POST MARKET

The Indian equity indices settled lower on Thursday as the lack of clarity on the future course of rate action by the US Federal Reserve dampened investor sentiment. Fresh foreign fund outflows also weighed on the markets.

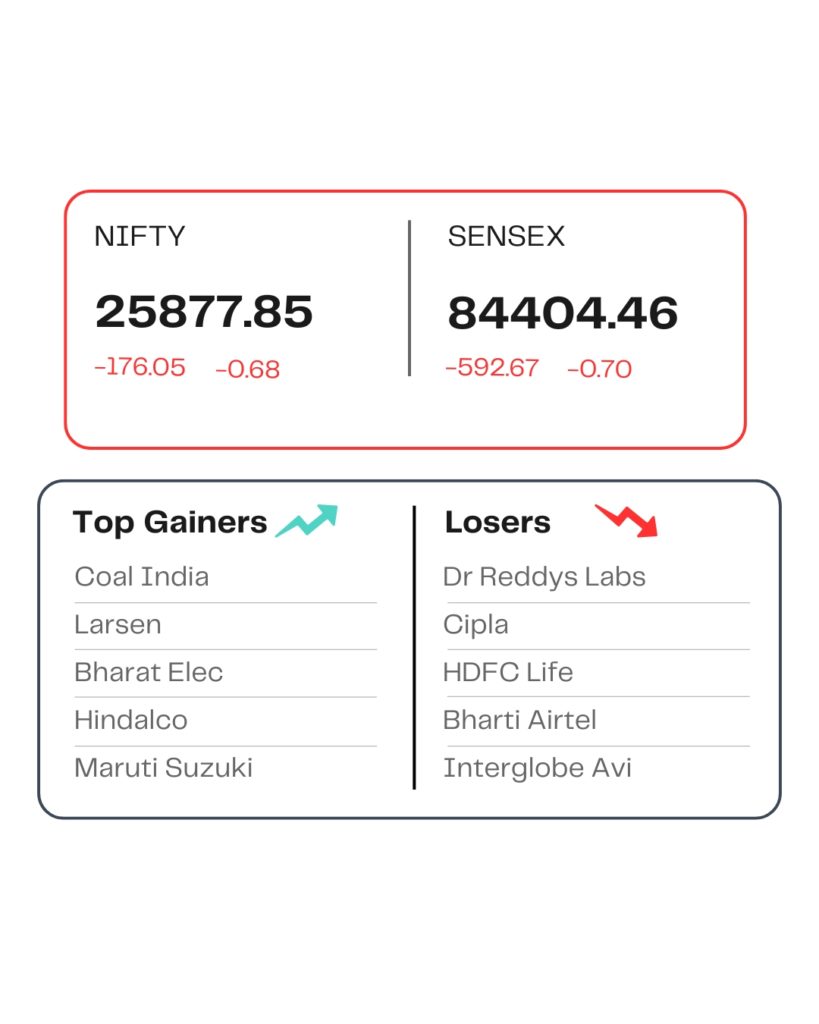

At close, the Sensex was down 592.67 points or 0.70 percent at 84404.46, and the Nifty was down 176.05 points or 0.68 percent at 25877.85.

Coal India, Larsen & Toubro, Bharat Electronics, Nestle, and Hindalco were among the top gainers. In contrast, Dr. Reddy’s Laboratories, Cipla, HDFC Life, Bharti Airtel, and Interglobe Aviation were among the top losers.

Among sectoral indices, Nifty Private Bank was down 0.7 percent, followed by Nifty Pharma, Nifty IT, and Nifty Bank, which declined 0.6 percent each. Nifty Metal, PSU Bank, Auto, and FMCG indices were also lower by 0.5 percent each.

The broader markets mirrored the headline index’s performance, with both small-cap and mid-cap stocks ending with losses.

STOCKS TODAY

Dr Reddy’s Laboratories

The shares of Dr Reddy’s Laboratories dropped nearly 3.89 percent after the company announced that it had received a non-compliance notice from Canada’s drug regulator for its Semaglutide Injection.

Canara Bank

The shares of Canara Bank jumped more than 3 percent after the PSU lender released its results for the second quarter of the financial year 2026. The bank reported a net profit of Rs 4,774 crore for the second quarter of the financial year 2026.

BHEL

Shares of Bharat Heavy Electricals Limited (BHEL) gained 6.48 percent on Thursday following strong September-quarter results. The firm posted a more than three-fold rise in consolidated net profit to Rs 374.89 crore for the quarter ended September 30, 2024.

Vodafone Idea

Vodafone Idea shares fell up to 6.73 percent on October 30 after the Supreme Court’s written order on the telecom company’s additional adjusted gross revenue (AGR) plea. This had a rub-off effect on other telecom stocks as well.

Source – Money Control