POST MARKET

Indian equity indices ended on a strong note on January 2, tracking firm global cues and buying interest in index heavyweights.

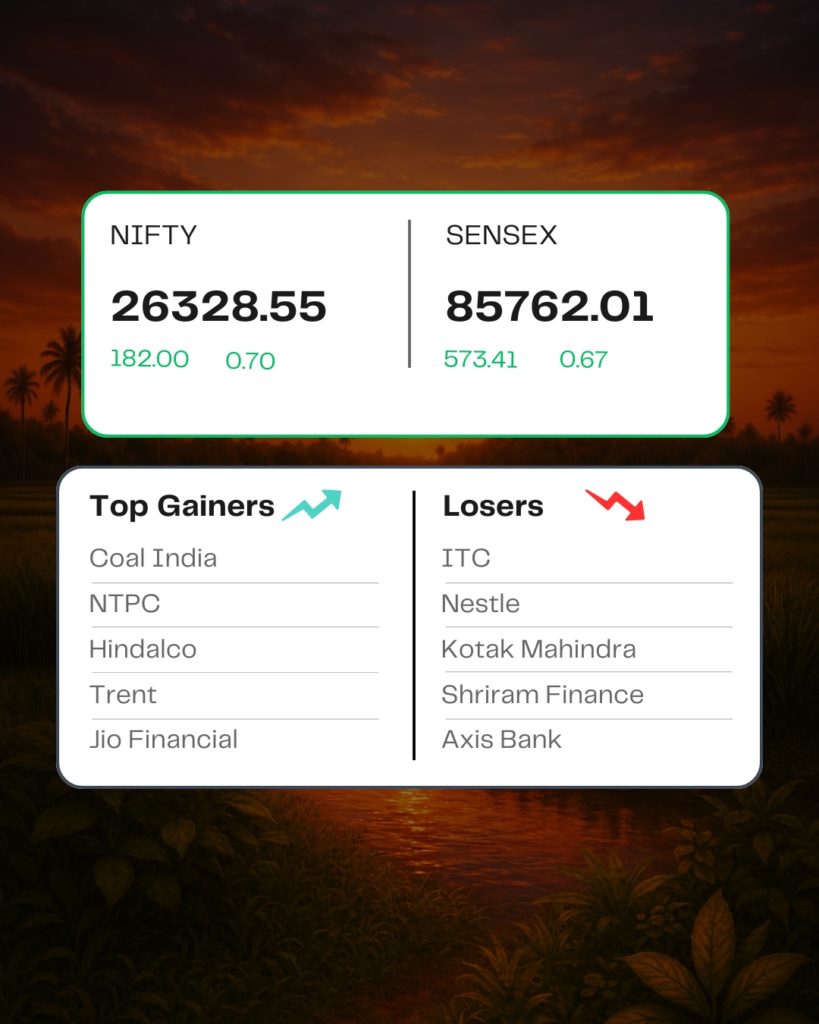

At close, the Sensex was up 573.41 points or 0.67 percent at 85,762.01, and the Nifty was up 182 points or 0.70 percent at 26,328.55. About 2527 shares advanced, 1347 shares declined, and 135 shares were unchanged.

Coal India, NTPC, Hindalco, Trent, Jio Financial were among the top gainers on the Nifty, while losers were ITC, Nestle, Axis Bank, Kotak Mahindra Bank, and Shriram Finance.

Except for FMCG (down 1%), all other sectoral indices ended in the green, with auto, metal, capital goods, media, realty, consumer durables, power, and PSU rising 1-2%.

Among the broader market indices, the BSE midcap index added 1 percent and the smallcap index rose nearly 1%.

STOCKS TODAY

Coal India

Coal India shares surged 7.15 percent after the PSU firm permitted coal consumers located in neighbouring countries like Bangladesh, Bhutan and Nepal, who wish to import coal from India, to directly participate in the Single Window Mode Agnostic (SWMA) auctions conducted by the company

Olectra Greentech

Olectra Greentech shares jumped over 6 percent to a one-month high on January 2 after the company announced the beginning of operations at its EV facility in Hyderabad. The shares of peer JBM Auto jumped nearly 8 percent, snapping a two-session losing streak.

Time Technoplast

Time Technoplast’s share price rose 4.39 percent after the company received approval from the Petroleum and Explosives Safety Organization (PESO) and M/s. TUV Rheinland (India), for the manufacture and supply of high-pressure type-3 fully wrapped fibre reinforced composite cylinders of 2 litres capacity for compressed gases applications.

Cupid

Shares of Cupid Ltd went down 20 percent after they were placed under the long-term Additional Surveillance Measure Stage 1 framework. The framework involves 100% margin requirements on T+3 days to curb volatility in certain stocks. The margin requirement limits speculative trading and reduces risk exposure in potentially unstable or manipulated stocks. It acts as a buffer against uncontrolled price moves.

Sapphire Foods

Shares tumbled almost 4.5 percent after Sapphire Foods and Devyani International, the two companies that operate quick-service chains such as KFC and Pizza Hut in India, announced plans for a merger on January 1. The two firms have outlined the key details of their proposed merger, which will bring together two of India’s largest franchise partners of Yum! Brands under a single, scaled quick-service restaurant (QSR) platform.

Source – Money Control