POST MARKET

Benchmark indices ended on a negative note after a range-bound session on July 9, as investors stayed cautious ahead of US President Trump’s announcement of trade deals with seven more countries on Wednesday.

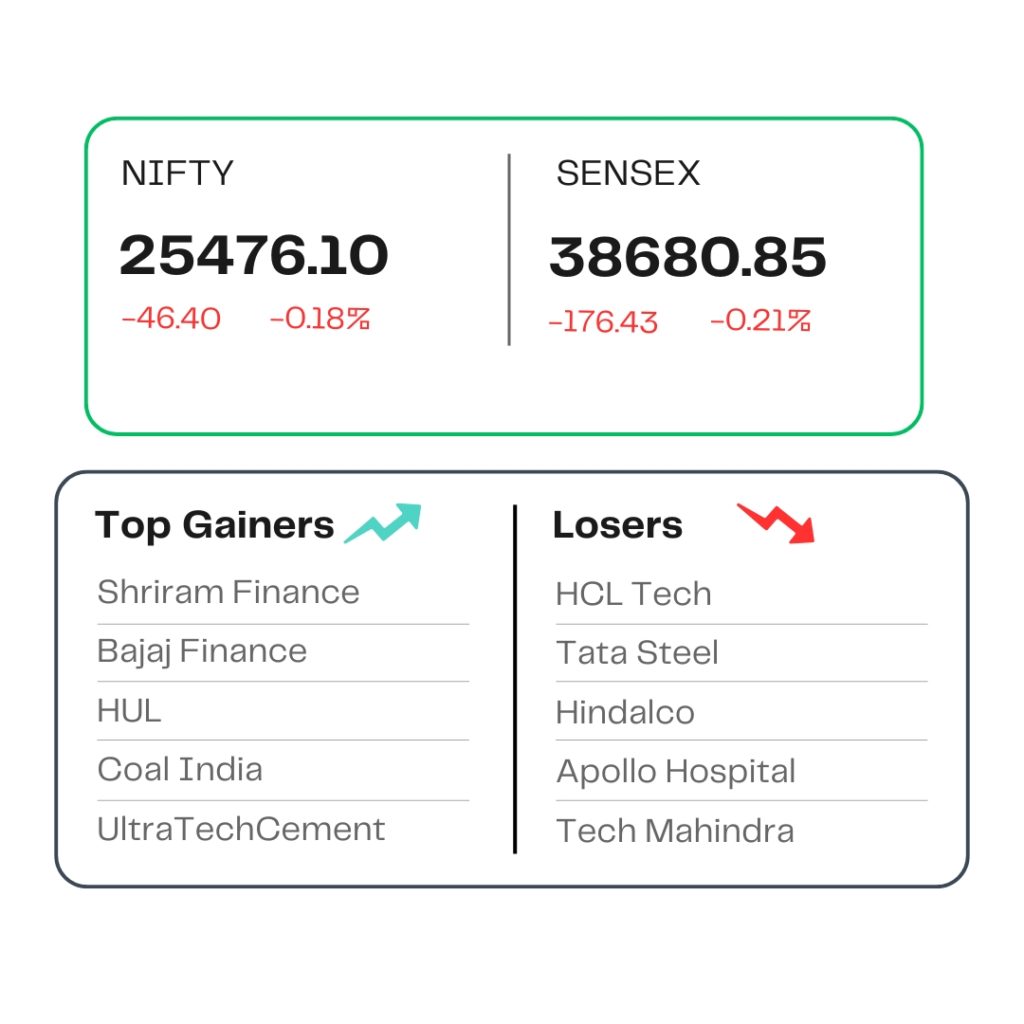

At close, the Sensex was down 176.43 points or 0.21 percent at 83,536.08, and the Nifty was down 46.40 points or 0.18 percent at 25,476.10. Broader indices outperformed the main indices, with the BSE midcap index ending flat, while the smallcap index added 0.5 percent.

Biggest Nifty losers included Tata Steel, HCL Technologies, Hindalco Industries, Apollo Hospitals, Tech Mahindra, while gainers were Shriram Finance, Bajaj Finance, HUL, UltraTech Cement, and Coal India.

On the sectoral front, Metal, Realty, and Oil & Gas indices are down 1.4 percent each, media, IT, and PSU Bank are down 0.5 percent each, while FMCG, auto, and Consumer Durables are up 0.3-0.8 percent.

Among the broader market indices, the BSE midcap index ended flat, while the smallcap index added 0.5 percent.

STOCKS TODAY

Vedanta

Vedanta shares dropped over 3% to close at Rs 441.30 apiece. This came after short seller Viceroy Research issued a report on its parent firm Vedanta Resources (VRL), claiming that the Anil Agarwal-led conglomerate “resembles a Ponzi scheme”. The US-headquartered short seller took a short position of VRL’s debt, calling it a “parasite holding company with no significant operations of its own, propped up entirely by cash extracted from its dying host, Vedanta Limited”.

Phoenix Mills

Mall operator Phoenix Mills Ltd shares tumbled over 3% after international brokerage Nomura initiated coverage on the stock with a ‘reduce’ call, given slowing growth and stretched valuations. Nomura issued shares of Phoenix Mills with a ‘reduce’ call and a price target of Rs 1,400, indicating an 11 percent downside from the previous session’s closing price.

Delhivery

Logistics player Ltd shares ran up 3% after domestic brokerage Motilal Oswal initiated coverage with a bullish outlook. Motilal Oswal issued a ‘buy’ rating on Delhivery shares, with a target price of Rs 480 per share, indicating an upside potential of around 17 percent.

Godrej Properties

The shares of Godrej Properties dropped nearly 2% after Nomura initiated a ‘Reduce’ rating on the stock. Nomura initiated a ‘Reduce’ rating on the shares of the real estate major, with a target price of Rs 1,900 apiece. This implies a downside potential of nearly 18 percent from the stock’s previous closing price of Rs 2,310 apiece.

Syrma SGS Technology

The shares of Syrma SGS Technology closed 5% higher after reports said that the firm is set to build India’s largest multi-layer Printed Circuit Board (PCB) and Copper Clad Laminate (CCL) manufacturing facility in Andhra Pradesh. The shares of the company recorded the biggest gain in over eight weeks to hit a fresh 52-week high of Rs 663 apiece in the morning.

Source – Money Control