POST MARKET

The benchmark equity indices bounced back from early losses to end higher on Tuesday, supported by trade deal optimism, firm cues from Asian markets, and fresh foreign fund inflows.

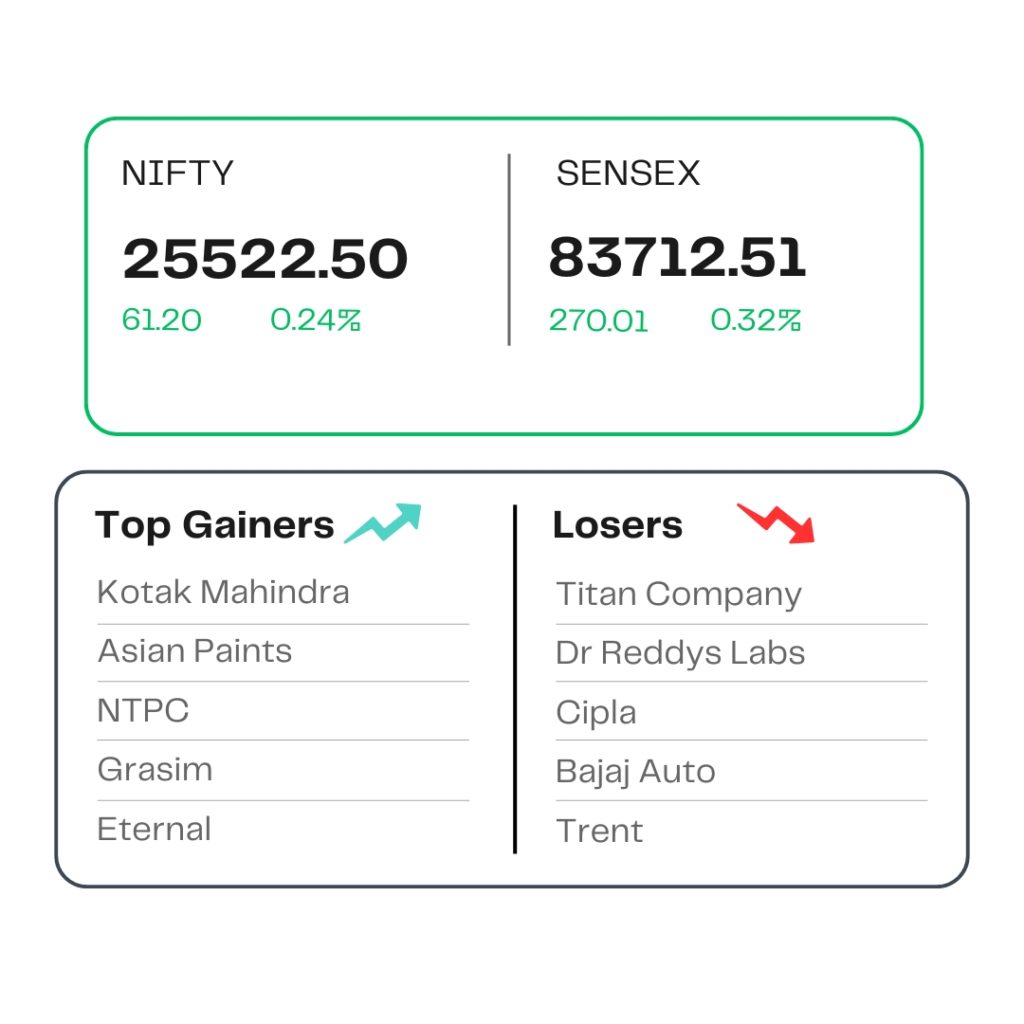

At close, the Sensex was up 270.01 points or 0.32 percent at 83,712.51, and the Nifty was up 61.20 points or 0.24 percent at 25,522.50. About 1889 shares advanced, 1990 shares declined, and 124 shares remained unchanged.

Top gainers include Kotak Mahindra, Eternal, Asian Paints, NTPC, Grasim, while the major losers in the Nifty include Titan Company, Dr Reddy’s Labs, Cipla, Bajaj Auto, Trent.

Among sectoral losers, Nifty Consumer Durables was the top loser, falling over 2 percent. Nifty Pharma, Auto, and FMCG also traded lower. On the gaining side, Nifty Private Bank rose 0.5 percent, followed by Nifty IT and Nifty Realty, which ended in the range of 0.3 to 1 percent.

STOCKS TODAY

Bharat Forge

Shares of auto companies declined sharply amid caution over US tariffs. President Donald Trump on Monday said the US was close to finalising a trade deal with India. Bharat Forge shares dropped nearly 2 percent to close at Rs 1,281.60 apiece.

PC Jewellers

Jewellery player PC Jeweller Ltd saw its stock crack over nine percent intraday as exchanges NSE and BSE put the stock under the short-term additional surveillance measures (ASM) framework. The stock has now snapped a 5-day winning streak. The stock recovered some losses to close over 4 percent lower at Rs 17.90 apiece.

Aurobindo Pharma

Macquarie has downgraded Aurobindo Pharma to ‘underperform’ from ‘outperform’, and reduced its target price by 40 percent to Rs 1,010 per share, Zee Business reported. The stock dropped nearly 4 percent to close at Rs 1,142 apiece. This happened after US President Donald Trump reignited investor concerns after sending tariff letters to several countries.

Navin Flourine

The shares of Navin Fluorine International jumped over 3 percent after the company launched a Qualified Institutional Placement (QIP) to raise Rs 750 crore. In an exchange filing released in the post-market hours of July 7, Navin Fluorine announced that its board has approved the launch of its QIP on the same day. The company has set a floor price of Rs 4,798.28 per share for the QIP, based on the pricing formula set by SEBI.

Schloss Bangalore

Shares of Schloss Bangalore Ltd, the owner of the Leela Hotels chain, rallied as much as 6 percent after two global brokerages initiated coverage with bullish views, citing strong fundamentals and a promising growth outlook. BOFA Securities started its coverage with a ‘Buy’ call, setting a price target of Rs 520 per share, implying an upside potential of 28 percent from the last close of Rs 406 on the NSE. Morgan Stanley echoed the optimism, initiating coverage with an ‘Overweight’ rating and a higher target of Rs 549.

Source – Money Control