What is Auto Slicing?

Auto Slicing is an additional feature on the Flattrade web trading platform that allows you to place large or bulk orders easily. This tool splits your large order into smaller parts and places them automatically, and this feature can be used for both buying and selling. Also, exchanges impose a limit called freeze quantity, which restricts the maximum number of shares that can be placed in a single order. That’s where Auto Slicing in Flattrade becomes essential, by splitting the orders automatically and staying within the exchange rules.

This smart solution saves our traders from price slippage, partial execution, or even order rejection.

Why is Auto Slicing important?

- Auto Slicing enables faster order execution with better price realization by breaking large trades into smaller, more market-friendly pieces.

- By matching several smaller orders over time, it improves the likelihood of full order execution, particularly in less liquid equities.

- Carefully splitting trades lessens the possibility of causing price swings and helps avoid attracting attention in the order book.

- Smaller orders tend to get filled more efficiently in active markets, enhancing the overall execution quality and fill speed.

- Auto Slicing provides benefits for all kinds of traders because it can be used for both intraday and delivery trades in the equity segment.

Things to know before using Auto Slicing

- Auto Slicing works best in high volume stocks.

- Works for both buy and sell orders.

- This feature is available for delivery, intraday, MTF and options orders.

What is Freeze Quantity?

Freeze Quantity refers to the maximum number of shares that can be placed in a single order on the stock exchange. These limits vary by stock and are predefined by exchanges like NSE and BSE.

For example, if the freeze quantity for a stock is 500, then the largest order allowed on the Flattrade platform is 10X times, that is 5,000 shares (i.e., 500 × 10). If you try to place 5,500 shares in one go, our order management system will reject it. These specific limits are designed to prevent errors, maintain orderly markets, and avoid sudden price impacts, ensuring that no trader can place disproportionately large orders that might unintentionally manipulate prices or disrupt liquidity.

Why Does Freeze Quantity Exist?

- The main purpose of freeze quantity is to guard against errors caused by manual entry. For instance, an excessive transaction could occur if an extra zero is inadvertently added when placing an order. Exchanges lower the possibility of such expensive errors by limiting the maximum quantity per order.

- Additionally, it helps keep big, obvious orders from influencing other traders’ judgments or generating abrupt price changes. By lowering the possibility of manipulation or volatility, limiting order size helps create more equitable and stable market conditions.

- Freeze quantity also guarantees equal access to liquidity. Exchanges provide an equal opportunity for all participants by limiting the quantity of shares in a single order, which prevents scenarios in which one trader may absorb all available volume.

- Finally, it aids in maintaining the operational effectiveness of exchanges. Processing orders that are very large can put a load on the trading infrastructure and raise the possibility of delays. Systems can operate dependably and at scale when the flow of orders is moderated by freeze quantity.

A Step by Step Guide

- Login to the Flattrade web platform by using your client ID, password and OTP

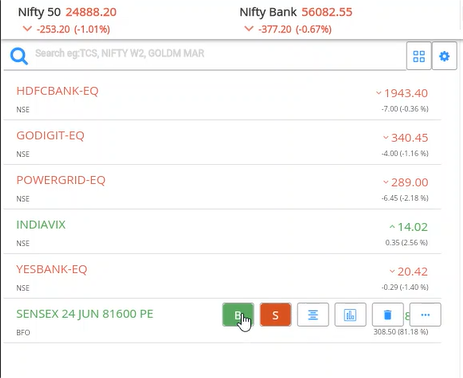

2. Use the Search bar to search the stock in the that you want to buy or sell

3. Select the stock or options contract you want to buy/sell

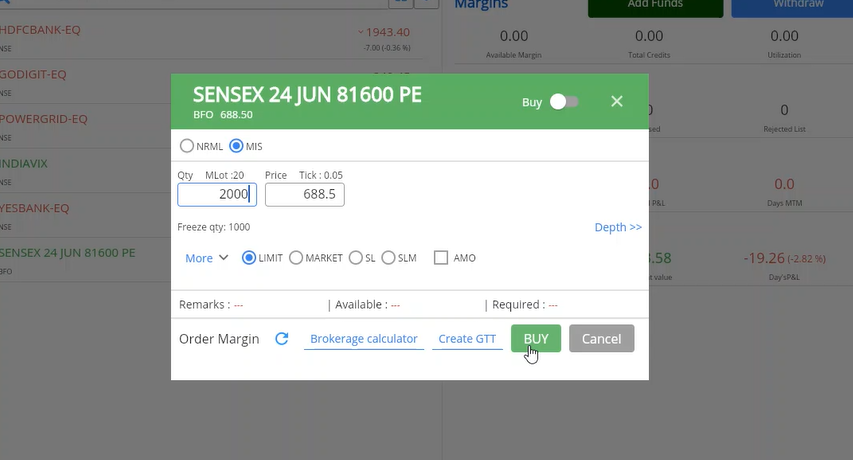

4. In the order window, enter the large quantity you wish to trade

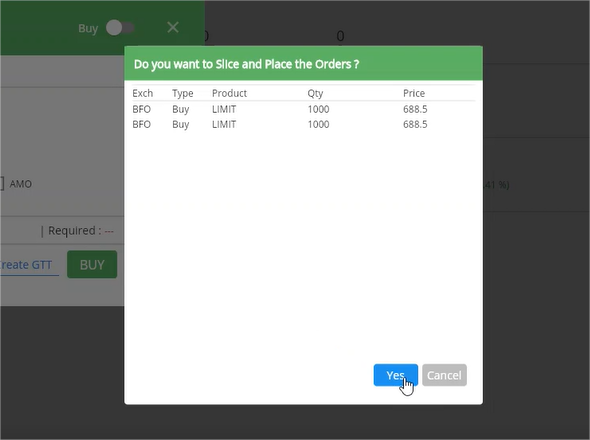

5. Flattrade platform automatically detects large orders and applies slicing. In the picture below, the large quantity is automatically placed into two orders.

Note: The freeze quantity for the above options contract is 1000, but it varies from stock to stock. Since the order is placed for 2000 quantity, the order is split into two separate orders automatically with Flattrade’s Auto Slicing feature. If an order for more than 10,000 quantity is placed, then the order will not go through because only 10X of the freeze quantity is allowed.

6. Finally, review your inputs and click Yes to place your order

Combine the Auto Slicing feature with Flattrade’s Zero-brokerage service to execute large deals at no order cost.

Save your time and also reduce execution risk.