Rohan, who was a young professional, began investing recently to build long-term financial security. Like many first-time investors, his early experience with the market shaped his expectations more than he realised.

When he began investing, markets felt reassuring. Prices moved up more often than they fell, and every dip seemed short-lived. He had read about volatility, but it felt difficult and theoretical. Like any other new investor, his early days were shaped by a relatively calm phase in the market, which made investing appear simpler than it truly was.

That illusion changed when the first significant market decline arrived unexpectedly.

One morning, Rohan opened his portfolio and saw widespread losses. Stocks he believed in were down significantly, headlines turned pessimistic, and expert opinions offered little clarity.

What unsettled him most was not the fall, but the uncertainty surrounding it. For the first time, he questioned his decisions and wondered whether staying invested was the right choice.

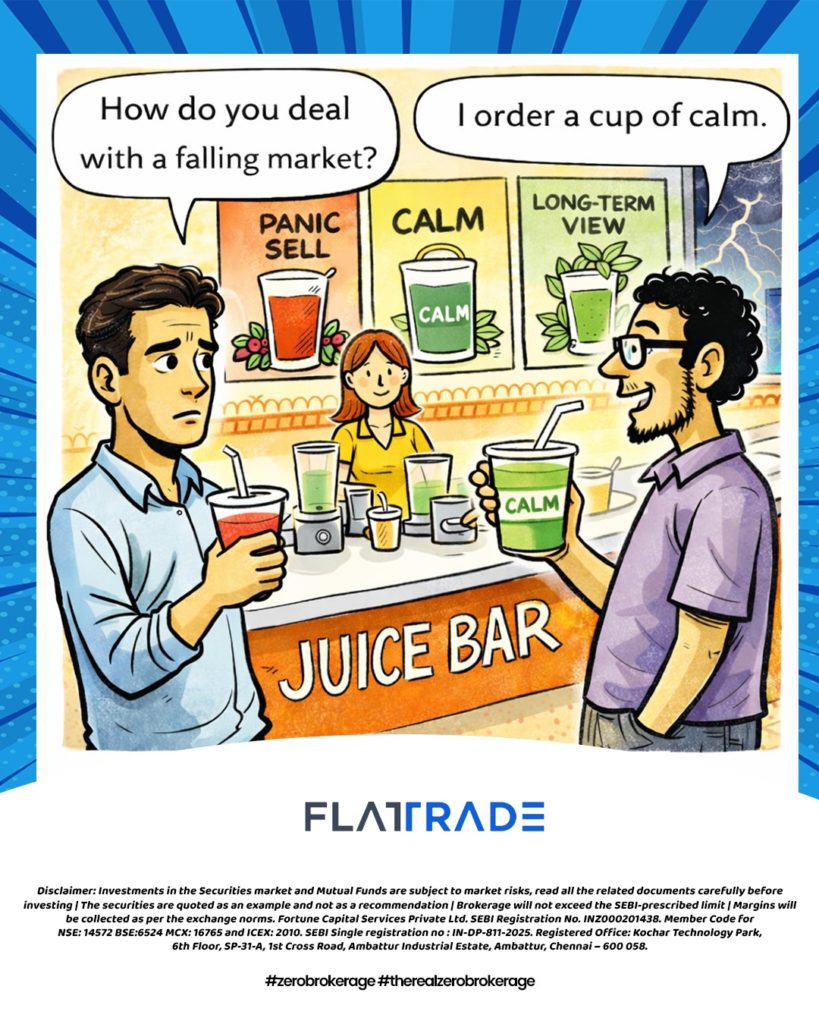

With each fluctuation, his pressure to act quickly was increasing. Selling felt like control, while holding felt risky. Each decline made the losses feel permanent, even though nothing fundamental had changed in the companies of the stocks he owned.

The fear was emotional rather than logical. It came from watching prices fall, not from changes in long-term value.

As days passed, the market remained volatile. Some sessions ended in recovery, while others ended with further declines. Rohan realised that reacting emotionally to each move was exhausting and unproductive. He revisited his original investment goals and the reasons behind his decisions. He reminded himself that his approach was built for the long term, not for short-term market movements.

That pause created clarity. He began to see that volatility was a natural part of investing, not a sign of failure.

He began to understand the difference between volatility and loss. Volatility was the market moving up and down in response to sentiment, news, and uncertainty. Loss, on the other hand, became permanent only when he chose to exit at unfavourable prices. This understanding changed how he viewed market corrections.

As weeks passed, the market slowly stabilised. When Rohan looked back, he realised the period he feared the most had taught him the most valuable lesson. Market corrections are not panic signals. They are reminders for patience and discipline.

Today, Rohan still faces market volatility, but his response has changed. He understands that market falls are inevitable, but emotional decisions are optional. His confidence now comes from experience, not from optimism.

Every market fall carries a lesson. The investors who benefit are those who stay invested long enough to learn it.

Because markets may fall again. What matters is whether you remain steady when they do.

And that lesson, once learned, lasts a lifetime.

The market fall Rohan once feared turned out to be his greatest teacher. It revealed the difference between temporary volatility and permanent loss, and the importance of patience during uncertain times. Investing is not about avoiding downturns; it is about learning how to respond to them.

Every market fluctuation carries a lesson. Those who stay invested long enough are the ones who truly learn it and grow stronger because of it.