Vidya Wires IPO is a bookbuilt issue of ₹300.01 crore. It combines a fresh issue of 5.27 crore shares aggregating to ₹274.00 crore and offer for sale of 0.50 crore shares aggregating to ₹26.01 crore.

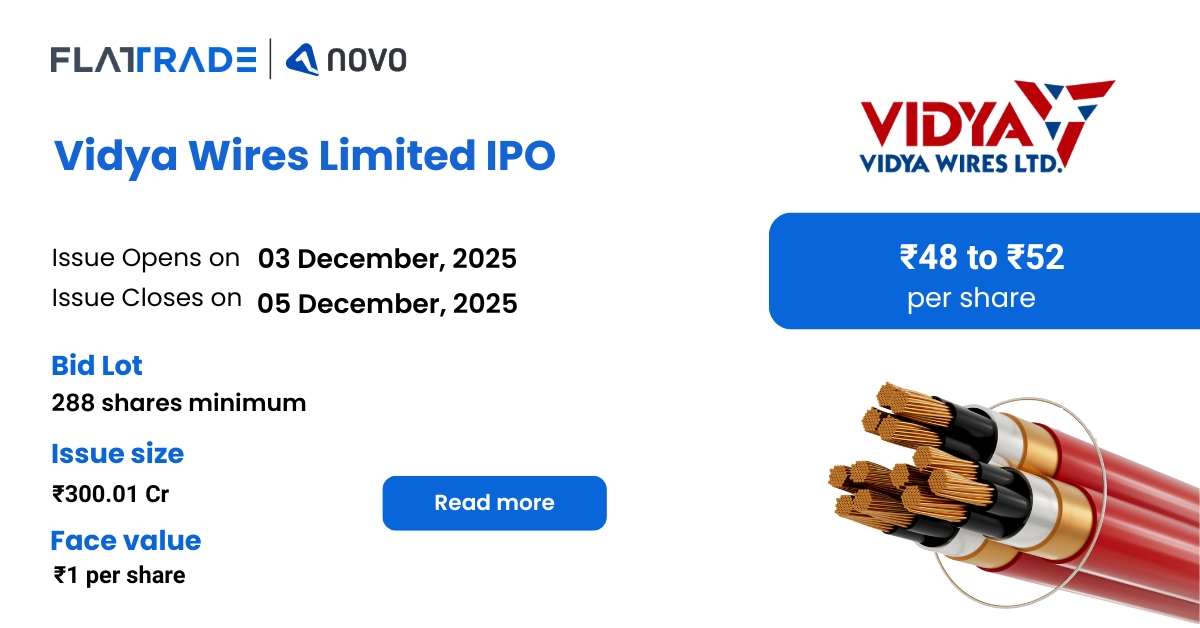

The IPO opens for subscription on December 3, 2025 and closes on December 5, 2025. The allotment is expected to be finalized on Monday, December 8, 2025. The price band for the IPO is set at ₹48 to ₹52 per share, and the minimum lot size for an application is 288 shares.

Company Summary

Incorporated in 1981, Vidya Wires Limited is engaged in manufacturing copper and aluminum wires.

The company manufactures winding and conductivity products for various industries, including precision-engineered wires, copper strips, conductors, busbars, specialized winding wires, PV ribbons, and aluminum paper-covered strips.

The company’s products are used in critical applications like energy generation, electrical systems, electric mobility, railways, and clean energy, offering conductivity, durability, and thermal efficiency for high-performance, reliable operations.

The company has expanded its manufacturing capacity to 19,680 MT per annum and plans to increase it to 37,680 MT per annum with an additional 18,000 MTPA units in Narsanda, Gujarat.

The company manufactures over 8,000 SKUs of winding and conductivity products, ranging from 0.07 mm to 25 mm, and plans to add new products like copper foils, solar cables, and aluminum winding wires.

As of November 14, 2025, the company had 139 permanent employees and over 394 contract labourers.

Product Portfolio

- Enameled Copper Winding Wires

- Enameled Copper Rectangular Strips

- Fibre Glass Covered Copper/ Aluminium Conductors

- Paper Insulated Copper Conductors/ Aluminium Conductors(Rectangular & Round)

- Twin/Triple Bunched Paper Insulated Copper Strips

- Cotton Covered Ropes

- PV Ribbon

- PV Bus Bar

- Copper Busbar

Company Strengths

- De-risked business model with wide customer base, diversified portfolio of products, and multiple end-user industries.

- Backward integration for quality control as well as sustainability initiatives.

- Their presence in strategically located region

- Diversified customer base having longstanding relationships with customers and suppliers

- Continuous financial performance

- Experienced professional management team

Company Financials

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 376.93 | 331.33 | 247.84 | 209.08 |

| Total Income | 413.09 | 1,491.45 | 1,188.49 | 1,015.72 |

| Profit After Tax | 12.06 | 40.87 | 25.68 | 21.53 |

| EBITDA | 18.67 | 64.22 | 45.52 | 35.84 |

| Net Worth | 178.37 | 166.336 | 125.54 | 100.11 |

| Reserves and Surplus | 162.37 | 150.36 | 121.54 | 95.86 |

| Total Borrowing | 162.75 | 145.63 | 109.71 | 97.11 |

| Amount in ₹ Crore | ||||

Objectives of IPO

- Funding capital expenditure requirements for setting up new project in the subsidiary viz. ALCU

- Repayment/prepayment, in full or part, of all or certain outstanding borrowings availed by the Company

- General corporate purposes

Promoters of the company

Shyamsundar Rathi, Shailesh Rathi and Shilpa Rathi are the promoters of the company.

IPO Details

| IPO Date | December 3, 2025 to December 5, 2025 |

| Listing Date | December 10, 2025 |

| Face Value | ₹1 per share |

| Price Band | ₹48 to ₹52 per share |

| Lot size | 288 shares |

| Total Issue size | 5,76,93,307 shares (aggregating upto ₹300.01 Cr ) |

| Fresh Issue | 5,26,92,307 shares (aggregating upto ₹274.00 Cr ) |

| Offer for Sale | 50,01,000 shares of ₹1 (aggregating upto ₹26.01 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 16,00,00,000 shares |

| Share Holding Post Issue | 21,26,92,307 shares |

Lot Allocation Details

Application | Lots | Shares | Amount |

Retail (Min) | 1 | 288 | ₹14,976 |

Retail (Max) | 13 | 3,744 | ₹1,94,688 |

S-HNI (Min) | 14 | 4,032 | ₹2,09,66 |

S-HNI (Max) | 66 | 19,008 | ₹9,88,416 |

B-HNI (Min) | 67 | 19,296 | ₹10,03,392 |

Allotment Schedule

| Basis of Allotment | Mon, 8 Dec, 2025 |

| Initiation of Refunds | Tue, 9 Dec, 2025 |

| Credit of Shares to Demat | Tue, 9 Dec, 2025 |

| Tentative Listing Date | Wed, 10 Dec, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on December 5, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII Shares Offered | Not less than 15% of the Net Offer |

To check allotment, click here