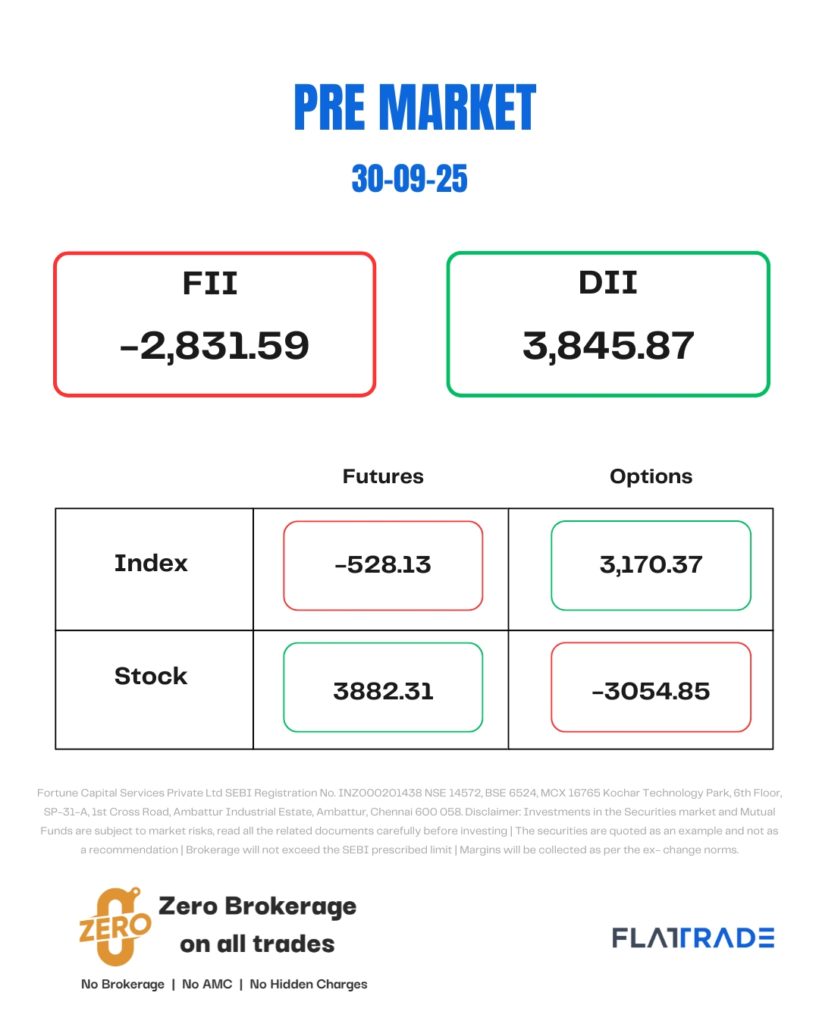

PRE MARKET

Gift Nifty indicates a mildly higher start for the broader index in India, with a gain of 17.5 points or 0.07 percent. The Nifty futures were trading around the 24,705.50 level

Wall Street indexes closed up on Monday, with the Nasdaq leading gains, as investors bought heavyweight technology stocks and shrugged off the uncertainty of a potential U.S. government shutdown and hawkish remarks from Federal Reserve officials.

The Dow Jones Industrial Average rose 68.78 points, or 0.15%, to 46,316.07, the S&P 500 gained 17.51 points, or 0.26%, to 6,661.21, and the Nasdaq Composite gained 107.09 points, or 0.48%, to 22,591.15.

Shares in Asia edged higher and gold continued its record climb on Tuesday as markets weighed prospects for a U.S. government shutdown that would delay closely watched jobs figures.

Japan’s Nikkei went down 0.13 percent, while Hong Kong’s Hang Seng and the KOSPI Index went up 1.19 apercent nd 0.09 percent, respectively.

STOCKS TODAY

Bharat Electronics

BEL has secured additional orders worth Rs 1,092 crore since September 16. These include orders for EW system upgrades, defence network upgrades, tank subsystems, TR modules, communication equipment, EVMs, and spares.

Mahindra and Mahindra

The company has entered into a Share Purchase Agreement with Tera Yatirim Teknoloji Holding Anonim Sirketi (TERA) to sell its entire stake in subsidiary Sampo Rosenlew Oy (SAMPO) to TERA for Rs 52 crore. Following the transaction, SAMPO will cease to be a wholly owned subsidiary.

Blue Dart Express

The transportation and distribution company has announced an average shipment price increase ranging from 9% to 12%, depending on product variables and the customer’s shipping profile. The new rates will take effect on January 1, 2026.

Tata Motors

Moody’s Ratings has revised the outlook on JLR (a subsidiary of Tata Motors) from positive to negative following a recent cyberattack. However, the agency affirmed JLR’s Ba1 rating.

JSW Infrastructure

The company’s subsidiary, Ennore Coal Terminal, has received a Show Cause Notice from the Office of the Commissioner of GST and Central Excise, Chennai, Tamil Nadu, demanding Rs 96.58 crore in GST along with applicable interest and penalties.

Source – Moneycontrol