POST MARKET

Indian benchmark indices continued their gaining momentum for the sixth consecutive day on August 21, lifted by pharma, oil & gas, and banking stocks.

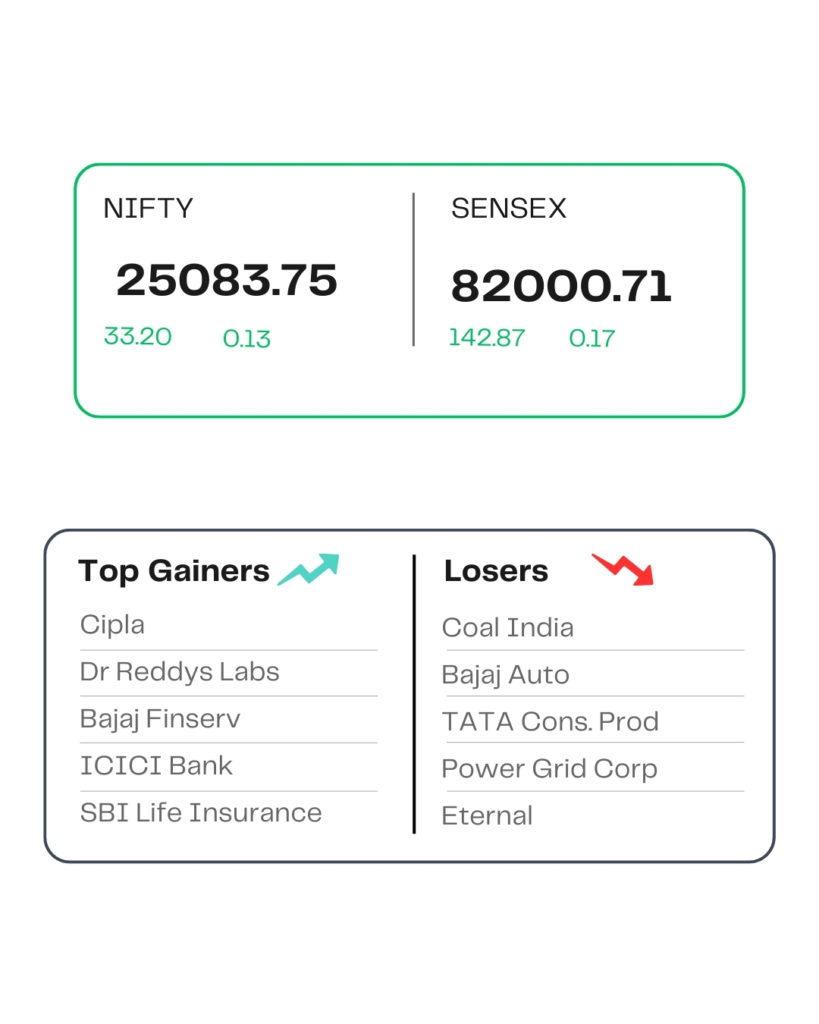

At close, the Sensex was up 142.87 points or 0.17 percent at 82,000.71, and the Nifty was up 33.20 points or 0.13 percent at 25,083.75. About 2025 shares advanced, 1886 shares declined, and 145 shares remained unchanged.

The biggest Nifty gainers were Dr Reddy’s Laboratories, Cipla, Bajaj Finserv, ICICI Bank, SBI Life Insurance, while losers were Bajaj Auto, Coal India, Power Grid Corporation, Eternal, and Tata Consumer Products.

On the sectoral front, the pharma index rose 1%, the realty index added 0.4% each, while the auto index shed 0.3% and the FMCG index declined 0.6%.

The midcap and smallcap indices, however, broke their three-day rally to end lower.

STOCKS TODAY

Jupiter Wagons

The stock jumped over 13 percent higher as its unlisted subsidiary, Jupiter Tatravagonka Railwheel Factory Pvt. Ltd., has received a Letter of Intent dated August 19, 2025, to supply 5,376 wheelsets for the Vande Bharat train. The order is valued at about Rs 215 crore.

Nazara Tech

Nazara Technologies Ltd saw further selling pressure in trade on Thursday, August 21, after the Lok Sabha passed the Promotion and Regulation of Online Gaming Bill, 2025. The bill aims to prohibit all pay-to-play online games, including both games of skill and chance. If passed, the bill would pause the total operations of regulated real-money gaming (RMG) platforms across India.

HDB Financial Services

The stock surged by a percent, as Motilal Oswal initiated coverage on newly listed non-bank HDB Financial Services Ltd with a ‘neutral’ outlook, believing that the firm can offer high-teens growth in its assets under management over the next few years. The brokerage kicked off coverage with a ‘neutral’ rating and a target price of Rs 860 per share, which indicates a nine percent upside.

Ola Electric

Shares of Ola Electric Mobility tumbled more than 8 percent on August 21 following a massive 30 percent rise over two sessions, after the latest data from the VAHAN portal showed rival electric two-wheeler maker Ather Energy nudging ahead on total monthly registrations so far in August, likely prompting some investors to book profits.

InterGlobe Aviation

Shares of InterGlobe Aviation, the operator of IndiGo, fell 2 percent on August 21 after Kotak Institutional Equities downgraded the stock to “add”, even as it maintained a target price of Rs 6,850, implying an upside potential of 14 percent from current levels.

Source – Money Control