POST MARKET

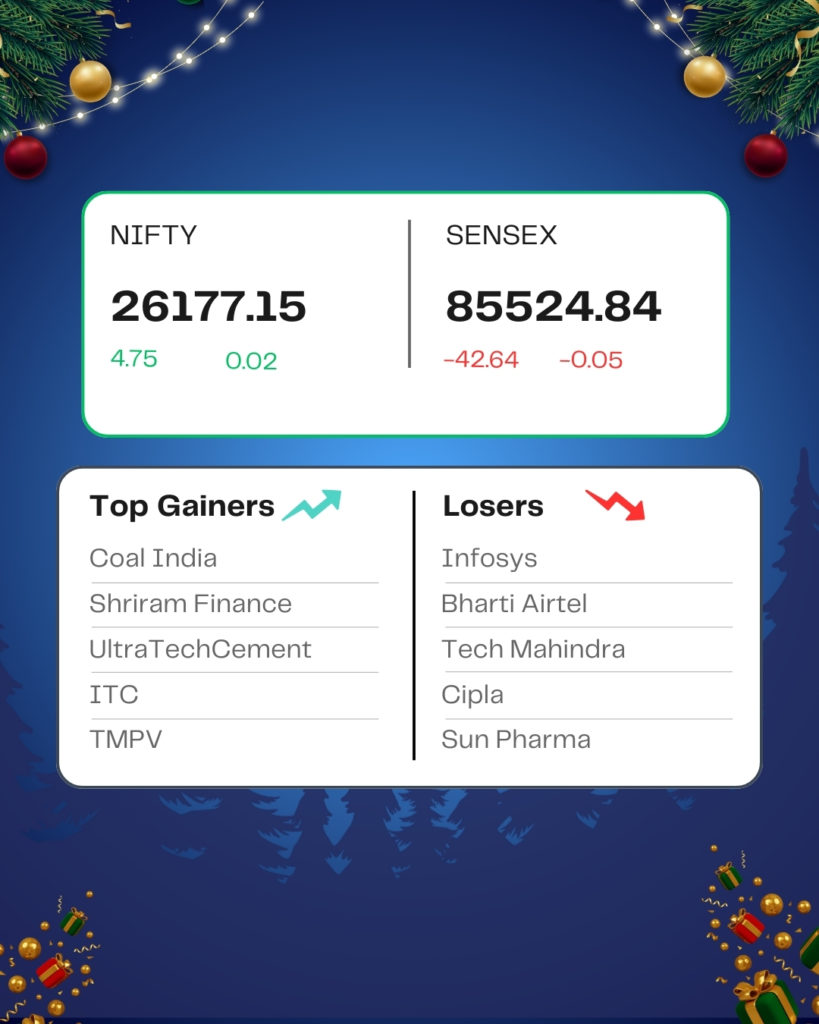

The Indian equity markets failed to build on the opening gains and traded in a range-bound movement throughout the session, breaking a two-day gaining streak.

At close, the Sensex was down 42.64 points or 0.05 percent at 85,524.84, and the Nifty was up 4.75 points or 0.02 percent at 26,177.15. About 2146 shares advanced, 1725 shares declined, and 130 shares remained unchanged.

Coal India, Shriram Finance, UltraTech Cement, Tata Motors Passenger Vehicles, and Power Grid Corporation were among the major gainers on the Nifty. At the same time, losers included Infosys, Bharti Airtel, Cipla, Tech Mahindra, and Axis Bank.

On the sectoral front, IT, Healthcare, PSU Bank, and realty down 0.2-0.8 percent, while the media index up 0.6 percent, and the metal index rose 0.5 percent, the PSU index up 0.5 percent, and the energy index up 0.6 percent.

Among the broader market indices, the BSE midcap index ended flat, while the smallcap index rose 0.4 percent.

STOCKS TODAY

Puravankara

The shares of Puravankara jumped more than 6.5 percent after the company announced that it acquired the land parcel spanning across 53.5 acres of land in Bengaluru’s Anekal Taluk. It said the acquisition further strengthens its presence in one of the city’s emerging residential growth corridors.

RITES

RITES Ltd, an infrastructure, consultancy, and engineering firm, on Tuesday said it has bagged a Rs 315.7 crore order from an international firm for the supply of service diesel electric locomotives in South Africa. The development underlines growing international engagement in railway technology and marks an important achievement in bilateral rail cooperation.

Coal India

Shares of Coal India rose 3.7% to Rs 400.6 apiece to become the top Nifty 50 gainer on December 23 as reports said its subsidiary is planning to launch an IPO soon. The stock rose for the fifth consecutive session. The PSU firm’s unit Bharat Coking Coal (BCCL) is likely to hit the primary market with a Rs 1,300-crore IPO within the next two weeks.

HFCL

Shares of HFCL Ltd rose almost 4 percent after the technology gear maker launched its qualified institutional placement (QIP) of shares at a premium. HFCL had set a floor price at Rs 65.84 per share, a 3% premium to its closing price on December 22. A premium is generally seen as a positive, as it suggests that stakeholders expect the stock’s market worth to rise, indicating confidence in future prospects.

Source – Money Control