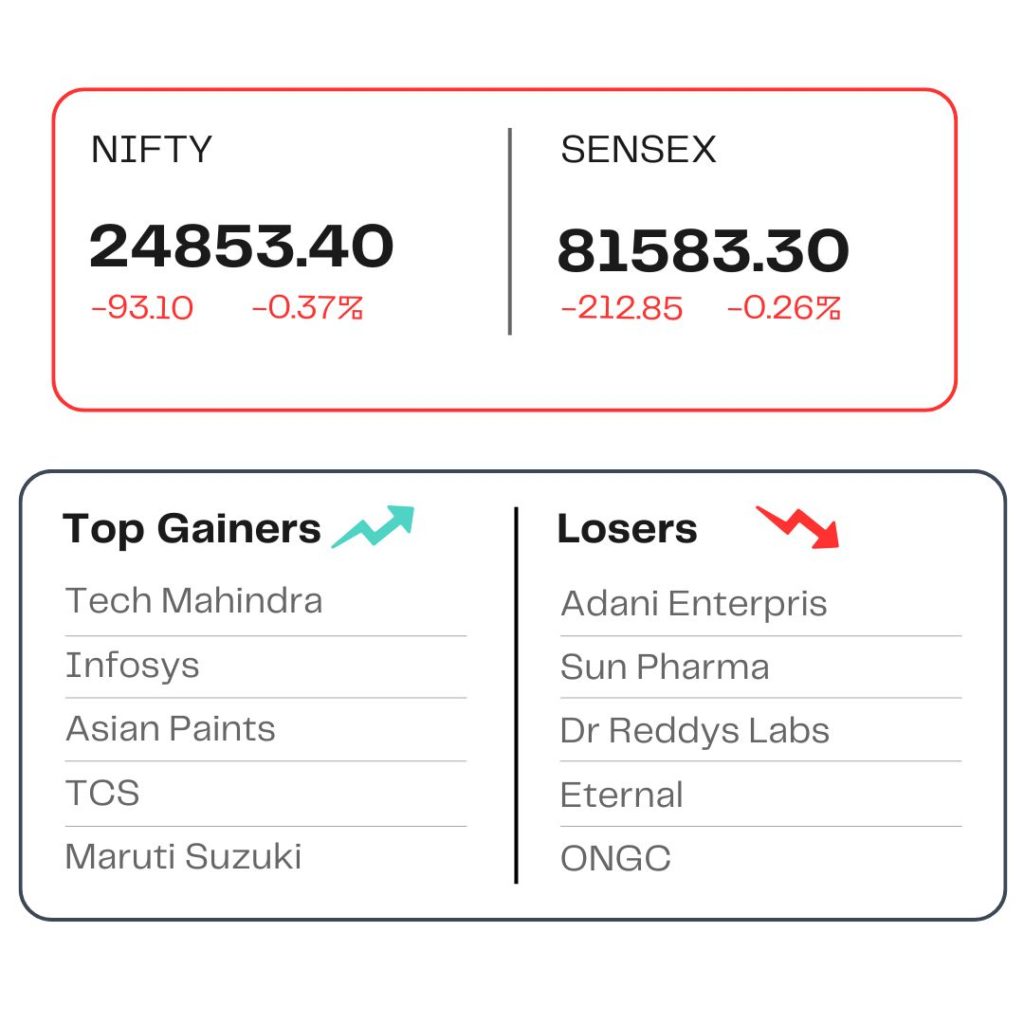

The Indian stock market saw a drastic fall on Tuesday, June 17, 2025, with both the benchmark indices Sensex and Nifty 50—finishing in the red. The BSE Sensex fell by more than 212 points to close at 81,583, while the Nifty 50 fell below the crucial mark of 25,000, ending at approximately 24,853, down by almost 0.37%.

Indian markets fell as geopolitical tensions rose. Donald Trump‘s appeal to American citizens to leave Iran increased the fear of escalation, sending crude prices up and negatively affecting sentiment in emerging markets. Profit-booking in financials, automobiles, metals, and oil & gas also contributed to the pressure. Broader indices experienced soft corrections with global macro uncertainty. FIIs also turned net sellers, further pulling the market down

Stocks in News

MCX:

The commodities exchange was the top performer, rising more than 2.5% to a new high of ₹8,021.50. The rally came on the back of a report that MCX is getting ready to introduce electricity derivatives later this year-a first for India. The initiative is viewed as a significant move toward diversifying its product lines, and analysts think it can materially increase trading volumes and profitability.

Mastek:

The firm added around 2.4% after news broke of the firm winning a significant order in the area of cybersecurity. Though information regarding the client or deal value was not provided, the news has rekindled interest in the mid-cap IT segment.

Navin Fluorine:

The stock recorded a rally of approximately 4.2%, following a positive “Buy“ recommendation by Jefferies, which envisages upside in its specialty chemicals business. The brokerage pointed towards upbeat management commentary and expected margin growth in the quarters ahead.

Vishal Mega Mart:

The shares dropped by almost 6.6% after a series of block deals. The big trades had investors raising eyebrows over possible offloading by major shareholders, which put the stock under pressure.

Tata Motors:

The stock edged down close to 1%, further extending its recent fall. Market players attributed weakness in its JLR business prospects, specifically apprehensions over operating margins, as one of the main reasons for the fall.

Source: Moneycontrol, Economic Times