POST MARKET

Indian equity indices settled on a muted note on November 7, after seeing volatility through the session.

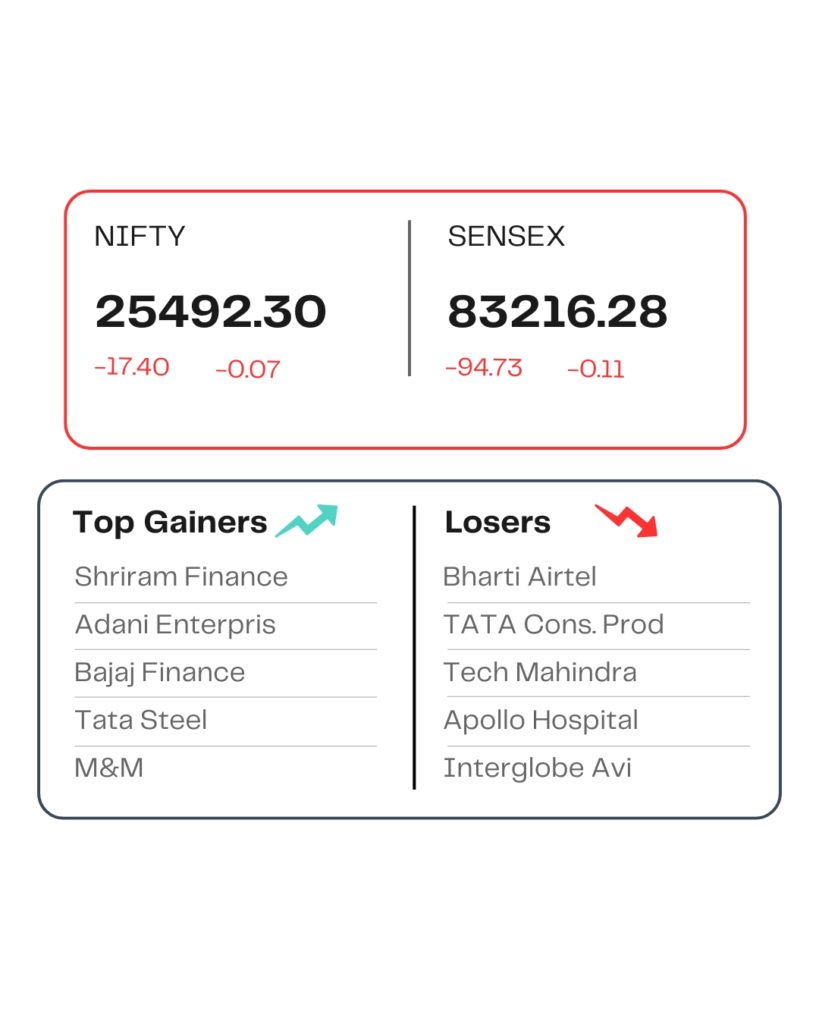

At close, the Sensex was down 94.73 points or 0.11 percent at 83,216.28, and the Nifty was down 17.40 points or 0.07 percent at 25,492.30. About 1962 shares advanced, 2036 shares declined, and 126 shares remained unchanged.

Among sectors, the metal index added 1.4%, while IT, Consumer Durables, FMCG, and telecom shed 0.5% each.

Shriram Finance, Adani Enterprises, Tata Steel, Bajaj Finance, and M&M were among the major gainers on the Nifty, while losers were Bharti Airtel, Tata Consumer, Apollo Hospitals, Tech Mahindra, and Interglobe Aviation.

Among the broader market indices, the BSE midcap index rose 0.2 percent, while the smallcap index ended flat.

STOCKS TODAY

LIC

The shares of Life Insurance Corporation of India (LIC) jumped 3.34 percent after brokerages issued bullish calls for the stock following better-than-expected Q2 results and positive management commentary. The stock ended at Rs 926 per share. The company had released its results in the post-market hours of November 6 (Thursday).

Divis Laboratories

Divi’s Labs shares saw profit booking on November 7, even as the company’s second-quarter profit was above analysts’ estimates. The company’s consolidated net profit rose to Rs 689 crore in the quarter ended September 30 from Rs 510 crore a year earlier.

Adani Enterprises

Adani Enterprises shares rose almost 3 percent after the Adani Group’s flagship firm said its unit Kutch Copper Ltd (KCL) signed a pact with Caravel Minerals to advance the development of a copper project in Western Australia. Shares of Caravel Minerals rose 17%.

Venkys

Venkys’ shares went down 8.82 percent after the July-September quarter results for the two firms failed to meet analysts’ expectations. The company incurred a net loss of ₹26.5 crore from a net profit of ₹7.76 crore

Source – Money Control