POST MARKET

Final hour buying helped the Indian indices erase all the intraday losses, as the indices remained under pressure for most part of the session after US President Donald Trump imposed an additional 25% tariff on India over Russian oil imports and also indicated imposing 100% tariffs on imported semiconductors.

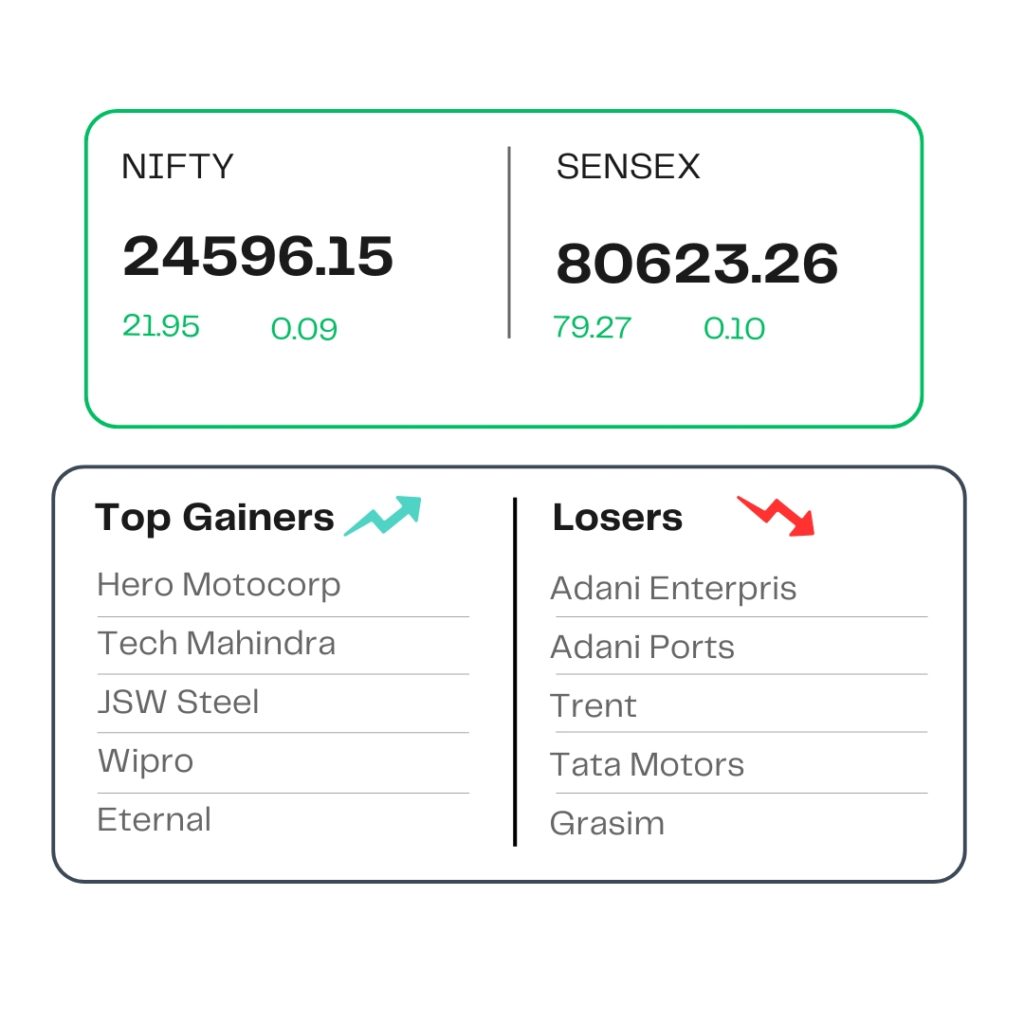

At close, the Sensex was up 79.27 points or 0.10 percent at 80,623.26, and the Nifty was up 21.95 points or 0.09 percent at 24,596.15. About 1716 shares advanced, 1996 shares declined, and 129 shares remained unchanged.

Top Nifty gainers were Hero MotoCorp, Tech Mahindra, Wipro, Eternal, JSW Steel, while losers included Adani Enterprises, Adani Ports, Trent, Tata Motors, and Grasim Industries.

All the sectoral indices recovered most of the intraday losses, with IT, media, and pharma rising 0.5-1 percent.

Among the broader market indices, the BSE Midcap index was up 0.3 percent, and the smallcap index ended on a flat note.

STOCKS TODAY

Bajaj Auto

Shares rose 1 percent after opening 4 percent lower after the company reported a 14 percent year-on-year rise in consolidated net profit to Rs 2,210.44 crore for the fiscal first quarter of FY26. Revenue from operations climbed to Rs 13,133.35 crore in Q1 FY26, marking a 10 percent increase from the same quarter last year.

BHEL

Shares of public sector engineering and manufacturing company Bharat Heavy Electricals (BHEL) fell over 6 percent on August 7 after the company reported a disappointing set of numbers in the June 2025 quarter (Q1FY26). The stock has crashed over 21 percent from its 52-week high.

NSDL

Shares of National Securities Depository Limited (NSDL) hit a new high of Rs 1,123, as they rallied 20 percent on the BSE in an otherwise choppy market. NSDL made a strong listing as the stock rose 17 per cent on its debut day on the BSE a day back. The stock price of NSDL has zoomed 25 percent against its issue price of Rs 800 per share.

Lupin

Shares of the pharmaceutical major gained nearly 5 percent on August 7 as analysts remained bullish after the firm posted a 52 percent year-on-year increase in net profit in the first quarter of the current financial year (Q1FY26).

Eternal

Shares of food delivery major, Eternal Ltd, formerly known as Zomato, recovered from 3 percent lows to close over a percent higher. The stock is in the news after seeing a large deal worth Rs 5,624 crore on the bourses. Reports had suggested that Alibaba-backed Antfin Singapore Holding Pte Ltd was likely to sell its entire stake in Eternal Ltd, the parent of Zomato, for Rs 5,375 crore through a block deal in a clean-up trade.

Source – Money Control