POST MARKET

Indian equity indices extended gains for the fourth day on June 9, as positive global cues and domestic monetary policy actions supported the sentiment..

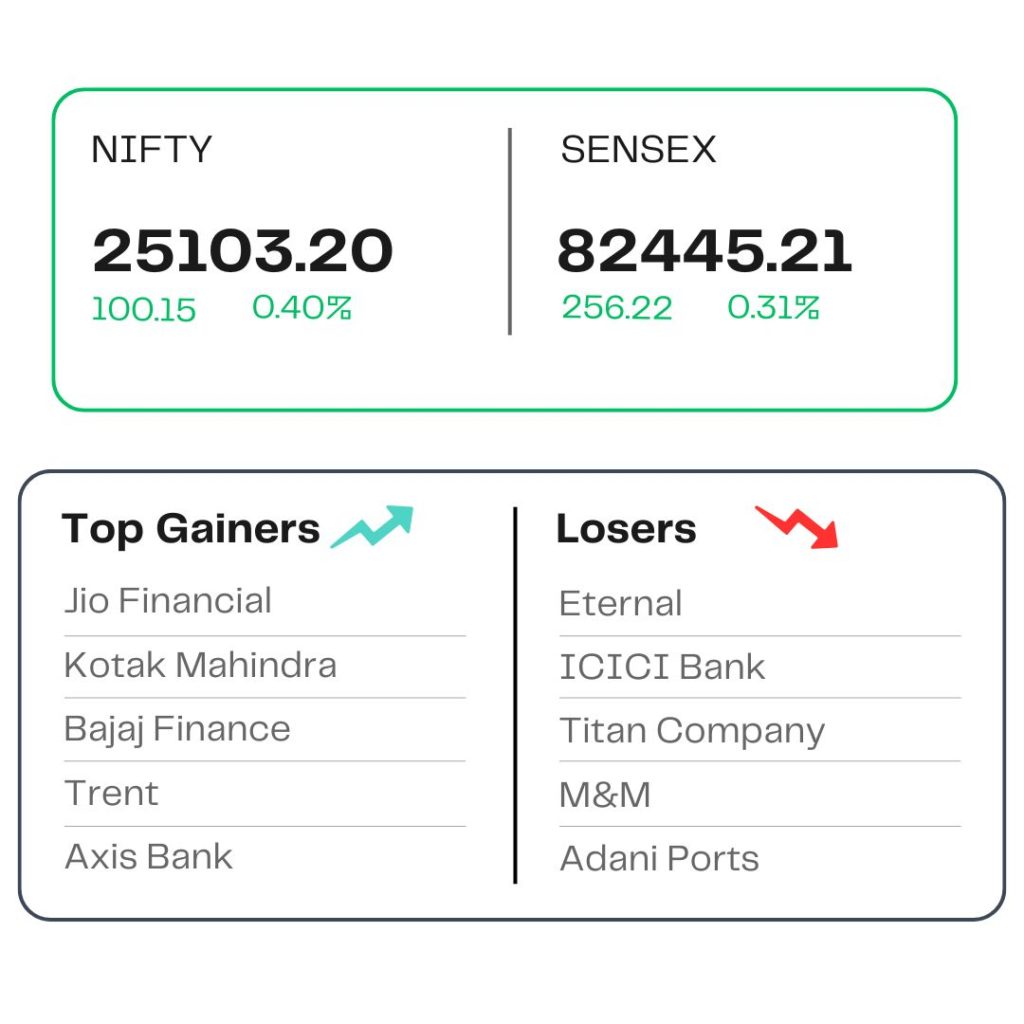

At close, the Sensex was up 256.22 points or 0.31 percent at 82,445.21, and the Nifty was up 100.15 points or 0.40 percent at 25,103.20. About 2667 shares advanced, 1374 shares declined, and 126 shares remained unchanged.

Bajaj Finance, Kotak Mahindra Bank, Axis Bank, Jio Financial, Trent were among major gainers on the Nifty, while losers were ICICI Bank, Titan Company, M&M, Adani Ports, Eternal.

All the sectoral indices, except the realty index, traded with gains. The Nifty IT, Nifty Media, and the Nifty PSU Bank led the gains, while the broader markets also rallied.

The broader market indices outperformed, with the Nifty Midcap index adding 1 percent and the Smallcap index rising 1.2 percent.

STOCKS TODAY

Swiggy

Shares of food delivery app Swiggy decreased 2.79 percent after multiple news reports suggested that the cab-hailing platform Rapido is set to enter the business with significantly lower commission charges compared to its more established rivals, further increasing competition. Shares of Eternal also reduced by nearly 2 percent.

MCX

Shares of MCX Ltd surged over 7 percent after the commodity exchange got SEBI’s approval to launch electricity derivatives. The electricity derivatives contracts to be introduced by MCX will help power distribution companies and large consumers to hedge against price volatility and manage price risks more effectively, by enhancing efficiency in the power market.

L&T Finance

Shares of L&T Finance (LTF) almost 2% on June 9 after the NBFC said it completed the acquisition of Paul Merchants Finance Ltd’s (PMFL) gold loan business. This acquisition includes PMFL’s 130 branches, approximately 700 employees, and the business transfer of its gold loan book size of Rs 1,350 crore to LTF.

Hyundai Motor

The shares of Hyundai Motor India jumped nearly 6 percent to hit a fresh life-time high, posting the biggest single-day rise in nearly 11 weeks, after the management sounded bullish on export plans and shared a 7-8 percent growth forecast for overseas shipment from India. The shares have now extended gains for a fourth consecutive session, rising nearly 9 percent since June 2.

Suzlon Energy

Wind energy player Suzlon Energy Ltd shares gained almost a percent in today’s trade, after a large trade involving shares worth almost Rs 1,300 crore took place in the block deal window. Around 19.81 crore shares, representing 1.45 percent equity, changed hands. The total deal was valued at around Rs 1,309 crore, with shares exchanged at Rs 66 apiece.

Source – Money Control