POST MARKET

The Indian equity indices bounced back to settle in the green on November 19, with the sharp rally in the IT pack leading the gains.

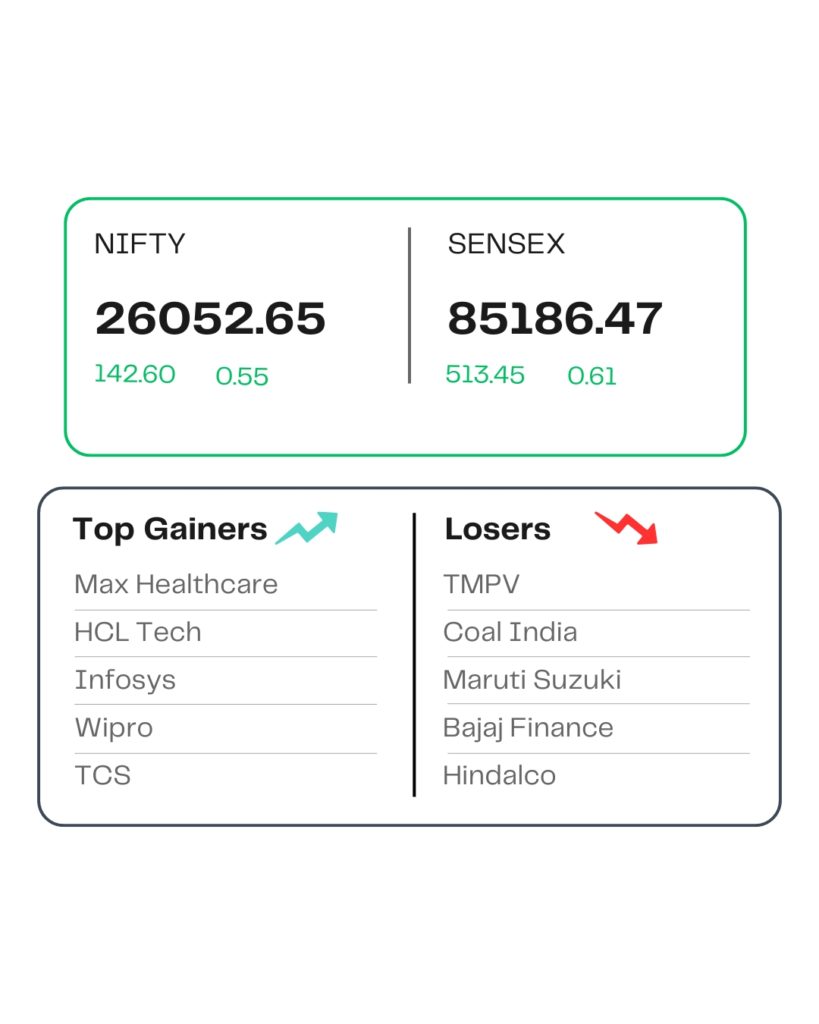

At close, the Sensex was up 513.45 points or 0.61 percent at 85,186.47, and the Nifty was up 142.60 points or 0.55 percent at 26,052.65. About 1756 shares advanced, 2248 shares declined, and 152 shares remained unchanged.

On the sectoral front, the IT index rose 3%, the PSU Bank index added 1.2%, the Nifty Bank index was up 0.5%, while the media index was down 0.3% and the realty index was down 0.4%.

The biggest Nifty gainers were HCL Technologies, Max Healthcare, Infosys, Wipro, and TCS, while losers were TMPV, Coal India, Maruti Suzuki, Adani Ports, and Bajaj Finance.

Among the broader market indices, the BSE Midcap index rose 0.3%, while the Smallcap index shed 0.4%.

STOCKS TODAY

KEC International

The shares of KEC International dropped more than 9 percent after Power Grid Corporation of India debarred the company from taking fresh tenders or contracts and being awarded contracts for a period of nine months due to “alleged transgression of contractual provisions.

Avanti Feeds

The shares of shrimp company Avanti Feeds sharply surged over 9 percent after China notified Japan that it will ban all imports of Japanese seafood. Indian shrimp-feed companies export products to China. Hence, the ban on Japanese seafood may have increased expectations of higher demand in China.

Waaree Energies

Shares of Waaree Energies fell 2.89 percent on November 19, a day after the firm said certain officials from the Income Tax Department visited some offices and facilities of the renewable energy firm. The shares closed at Rs 3,187.00 per share.

Sammaan Capital

Sammaan Capital shares fell 13.33 percent as the Supreme Court reportedly questioned the “friendly approach” by the Central Bureau of Investigation (CBI) in the probe of alleged irregularities at the NBFC (Non-Banking Financial Company).

Infosys

Shares of IT major Infosys Ltd rose 3.74 percent on November 19, a day after the firm said the window for Rs 18,000-crore share buyback will open on November 20.

Source – Money Control