POST MARKET

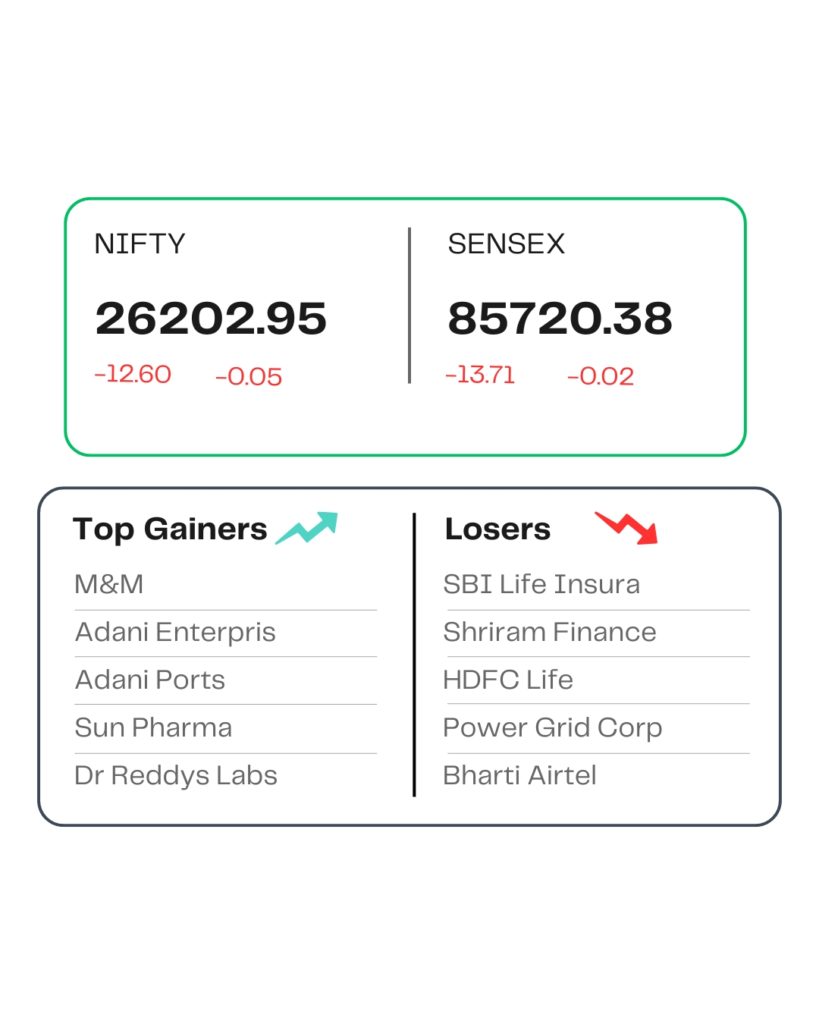

Indian equity indices ended on a flat note, snapping a two-day winning run on November 28.

At close, the Sensex was down 13.71 points or 0.02 percent at 85,706.67, and the Nifty was down 12.60 points or 0.05 percent at 26,202.95. About 1945 shares advanced, 2023 shares declined, and 152 shares remained unchanged.

On the sectoral front, pharma, media, and auto rose 0.5-1%, while power, oil & gas, and telecom shed 0.5-1% each.

Adani Enterprises, M&M, Adani Ports, Sun Pharma, and HUL were among the top gainers on the Nifty, while losers were SBI Life Insurance, Shriram Finance, HDFC Life, Power Grid Corp, and Bharti Airtel.

Among the broader market indices, the BSE Midcap and smallcap indices ended on a flat note.

STOCKS TODAY

Hindustan Zinc

The shares of Hindustan Zinc jumped 2.22 percent as a sharp rise in silver prices boosted investor sentiment for the stock. Silver futures on the Multi-Commodity Exchange of India (MCX) with December expiry rose nearly 2 percent to Rs 1.65 lakh per kilogram.

Nectar Lifesciences

The shares of Nectar Lifesciences jumped almost 20 percent. This comes after the company announced that its board will consider a buyback of shares on December 3. The company announced that the trading window for shares by the company’s executives will remain closed from November 27 till the completion of 48 hours after the conclusion scheduled on December 3 to consider the buyback of shares.

GAIL

Shares of GAIL (Gas Authority of India Ltd) Ltd declined 6% to Rs 172 apiece, their lowest level since October 14, on a smaller-than-expected tariff hike by regulator Petroleum and Natural Gas Regulatory Board. The company’s transmission tariff has been revised up by 12% to Rs 65.7 per mmbtu by PNGRB.

63 Moons

Shares of 63 moons rose over 15.15 percent after the National Spot Exchange settlement scheme was approved by the National Company Law Tribunal (NCLT), thus paving the way for resolution and financial closure. The NCLT approval marks a final stop for the 12-year-long NSEL crisis, potentially leading to all legal cases against the company being withdrawn.

Mahindra & Mahindra

Mahindra & Mahindra (M&M) shares rose more than 2 percent on Friday, emerging as one of the top gainers in the Nifty Auto index and the second-biggest gainer in the Nifty50 pack. The stock gained after the company launched the XEV 9S, a new electric seven-seater SUV, priced from Rs 19.95 lakh (ex-showroom)

Eureka Forbes

Eureka Forbes rose sharply, surging 8.4 percent. The stock has gained about 14 percent in the past five trading days, extending a strong upward trajectory. At the close, the company’s market capitalisation stood at Rs 12,767 crore, and the stock traded at a P/E multiple of 68.94.

Source – Money Control