POST MARKET

The Indian equity market ended flat with a negative bias on Tuesday, as gains in financials, autos, and metals were offset by losses in FMCG, I,T and select heavyweight stocks.

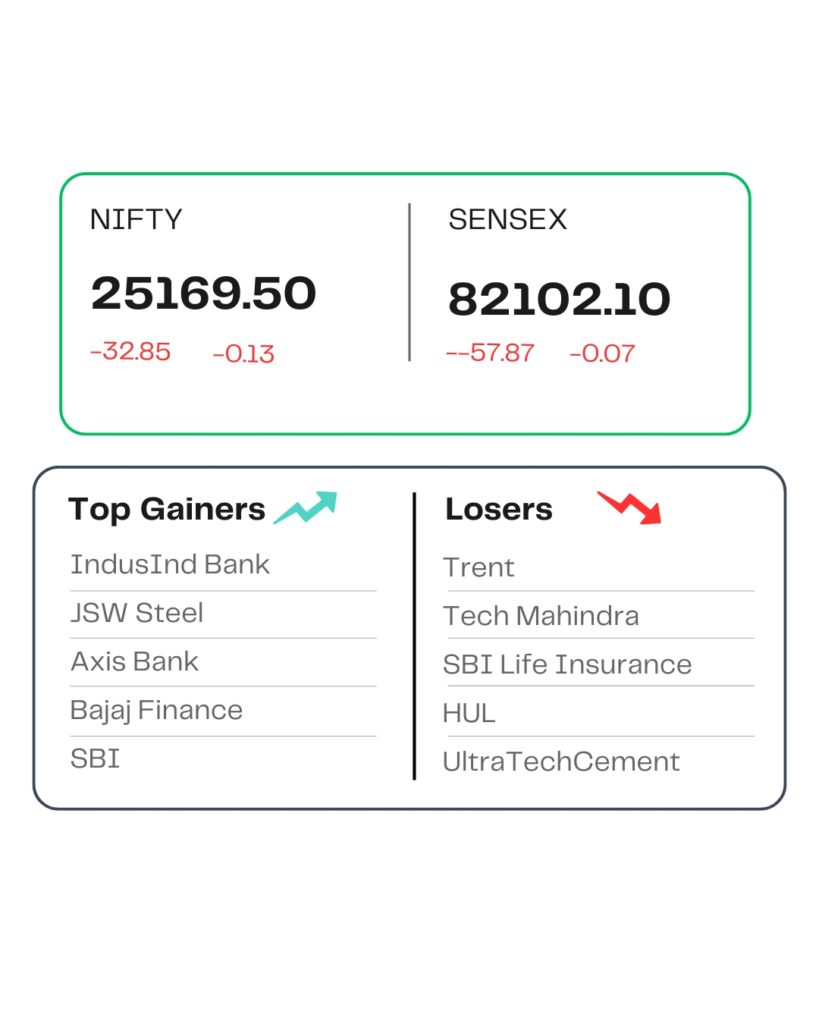

At the close, the Sensex was down 58 points or 0.07 percent at 82,102, while the Nifty 50 slipped 33 points or 0.13 percent to 25,170. Market breadth on the NSE remained weak, 1751 shares advanced, 2216 shares declined, and 146 shares remained unchanged.

The biggest Nifty losers were Trent, Tech Mahindra, SBI Life Insurance, HUL, Ultratech Cement, while gainers were IndusInd Bank, JSW Steel, Axis Bank, Bajaj Finance, and SBI.

On the sectoral front, FMCG went down almost 1 percent, the IT index went down 0.7 percent, while Nifty Metal went up 1 percent, Bank Nifty went up 0.5 percent, and Nifty Auto rose 0.6 percent.

STOCKS TODAY

MRF

Shares of tyre maker MRF Ltd rose over 2 percent to hit fresh record high on auto demand surge. Auto dealers saw increased footfalls as buyers thronged dealerships in large numbers on September 22 to buy vehicles with lower price tags under the new GST regime, said Federation of Automobile Dealers Association (FADA) President C S Vigneshwar.

Vodafone Idea

The shares of Vodafone Idea ended almost 4 percent higher on September 23. The stock has now rallied around 38 percent in September so far as investors awaited Supreme Court’s decision on possible relief from some AGR dues.

Yatra Online

Yatra Online Limited shares went down almost 1.5 percent as the company has announced the resignation of Mr. Darpan Batra as Company Secretary, Compliance Officer, and Key Managerial Personnel, effective from the close of business hours on September 22, 2025.

KEC International

KEC International share price added over 2 percent following the company won new orders worth Rs 3243 crore. The company secured new orders of Rs 3,243 crores for transmission & distribution projects 400 kV transmission lines in the United Arab Emirates (UAE) and supply of towers, hardware and poles in the Americas,” company said in its press release.

Adani Power

The shares of Adani Power dropped nearly 4.64 percent on September 23 as investors may have resorted to profit booking at elevated levels. The stock had rallied 20 percent earlier yesterday after it turned ex-date for 1:5 stock split.

Source – Money Control