POST MARKET

Indian equity indices ended on a negative note, dragged down by sharp declines in private bank, auto, and metal stocks, snapping a four-day winning streak.

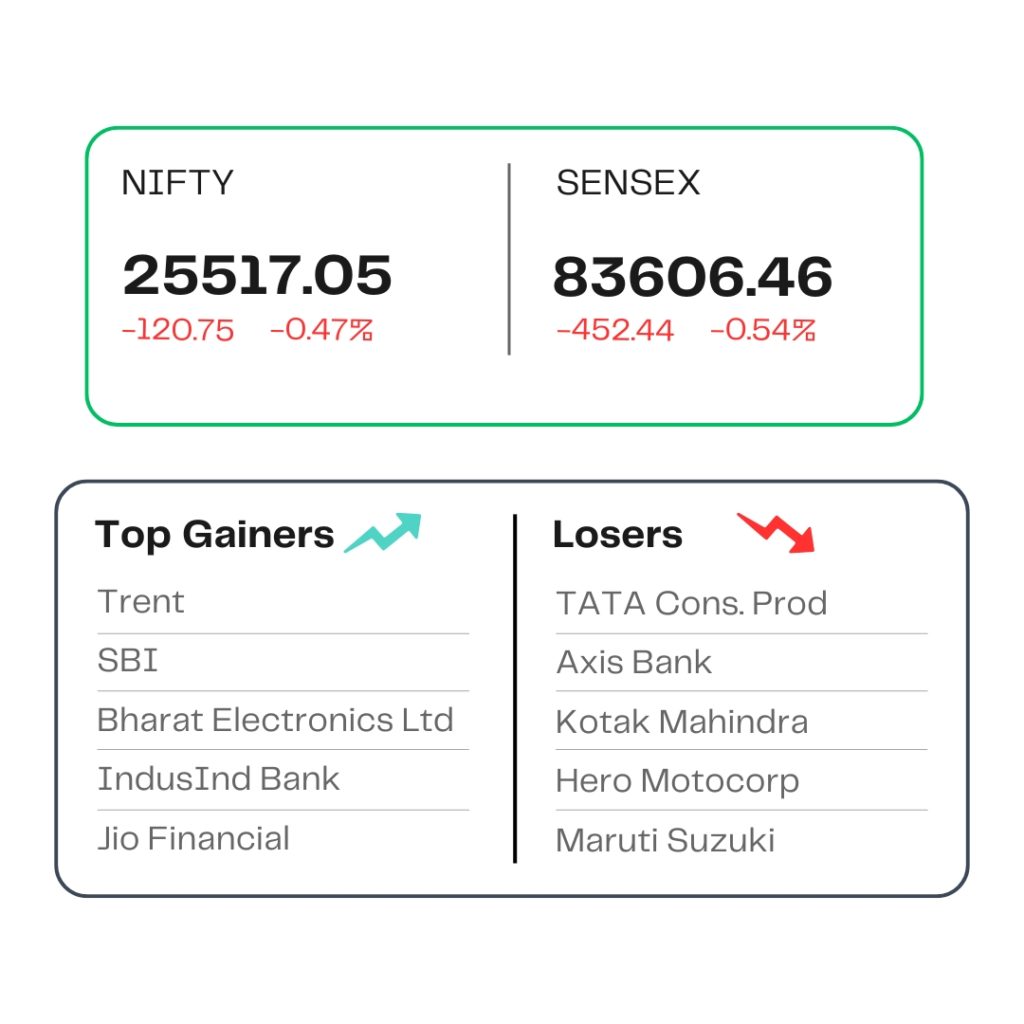

At close, the Sensex was down 452.44 points or 0.54 percent at 83,606.46, and the Nifty was down 120.75 points or 0.47 percent at 25,517.05. About 2288 shares advanced, 1674 shares declined, and 160 shares remained unchanged.

Tata Consumer, Axis Bank, Kotak Mahindra Bank, Hero MotoCorp, and Maruti Suzuki were among the major losers on the Nifty, while gainers were Trent, SBI, IndusInd Bank, Bharat Electronics, and Jio Financial.

On the sectoral front, the PSU Bank index rose 2.6 percent, while realty, FMCG, auto, and metal ended in the red.

The broader market indices saw an increase, with the BSE Midcap index rising 0.6 percent and the smallcap index adding 0.8 percent, despite the muted sentiment in the market.

STOCKS TODAY

JB Chemicals

Shares nosedived as much as 7 percent after Torrent Pharmaceuticals acquired a controlling stake in the company from global private equity firm KKR at an equity valuation of Rs 25,689 crore (fully diluted basis). This marks the second-largest deal in India’s pharma sector, behind Sun Pharma’s 2015 acquisition of Ranbaxy.

IDBI Bank

Shares of the lender rallied as much as 4 percent after reports surfaced that the Centre is gearing up to invite financial bids for the lender. As per a report by CNBC-TV18, the government is close to finalising the share purchase agreement with potential buyers, and may soon seek approval from the ministerial panel overseeing the deal.

Waaree Energies

The renewable energy company’s shares surged 7 percent on June 30 after its subsidiary secured an order for the supply of 540 Megawatt (MW) solar modules. The order was secured from a US-based developer and owner-operator of utility-scale solar and energy storage projects.

Alembic Pharma

The share price surged as much as 13 percent on June 30 after the company received final approval from the US Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) for Doxorubicin Hydrochloride Liposome Injection in two dosage strengths — 20 mg/10 mL and 50 mg/25 mL single-dose vials.

Jyoti CNC Automation

The stock price tumbled as much as 6 percent as a large deal took place in the block deal window. Around 6.06 percent equity or 1.37 crore shares in the firm were traded through the block deal route for Rs 1,499 crore. The shares were exchanged at Rs 1,087 per share, implying a 3.7 percent discount from the previous session’s closing price.

Source – Money Control