POST MARKET

Indian equity indices ended on a strong note on June 6 after the RBI cut the repo rate by 50 basis points and CRR by 100 basis points.

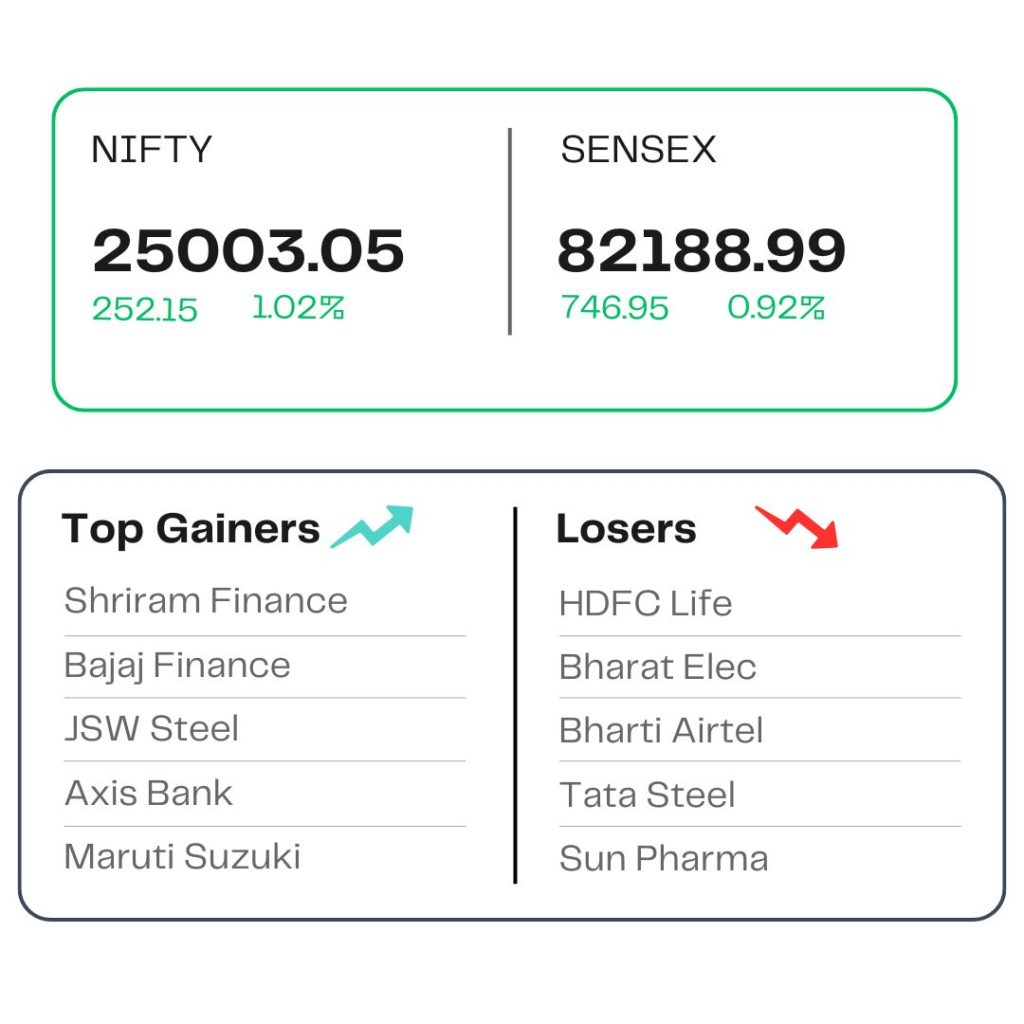

At close, the Sensex was up 746.95 points or 0.92 percent at 82,188.99, and the Nifty was up 252.15 points or 1.02 percent at 25,003.05. About 2163 shares advanced, 1712 shares declined, and 127 shares remained unchanged.

Biggest Nifty gainers included Shriram Finance, Bajaj Finance, JSW Steel, Axis Bank, Maruti Suzuki, while losers were HDFC Life, Bharat Electronics, Tata Steel, Bharti Airtel, Sun Pharma.

Except Media (down 1 percent), all other sectoral indices ended higher, with Realty rising more than 4 percent and metal, auto, and consumer durable jumping more than 1 percent each.

Broader market indices joined the rally, with, BSE midcap index adding 0.9 percent and the smallcap index jumping 0.4 percent.

STOCKS TODAY

Cochin Shipyard

Shares of Cochin Shipyard surged over 8 percent intraday but ended the day with a little over 1 percent increase, continuing their sharp upward trajectory for the fourth straight session, as optimism around increased defence spending both in India and globally lifted investor sentiment. The stock has seen an over 23 percent increase over the week.

Hi Tech Pipes

Shares of Hi-Tech Pipes surged more than 7 percent on Friday, driven by positive sentiment following the Reserve Bank of India’s 50 basis points (bps) rate cut, which lifted broader market indices and sparked buying across interest rate-sensitive and metal stocks. Additionally, SBI Securities tagged its ‘Buy’ rating on the small-cap counter.

Hindustan Zinc

The shares of Hindustan Zinc jumped nearly 3 percent following a fundraising move of Rs 5000 crore and also on signs that the bullish momentum in silver prices may be showing signs of further strength, sending the stock to a five-month high in early trade.

Silver’s future contracts with July expiry on the Multi Commodity Exchange (MCX) opened at a lifetime high of Rs 1,05,316 per kg.

Tata Investment Corporation

Shares of Tata Investment Corporation rallied nearly 3 percent to Rs 7,150 per share after reports suggested that Tata Capital is likely to receive approval from the Securities and Exchange Board of India (SEBI) for its upcoming initial public offering (IPO) worth nearly Rs 17,200 crore (equivalent to about $2 billion).

Azad Engineering

Shares of Hyderabad-based Azad Engineering Ltd sank nearly 6 percent at closing on June 6 after a block deal involving shares worth Rs 730 crore took place. Around 48 lakh shares or seven percent equity changed hands at an average of Rs 1,640 per share via block deals. This came as a 6.5 percent discount to the previous session’s closing price of Rs 1,753.6 per share on the NSE.

ECONOMY NEWS

RBI MPC Meeting

On June 6th, 2025, RBI’s MPC meeting decisions were announced. RBI announced a slash in the Cash Reserve Ratio (CRR) by 100 basis points to 3% and the Repo Rate by 50 basis points to 5.50%. As part of its third straight rate drop in 2025 (totaling 100 basis points), this “jumbo” move comes despite ongoing worries about slowing inflation and global economic slowdowns. CPI Inflation for FY26 cools down to 3.7 percent from the previous 4 percent. With a GDP estimate of roughly 6.5% for the fiscal year and market analysts praising the decision for strengthening borrowing and liquidity, economic forecasting is still cautious.

US Dollar declines amid economic weakness.

The dollar fell over the week due to uncertainty surrounding the ongoing trade talks between the U.S., China, and the EU, as well as indications of the U.S. economy’s fragility. Market observers are preparing for the next U.S. non-farm payrolls data, which is expected to reveal a slight increase of about 130,000 jobs as the unemployment rate stays close to 4.2%. The euro, pound, Australian dollar, and New Zealand dollar all saw gains as a result of the dollar’s decline, while Bitcoin had a 2.4% increase, rising beyond $102,900, indicating a flight to alternative assets in the face of erratic macroeconomic data.

AN OUTLOOK

- Important economic statistics, including GDP, inflation, and manufacturing activity, will be released in the US, UK, and India next week.

- Investors can use these figures to gauge the strength or weakness of the economy, and they may also have an impact on market mood and central bank policies.

- Interest rate decisions made by central banks such as the US Fed and RBI may be impacted by the outcomes.

- Traders and experts are thus getting ready to be vigilant for possibly abrupt movements in the bond, currency, and equity markets linked to these data points.

Source – Money Control, Reuters