POST MARKET

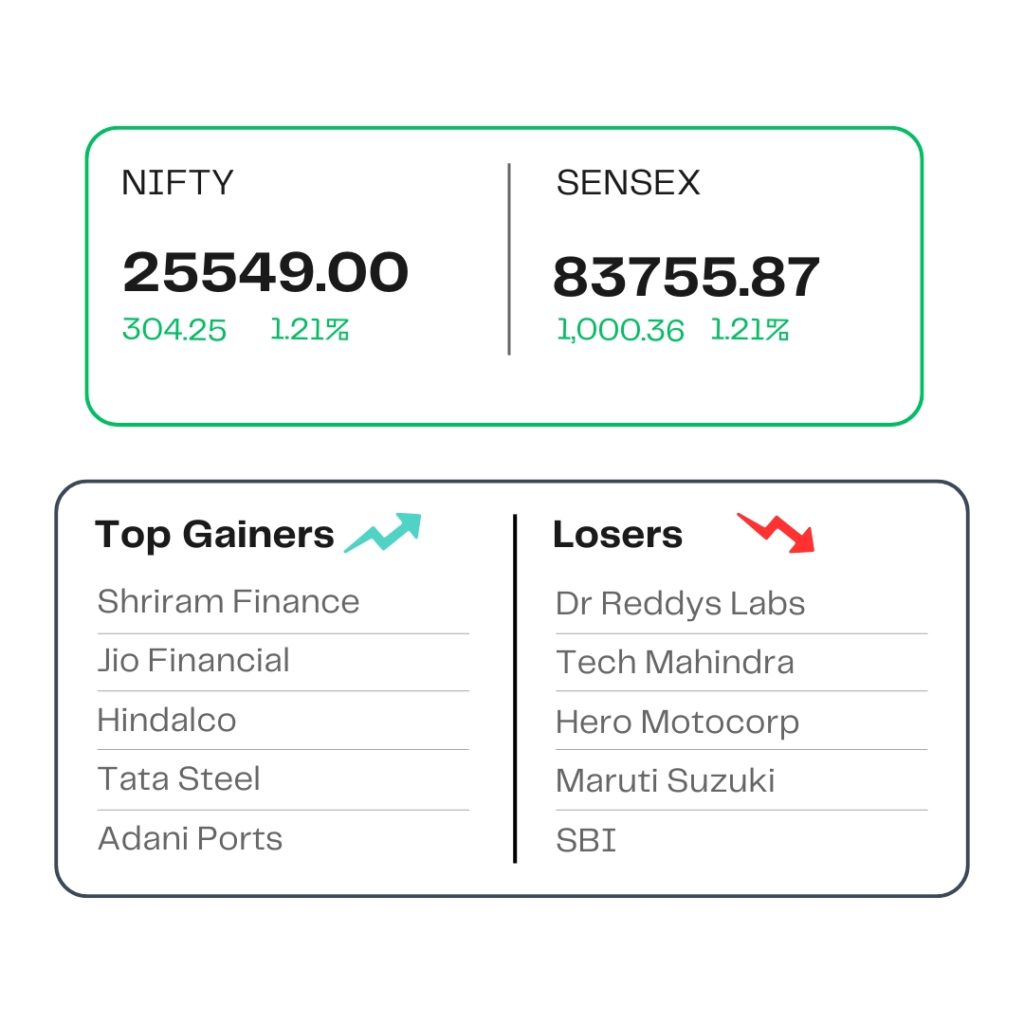

The Indian equity indices extended their gains for the third consecutive session on Thursday, with the Sensex and Nifty rising over 1 percent, supported by positive global cues and easing geopolitical tensions.

At close, the Sensex was up 1,000.36 points or 1.21 percent at 83,755.87, and the Nifty was up 304.25 points or 1.21 percent at 25,549. About 1983 shares advanced, 1855 shares declined, and 151 shares remained unchanged.

The biggest Nifty gainers were Shriram Finance, Hindalco Industries, Tata Steel, Jio Financial, Adani Ports, while losers were Dr Reddy’s Laboratories, Tech Mahindra, Hero MotoCorp, Maruti Suzuki, and SBI.

Among sectors, private bank, oil & gas, and metal indices are up 1-2 percent, while realty, media indices shed 1 percent each.

The broader market indices closed with the BSE midcap index rising 0.5 percent and the smallcap index ending flat.

STOCKS TODAY

Bharti Airtel

The shares jumped over 2 percent on June 26 to hit a fresh record high of Rs 2,003.80 apiece on the BSE. The telecom stock has now recorded gains in six out of the past seven sessions, rising over 8 percent during the period. Bharti Airtel shares have gained over 25 percent so far in 2025. The stock has jumped nearly 37 percent in the past year, and over 263 percent in the past five years.

HDFC Bank

Shares rose 2 percent and helped Bank Nifty hit a fresh record high. Experts say that the Reserve Bank of India’s (RBI) move to relax project finance regulations to make lending more affordable for infrastructure and industrial projects is a positive. While the draft guidelines had proposed sharply higher provisioning requirements of up to 5 percent during the construction phase, the final norms are significantly more lenient.

Interglobe Aviation

Shares of Interglobe Aviation extended gains for a fifth straight session after B&K Securities initiated coverage with a buy rating, citing India’s robust, underpenetrated air travel market. B&K expects sustained demand-supply imbalance due to ongoing aircraft supply constraints, which should support fares and profitability.

Om Infra

The small-cap company’s shares gained over 7 percent after it announced on June 25 that it had won an order worth Rs 199 crore for Turnkey contract execution for hydro mechanical works for “India’s largest power generation project” of 2880 MW Dibang Project from NHPC in Arunachal Pradesh. The order needs to be executed within 46 months from the date of commencement.

One Mobikwik Systems

The share soared over 12 percent after 9 percent equity in the firm, worth Rs 168 crore, was exchanged in the block deal window on Thursday, June 26. Net1 Applied Technologies Netherlands BV, an arm of South Africa’s Net1 UEPS Technologies, was preparing to offload around 8 percent of its holdings in the firm.

Source – Money Control