POST MARKET

Indian equity indices ended lower for the fourth consecutive session on July 14, with Nifty below 25,100.

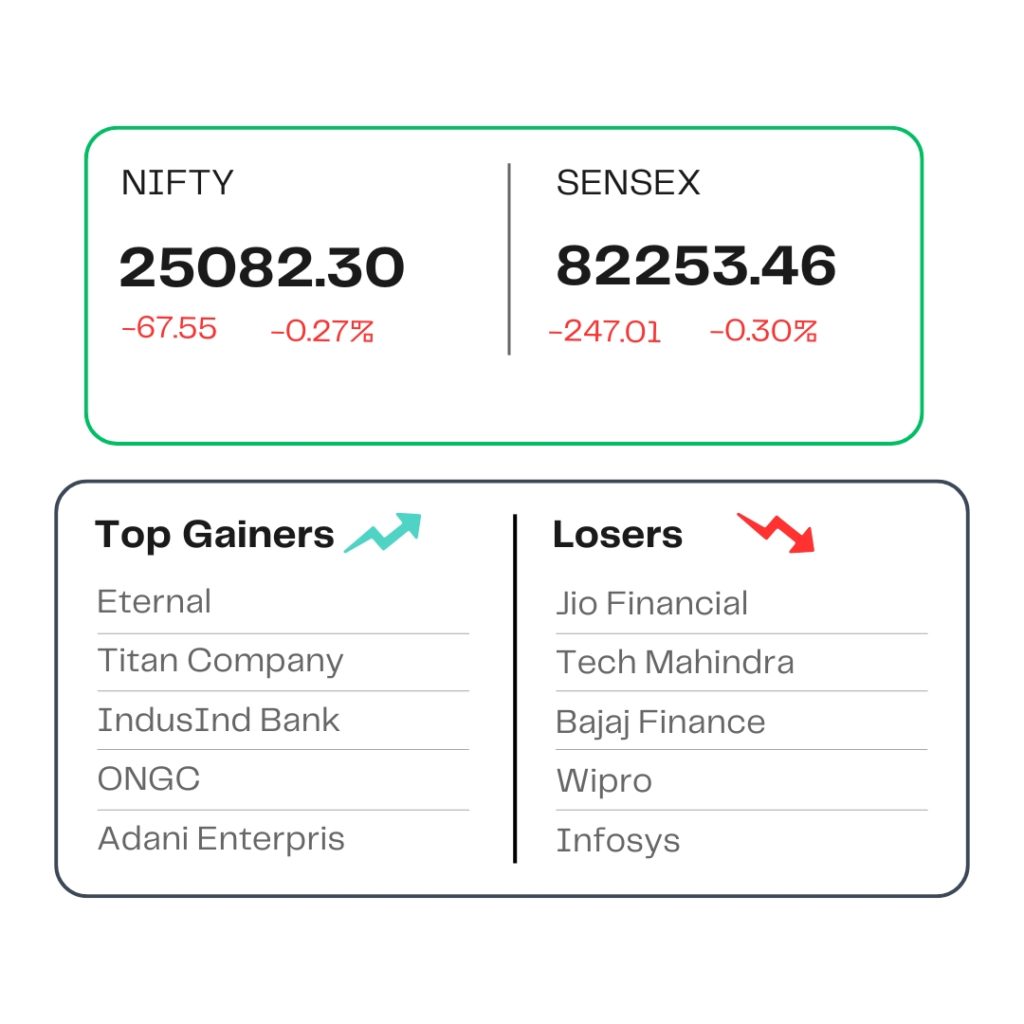

At close, the Sensex was down 247.01 points or 0.30 percent at 82,253.46, and the Nifty was down 67.55 points or 0.27 percent at 25,082.30. About 1991 shares advanced, 2020 shares declined, and 151 shares remained unchanged.

Jio Financial, Bajaj Finance, Tech Mahindra, Wipro, and Asian Paints were among the major losers on the Nifty, while gainers were Eternal, Titan Company, IndusInd Bank, ONGC, and SBI Life Insurance.

Among sectors, the IT index shed 1 percent, while pharma, consumer durables, media, realty, and PSU bank rose 0.5-1 percent.

Broader indices outperformed the main indices, with BSE Mid and Smallcap indices rising 0.5 percent each.

STOCKS TODAY

Ola Electric

Shares of Ola Electric jumped over 18 percent on Monday, after the company forecast improved gross margins for fiscal 2026 after posting a narrower sequential loss for the first quarter, helped by stronger sales of its newer, more cost-efficient scooter models. The shares closed at Rs 47.07.

Avenue Supermarkets

Shares of retail giant Avenue Supermarts, the operator of the DMart retail chain, went down 1.30 percent on July 14, after the consumer player posted a nearly flat net profit for the June quarter of FY26, as rising competition and margin pressures offset strong revenue growth.

Landmark Cars

Shares of Landmark Cars Ltd. rose as much as 6 percent to Rs 537 on Monday, July 14, after domestic brokerage B&K Securities initiated coverage on the stock with a bullish outlook, citing strong growth potential and improving profitability over the next two years. The brokerage has assigned a ‘Buy’ rating with a price target of Rs 820, signalling a potential upside of more than 60 percent from Friday’s close of Rs 507 per share on the NSE.

BEML

The defence company’s share price snapped 2-day losing streak and gained around 3.75 percent on July 14 as the company board is going to consider sub-division / split of equity shares. The company’s share price rose more than 5 percent and more than 33 percent in June and May, respectively.

AU Small Finance Bank

Private lender AU Small Finance Bank Ltd shares lost almost 2 percent after domestic brokerage Kotak Institutional Equities downgraded its rating on the stock, while increasing the target price. They cut their outlook on the stock to ‘sell’, from ‘add’ earlier, but hiked the target price to Rs 700 per share, from Rs 650 earlier. This indicates a 15 percent downside from the previous session’s closing price.

Source – Money Control