POST MARKET

Indian equity indices rallied for the third consecutive session as the bulls got into the festive mood on Friday, October 17, with the benchmark indices closing the week with two percent gains each.

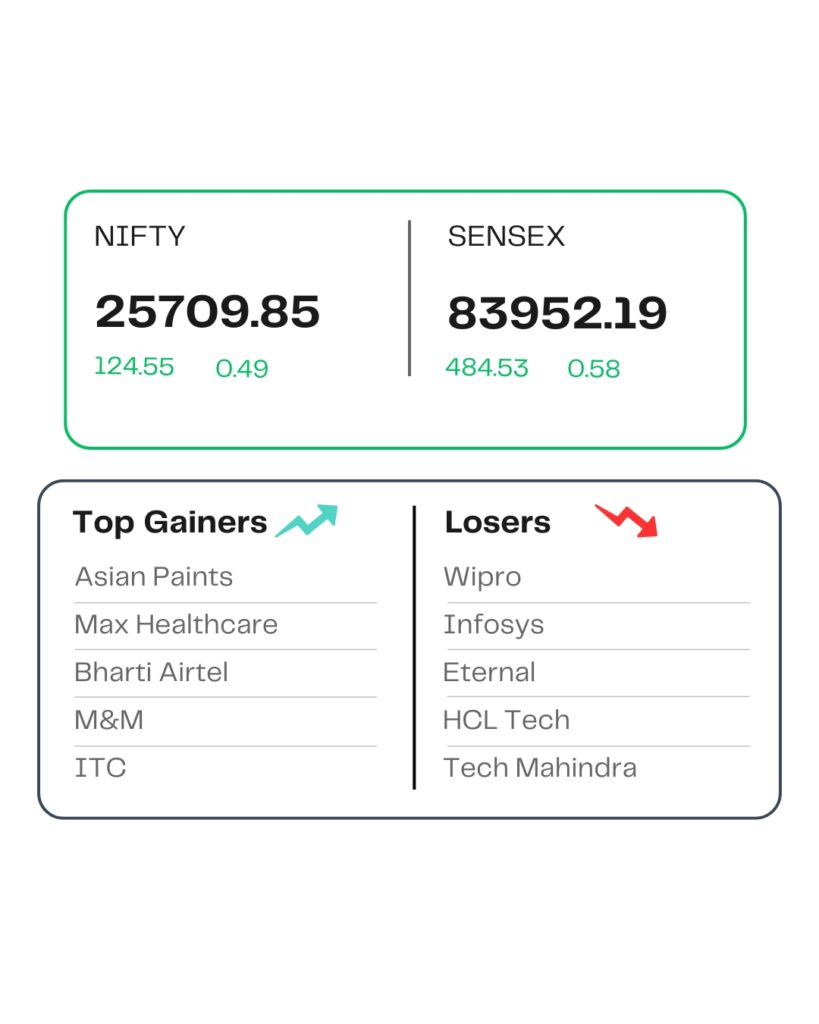

At close, the Sensex was up 484.53 points or 0.58 percent at 83,952.19, and the Nifty was up 124.55 points or 0.49 percent at 25,709.85. About 1658 shares advanced, 2318 shares declined, and 158 shares remained unchanged.

Asian Paints, Bharti Airtel, Max Healthcare, ITC, M&M were among the major gainers on the Nifty, while losers were Wipro, Infosys, Eternal, HCL Technologies, Tech Mahindra.

Among sectors, media, IT, metal, PSU Bank indices fell 0.5-1%, while auto, bank, healthcare, FMCG, and consumer durables rose 0.5-1%.

Among the broader market indices, the BSE midcap and smallcap indices shed 0.4% each.

POST MARKET

Zee Entertainment

Zee Entertainment shares declined 3.60 percent after the company reported a 63 percent decline in consolidated net profit at Rs 76.5 crore in the second quarter ended September 30. The company had posted a consolidated net profit of Rs 209 crore in the corresponding quarter last fiscal.

Asian Paints

Shares of paint company Asian Paints traded higher by 4.07 percent on Friday, while he global oil benchmark Brent crude slipped 0.25 percent to USD 60.94 a barrel. Crude oil derivatives are a key raw material for the decorative paints industry.

Yes Bank

Yes Bank shares declined over 3.5 percent on October 17 after Japanese lender Sumitomo Mitsui Banking Corporation (SMBC)said it has no immediate plans to raise its stake in the private lender beyond 24.99%.

Eternal

Online delivery platform Eternal (parent of Zomato) shares fell over 1.5 percent to Rs 339, thus extending their losses for the second day, as brokerages were disappointed with shrinking margins for its quick commerce business Blinkit.

Wipro

Wipro Ltd shares plunged as much as 5.17 percent after the IT company announced its Q2 FY26 results. The stock fell to the day’s low of Rs 242 on NSE from the previous close of Rs 253.81, as brokerage views remained mixed on the muted revenue growth and cautious guidance.

Source – Money Control