POST MARKET

The Indian equity indices erased gains and ended lower on Thursday as investors booked profits ahead of the Bihar state election results, sending the Sensex and Nifty lower.

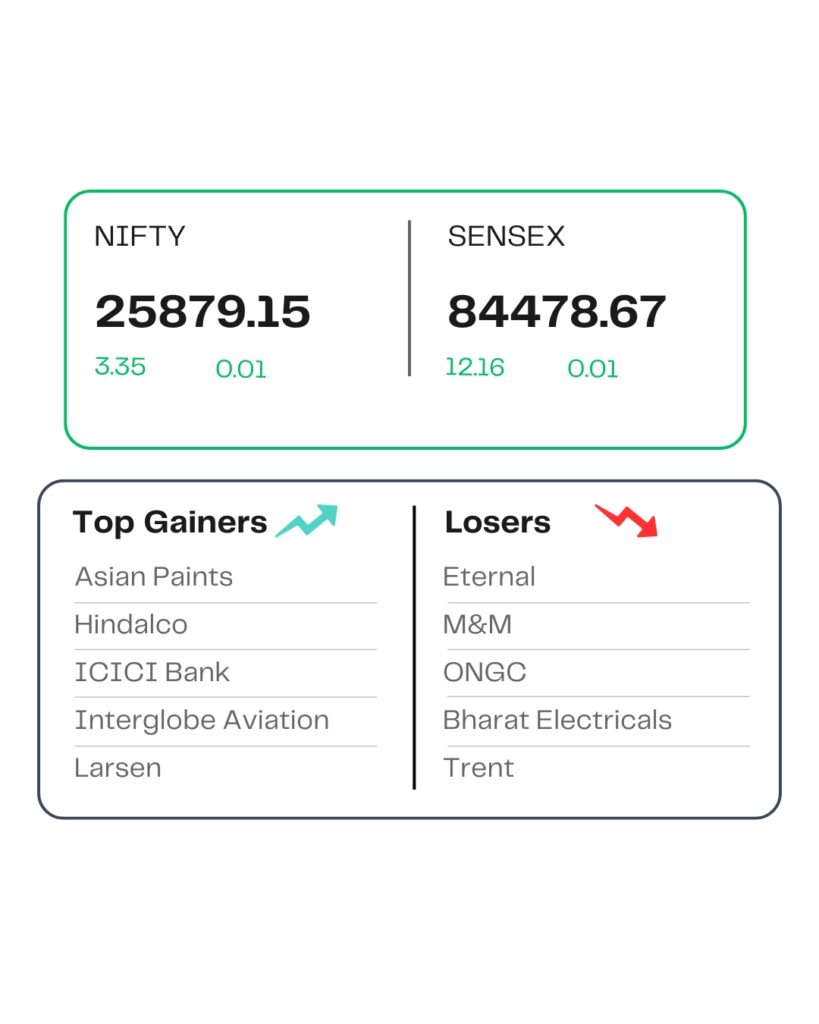

At close, the Sensex was up 12.16 points or 0.01 percent at 84,478.67, and the Nifty was up 3.35 points or 0.01 percent at 25,879.15. About 1661 shares advanced, 2193 shares declined, and 107 shares were unchanged.

Asian Paints, ICICI Bank, L&T, Interglobe Aviation, and Hindalco were among the major gainers on the Nifty, while losers included Eternal, Shriram Finance, Adani Ports, Bharat Electronics, and M&M.

Among sectors, IT, media, and PSU bank shed 0.5% each, while metal, pharma, and realty rose 0.5% each.

Among the broader market indices, the BSE Midcap and smallcap indices were down 0.3 percent each.

STOCKS TODAY

Biocon

The shares of Biocon extended sharp gains of 2.73 percent for the second consecutive session after the pharma company’s strong Q2 results boosted investor sentiment. Brokerages remain positive for the stock, raising target prices after the earnings announcement.

Yatra Online

The shares of Yatra Online jumped nearly 3.52 percent, extending sharp gains for the third consecutive session after the firm released strong results for the second quarter of the ongoing financial year 2026. The stock has now gained more than 35 percent in just three sessions.

Ashok Leyland

Ashok Leyland shares rose sharply, gaining as much as 5.5 percent after the company reported a 9.3 percent year-on-year rise in revenue to Rs 9,588 crore, broadly in line with expectations, supported by healthy volume growth across segments. The stock has now advanced 36 percent in the past year.

Nazara Technologies

The shares of gaming platform Nazara Tech jumped more than 6 percent a day after the company released its results for the second quarter, where they reported a consolidated net loss of Rs 33.9 crore for the second quarter of the ongoing financial year 2026.

Source – Money Control