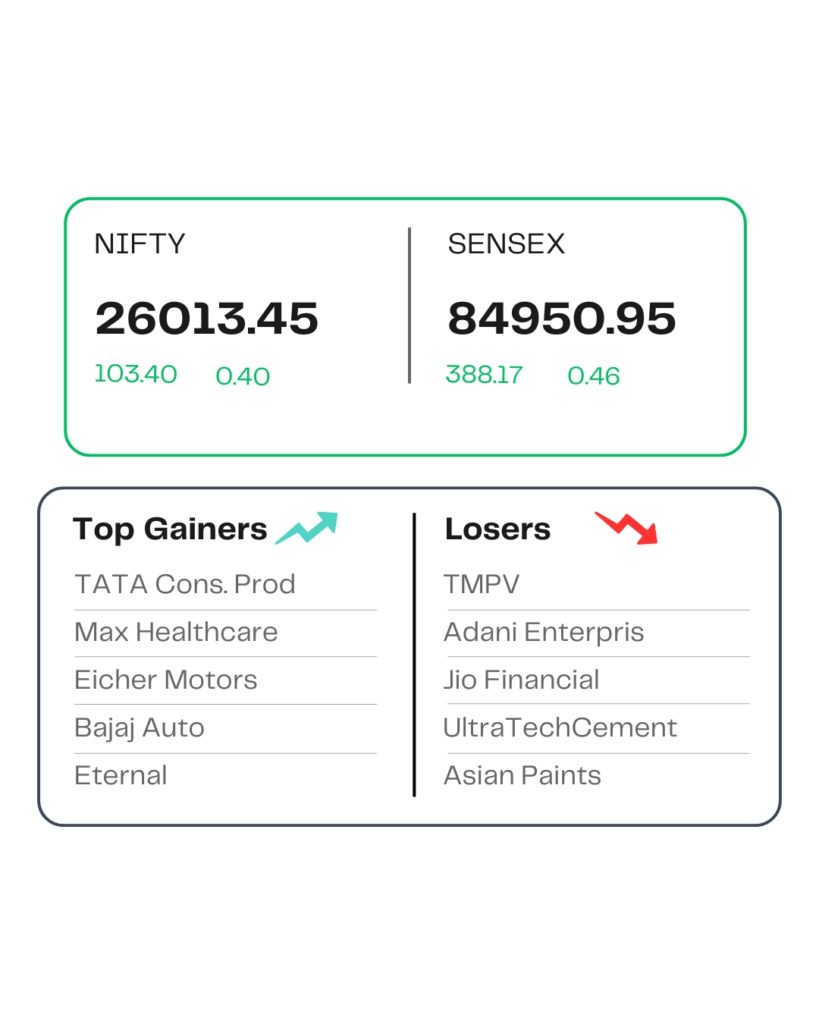

POST MARKET

Indian equity indices extended their winning streak to the sixth consecutive session on November 17, with the gains led by the banking and financial services pack.

At close, the Sensex was up 388.17 points or 0.46 percent at 84,950.95, and the Nifty was up 103.40 points or 0.40 percent at 26,013.45. About 1862 shares advanced, 2068 shares declined, and 155 shares remained unchanged.

Bajaj Auto, Tata Consumer, Eicher Motors, Max Healthcare, and Maruti Suzuki were among the major gainers on the Nifty, while losers were TMPV, Adani Enterprises, Jio Financial, Interglobe Aviation, and UltraTech Cement.

All the other sectoral indices ended in the green with auto, bank, realty, capital goods, consumer durables, and PSU Bank up 0.5-1%.

Among the broader market indices, the BSE Midcap and smallcap indices rose 0.6% each.

STOCKS TODAY

Siemens India

The shares of Siemens India jumped almost 5 percent, recording its biggest day rise in around six months. This comes after the company reported a consolidated net profit of Rs 484.9 crore for the second quarter of the ongoing financial year 2026.

Marico

The shares of Marico jumped almost 3 percent after the company released its results for the second quarter of the financial year 2026, where the company reported a net profit of Rs 420 crore for the July-September quarter of FY26, marking a marginal fall from the Rs 423 crore net profit reported in the same quarter of the previous financial year.

Alembic Pharmaceuticals

Alembic Pharmaceuticals’ share price rose almost 5 percent following the company’s receipt of final approval from the US Food & Drug Administration (USFDA) for its abbreviated new drug application (ANDA) Diltiazem Hydrochloride Tablets USP, 30 mg, 60 mg, 90 mg, and 120 mg.

Spicejet

The shares of SpiceJet jumped more than 5 percent after the airline said that it expects its operational fleet to double by the end of this year, driving a sharp expansion in network reach and scale.

Narayana Hrudayalaya

The shares of Narayana Hrudayalaya jumped 14.53 percent after the company reported a consolidated net profit of Rs 258.37 crore for the July-September quarter of the financial year 2026.

Source – Money Control