POST MARKET

The equity benchmark indices settled flat on Friday as weak global cues and foreign fund outflows kept investor sentiment subdued.

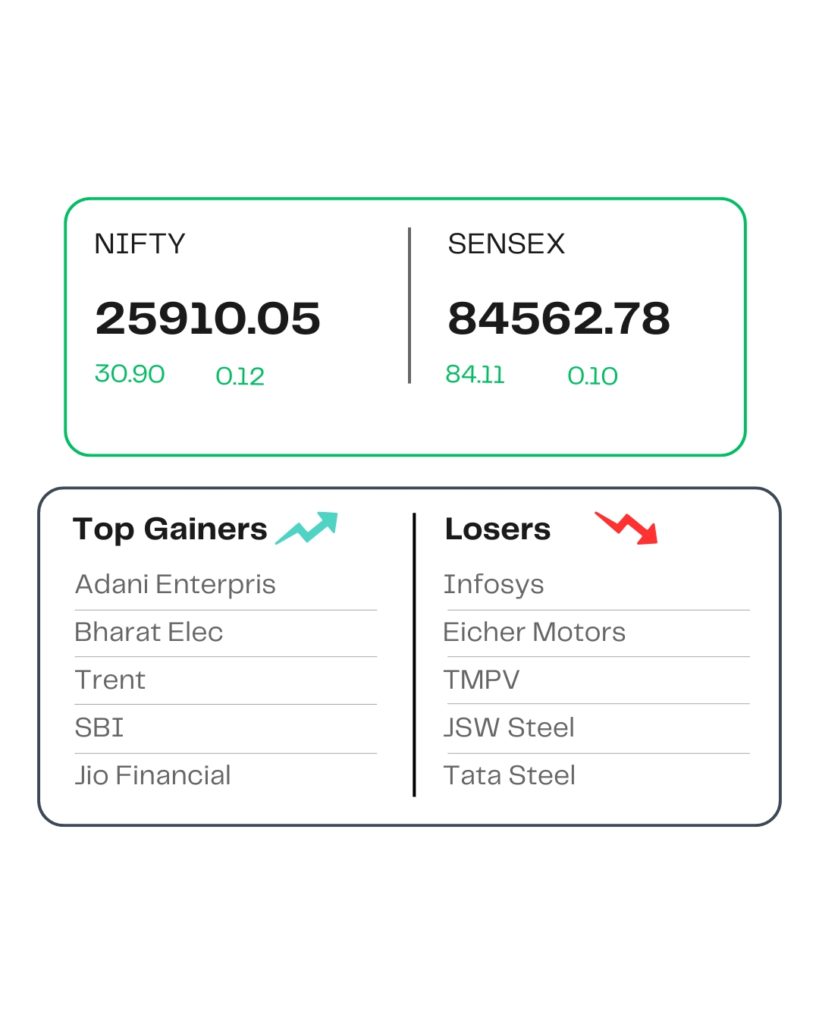

At close, the Nifty 50 index was at 25,910.05, higher by 31 points or 0.12 percent, while the Sensex index closed at 84,630.96, up 152 points or 0.2 percent.

Bharat Electricals, Adani Enterprise, Trent, SBI and Jio Financial were among the top gainers, while the top losers include Infosys, Eicher Motors, TMPV, JSW Steel, and Tata Steel

Infosys, Eicher Motors, and Tata Steel were the major laggards in the Nifty50 pack, declining up to 3 percent, while Asian Paints and Jio Financial Services rose to 1 percent.

STOCKS TODAY

Jubilant Foodworks

The shares of Jubilant Foodworks, the operator of Domino’s India, jumped 7.29 percent. This came after the company reported strong results with a net profit of Rs 64 crore for the second quarter of the ongoing financial year 2026.

LG Electronics

The shares of LG Electronics India dropped 3.31 percent after the company reported a net profit of Rs 389 crore for the July-September quarter of FY26. This marks a 27 percent year-on-year (YoY) decline from the Rs 535.7 crore net profit reported in the corresponding quarter of the previous financial year.

Muthoot Finance

The shares of Muthoot Finance jumped nearly 10 percent to hit a fresh 52-week high after the company reported strong operating performance in the second quarter of the financial year 2026. The sharp rise in the share price also comes on the back of soaring gold prices.

Infosys

The shares of Indian IT company Infosys tumbled in trade and went down over 2.5 percent amid rising expectations of the US Federal Reserve keeping its policy repo rate unchanged during its upcoming FOMC meeting scheduled in December.

Bharat Dynamics

Shares of Bharat Dynamics rose 6.32 percent after the company reported a 76.2% YoY rise in Q2 net profit, and total revenue more than doubled. The company also signeda contract worth Rs 2,096 crore with the Ministry of Defence for the supply of Invar Anti-tank missiles for the Indian Army.

Source – Money Control