POST MARKET

Indian benchmark indices Sensex and Nifty continued to trade with modest gains on August 11, supported by banking, auto, and realty stocks. Broader markets also supported the enthusiasm in the markets as they gained in tandem amid supportive global cues.

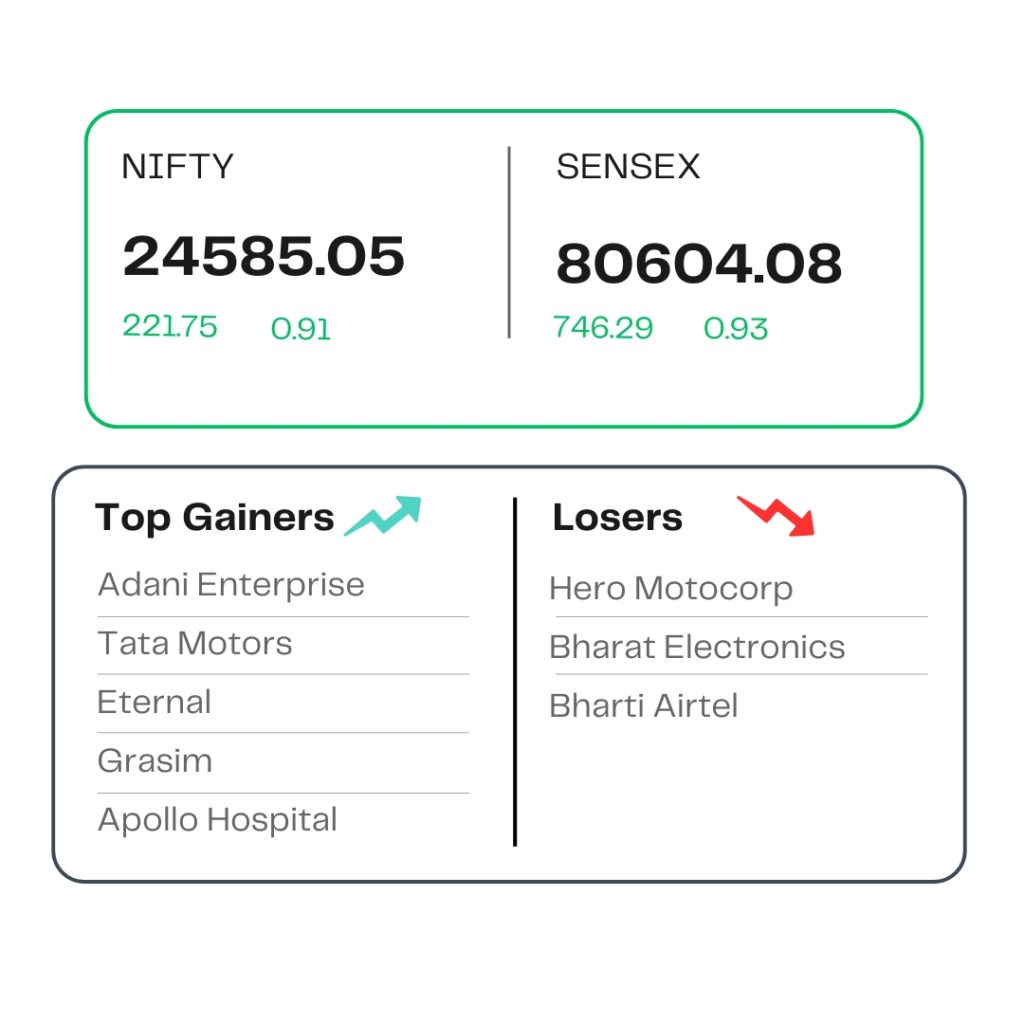

At close, the Sensex was up 746.29 points or 0.93 percent at 80,604.08, and the Nifty was up 221.75 points or 0.91 percent at 24,585.05. About 2136 shares advanced, 1867 shares declined, and 161 shares remained unchanged.

The biggest Nifty gainers were Adani Enterprises, Tata Motors, Eternal, Grasim Industries, and Apollo Hospitals, while losers included Hero MotoCorp, Bharat Electronics, and Bharti Airtel.

Except consumer durables, all other sectoral indices ended in the green with pharma, metal, auto, oil & gas, PSU Bank, and realty up 0.5-2 percent.

The broader market indices outperformed as the BSE Midcap index added 0.8 percent and the Smallcap index rose 0.35 percent.

STOCKS TODAY

State Bank of India

Shares of State Bank of India (SBI) gained by two percent after the lender reported steady June quarter results, with higher treasury income helping profit surpass Street expectations. Analysts remain largely positive, pointing to the management’s guidance on stable asset quality and margins as important positives.

Grasim Industries

Grasim Industries, the flagship business of the Aditya Birla Group, saw its shares rally over three percent after reporting its earnings for the quarter ended June 30, 2025. The Aditya Birla Group firm posted a 32 percent sequential jump in net profit for Q1FY26, coming in at Rs 1,419 crore versus Rs 1,075 crore in the preceding quarter.

PG Electroplast

After sinking 23 percent in the previous session, shares of PG Electroplast (PGEL) extended their fall in trade as investors continued to offload their holdings. The bulk of the losses today came after domestic brokerage Nuvama Institutional Equities trimmed its target price on the stock by 35 percent.

Manappuram Finance

Shares of Manappuram Finance fell 3 percent after the company reported weak June quarter (Q1FY26) results. Brokerages stayed in a wait-and-watch mode, with management indicating that the worst phase is over and profitability is expected to return by the fourth quarter of FY26.

Sun TV

Sun TV shares rose four percent after the firm said all legal notices issued by family members to the promoter have been “irrevocably withdrawn”. Earlier this year, DMK MP Dayanidhi Maran sent a legal notice to his elder brother Kalanithi Maran, his sister-in-law, and six others, objecting to the share transactions of the Sun TV Network, which took place in 2003.

Source – Money Control