On another turbulent day on June 18, benchmark indices closed lower for the second session in succession, as investors remained on their guard ahead of the US Federal Reserve announcement later tonight, and the continuing tensions in the Middle East.

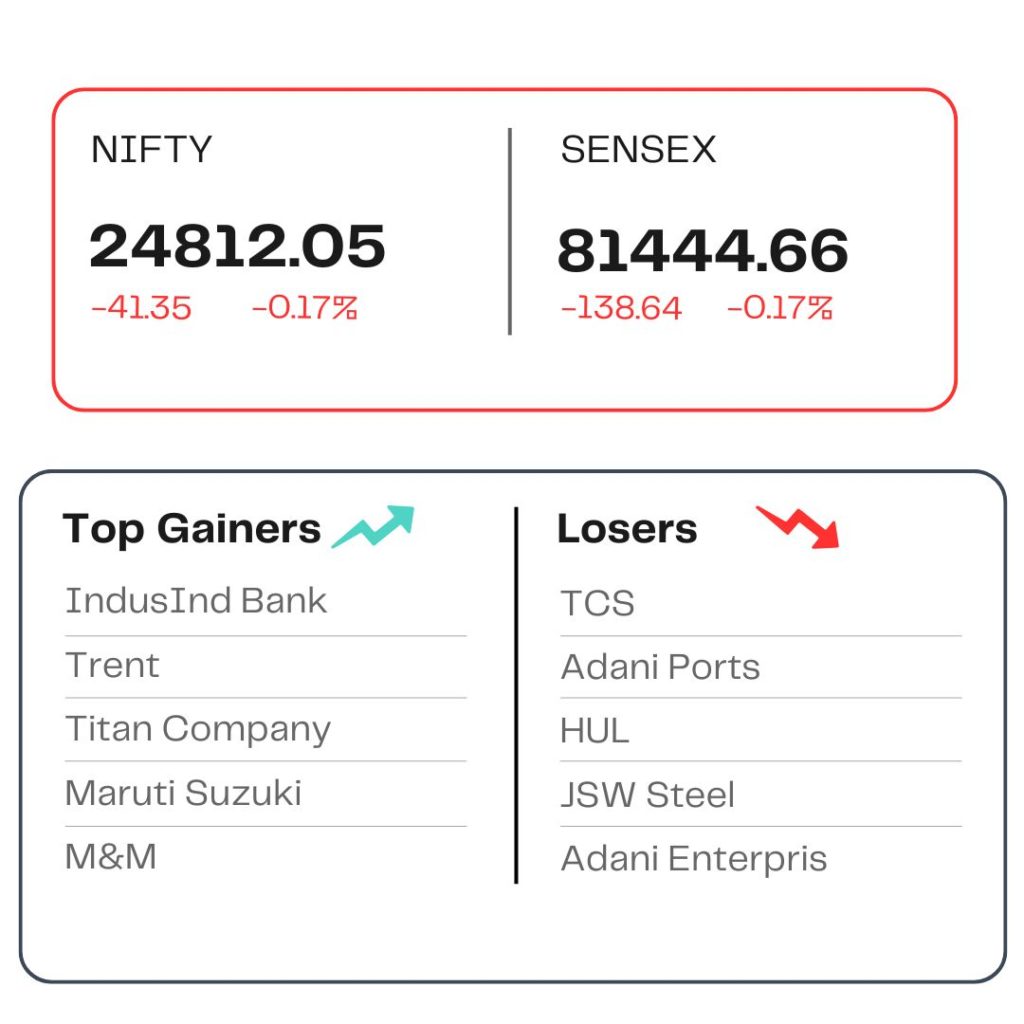

At close, the Sensex lost 138.64 points or 0.17 percent at 81,444.66, and the Nifty lost 41.35 points or 0.17 percent at 24,812.05. The laggard performance of the broader market indices was seen again as BSE mid and smallcap indices lost 0.3 percent each.

On the sectoral side, with the exception of auto, private bank, consumer durables, all the other indices closed in the red with IT, media, metal, oil & gas, realty losing 0.5-1 percent.

Stock in News

Stocks of Hindustan Zinc plunged 7 percent to Rs 452.5 during morning trade on June 18 after Vedanta sold a 1.71 percent or 7.2 crore shares of the firm through block deals on Wednesday and the deal size was likely to be around Rs 3,323 crore.

Shares of One MobiKwik Systems Ltd., the parent entity of MobiKwik digital payments platform, dropped as much as 8 percent to Rs 247 intraday as the six-month lock-in for pre-IPO shareholders expired today.

IndusInd Bank shares increased by 3.5 percent to Rs 838 per share on June 18 after global broker Nomura upgraded the stock‘s rating to “buy.” It also increased the target price to Rs 1,050 from Rs 700, signaling a possible upside of 25 percent from the present level.

The stock of Adani Ports & Special Economic Zone (APEZ) fell nearly 2 percent on June 18 to hover around Rs 1,369 per unit in the afternoon. The stock has now extended losses to sixth straight session as investors are still worried about the possible danger to its flagship port in Israel due to the present conflict in the Middle East.

Trent‘s shares recorded significant gains on June 18 as investors praised bullish reports released by brokerages for the company. Shares of the company rose more than 2 percent to an intraday high of Rs 5,740 per share.

Source: Moneycontrol