock rose 3 percent to become the top gainer on the Nifty on June 4 after Morgan Stanley reiterated it as its top pick in the space, citing the company’s leadership in both food delivery and quick commerce, efficient cost structure, and a strong balance sheet that reduces the risk of further equity dilution.

Motilal Oswal

The stock rose 2 percent on the back of a large trade deal worth Rs 334 crore. Motilal Oswal Financial Services saw 40.44 lakh equity shares worth Rs 334 crore change hands at Rs 826 per share. The likely sellers of the deal were not immediately known.

GRSE

Shares of Garden Reach Shipbuilders & Engineers (GRSE) jumped nearly 7 percent to hit a fresh record high of Rs 3,464 per share mid-day on June 4 after the company signed a memorandum of understanding (MoU) with Norway’s Kongsberg for the construction of India’s first-ever polar research vessel (PRV). Over the past month, the shares have rallied by over 60 percent.

Aditya Birla Fashion and Retail

The stock declined 10 percent as around 7.6 crore shares or 6.23 percent equity worth Rs 617 crore changed hands at Rs 81 per share. According to reports, Walmart-owned Flipkart was set to offload its entire 6 percent stake in ABFRL through a block deal estimated to be worth nearly Rs 600 crore, and Goldman Sachs is reported to be the broker facilitating the transaction.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.