POST MARKET

The Indian equity indices declined on Friday amid profit booking in a holiday-truncated week, with sustained selling by foreign institutional investors (FIIs) weighing on sentiment.

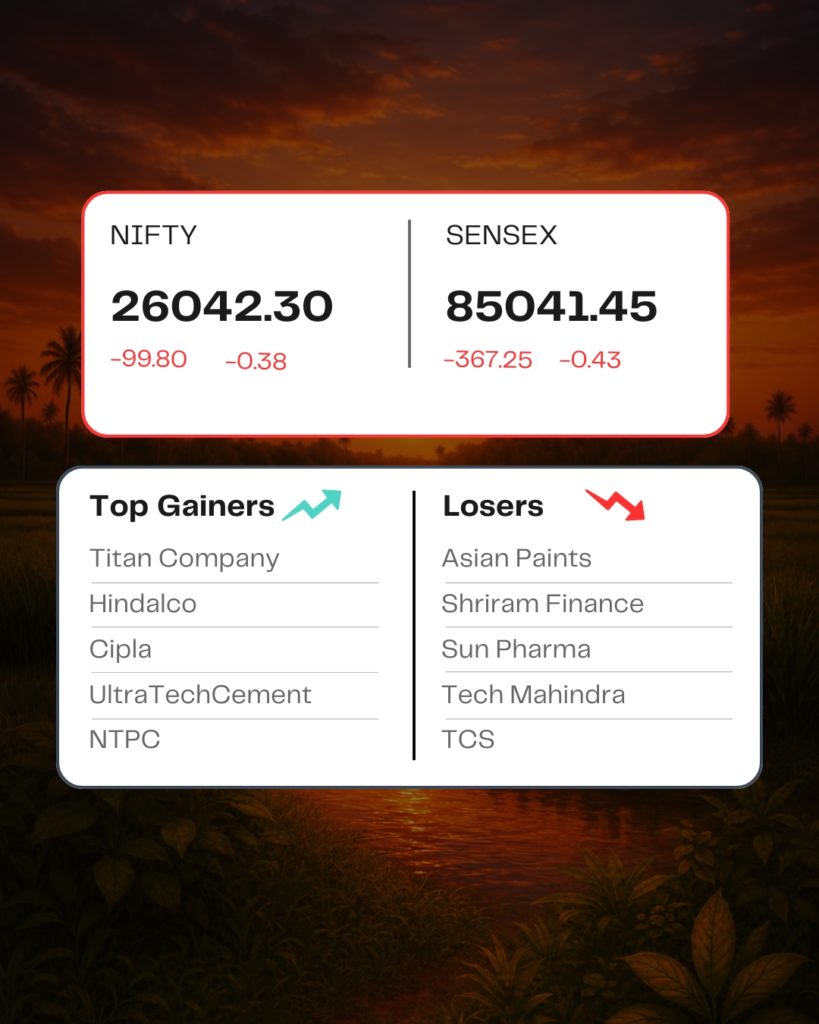

At close, Sensex settled 367.25 points or 0.43 percent lower at 85,041.45, while the broader Nifty declined to 26,042.30, down 99.80 points or 0.38 percent.

Titan Company, Nestle, Hindalco, UltraTechCement, and Cipla were among the top gainers, while the top losers include Asian Paints, Shriram Finance, Sun Pharma, HDFC Life, and Tech Mahindra.

Sectoral action ended mixed, with Nifty Metal and Nifty FMCG high while Pharma and auto ended marginally lower.

Among the broader market indices, the BSE midcap index was down almost 0.2 percent, and the smallcap index ended 0.34 percent lower.

STOCKS TODAY

Titan Company

The shares of Titan Company rose more than 2 percent after the company announced their new brand ‘beYon – from the House of Titan’ with its first exclusive retail store in Mumbai being opened on December 29. It said that the brand will offer a curated range of Lab Grown Diamond (LGD) jewellery, marking its entry into the emerging segment.

Swiggy

The shares of Swiggy dropped around 2 percent after delivery partners across platforms called for an all-India strike on December 25 and December 31, citing various reasons. The fall also comes after quick commerce rival Zepto is likely to confidentially file draft IPO papers today.

Rail Vikas Nigam Ltd

RVNL share price went up over 12 percent after the government’s revised passenger train fares came into effect from Friday, marking the second fare hike this year. The Indian Railways had earlier announced that the new fare structure would be effective from December 26 and is expected to generate additional revenue of about Rs 600 crore in 2025-26.

AMSL

Apollo Micro Systems Ltd (AMSL) shares rose 2.17 percent after the company said it has received orders aggregating Rs 100.2 crore from a private firm for the supply of Unmanned Aerial Systems. The orders are to be executed over a period of four months.

Stylam Industries

The share price went down 2.2 percent after Stylam Industries on December 26 announced that Japan’s AICA Kogyo will buy a 40 per cent stake in the company for Rs 1,525 crore. The stake acquisition will be done by the Japanese conglomerate in various tranches. Stylam’s promoters Pushpa Gupta, Dipti Gupta and Manav Gupta have entered into a share purchase agreement with the company to sell around 45.97 lakh shares, representing 27.12 percent stake, in two tranches.

Source – Money Control