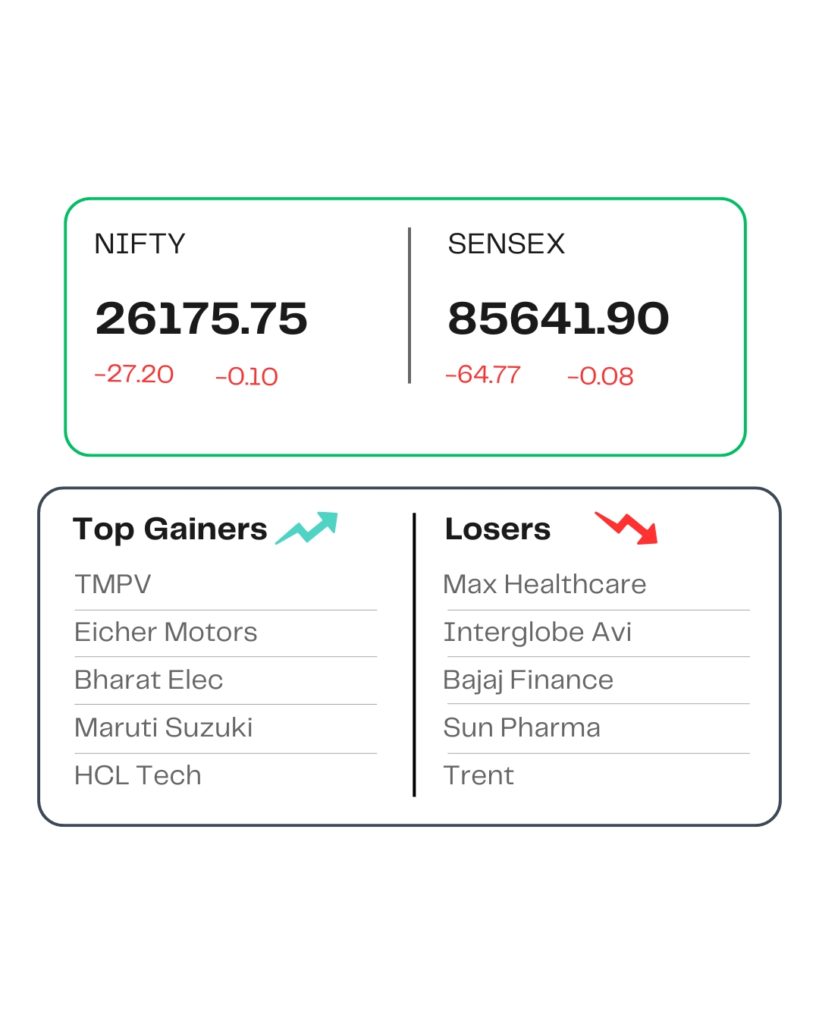

POST MARKET

Indian equity indices ended on a flat note in the volatile session on December 1, as they declined from record highs on Monday amid weak global cues and concerns over the interest rate outlook.

At close, the Sensex was down 64.77 points or 0.08 percent at 85,641.90, and the Nifty was down 27.20 points or 0.10 percent at 26,175.75. About 1783 shares advanced, 2288 shares declined, and 183 shares unchanged.

Interglobe Aviation, Bajaj Finance, Max Healthcare, Sun Pharma, Trent were among top losers on the Nifty, while gainers were Adani Ports, Kotak Mahindra Bank, Tata Motors PV, Kotak Mahindra Bank, Eicher Motors.

Among sectors auto, IT, PSU Bank, metal rose 0.3-0.5% each, while realty index down 1% and consumer durables, pharma indices down 0.5% each.

Among the broader market indices, the BSE Midcap and smallcap indices ended flat.

STOCKS TODAY

One97Communications

The shares of One97 Communications, the parent company of Paytm, rose more than 3.6 percent. The stock has extended gains for the fourth consecutive session amid positive investor sentiment following bullish brokerage calls and RBI’s final approval for Payment Aggregator license.

Hindustan Copper

The shares of metal company Hindustan copper went up rose 3.65 percent in trade, as soaring commodity prices, rising expectations of a rate cut by the US Federal Reserve and strong manufacturing data boosted investor sentiment.

Teamlease Services

The shares of Teamlease Services jumped around 2.29 percent after Investec issued a bullish call for the stock, stating that the company is set to benefit from the new labour laws introduced in India. The new labour laws are set to benefit staffing firms over medium to long term.

Wockhardt

The shares of Wockhardt sharply surged 20 percent after the company announced that the US FDA has formally accepted the New Drug Application (NDA) for its antibiotic Zaynich recognizing its potential to address urgent and unmet medical needs.

Bank of Maharashtra

Shares of state-owned Bank of Maharashtra fell almost 1.5 percent on Monday following a report that the Centre may offload about a 5 percent stake in the lender to meet minimum public shareholding norms.The government held 79.60 percent in the bank as of September 2025.

Source – Money Control