POST MARKET

Indian equity benchmarks extended their losing streak for a fifth straight session on January 9, 2026, primarily due to uncertainty surrounding the US Supreme Court’s verdict on the legality of Trump tariffs, which was expected later that day.

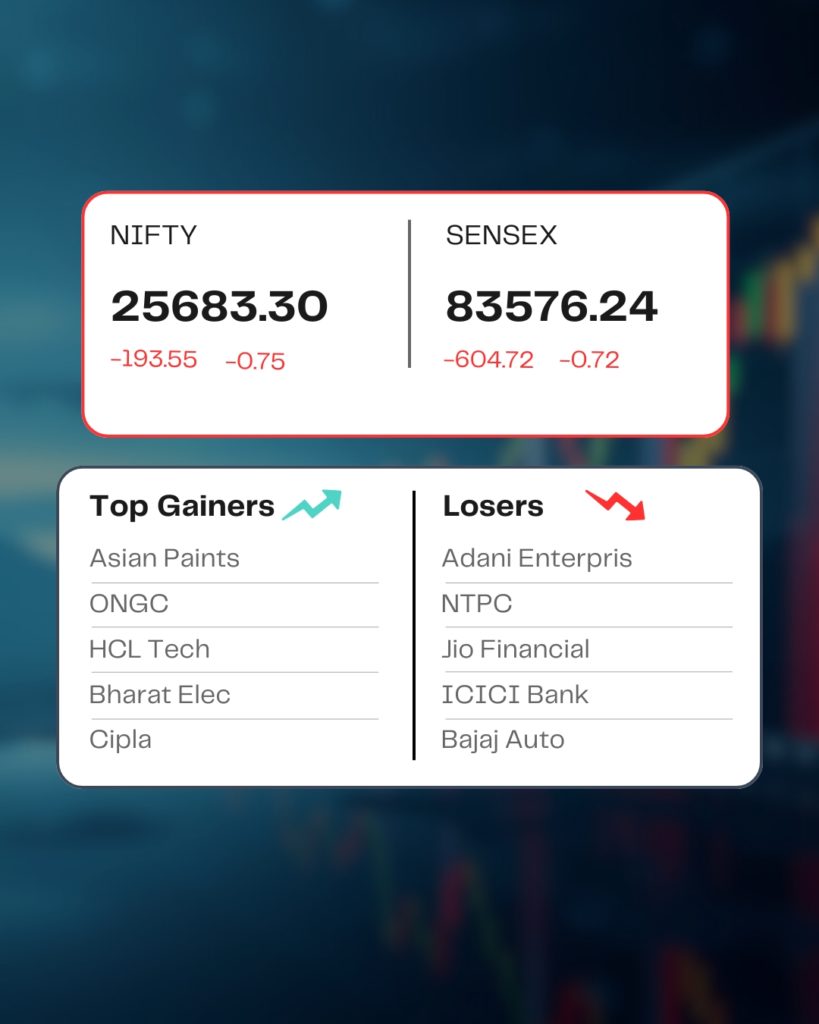

At close, the Sensex was down 604.72 points or 0.72 percent at 83,576.24, and the Nifty was down 193.55 points or 0.75 percent at 25,683.30. About 918 shares advanced, 2889 shares declined, and 131 shares were unchanged.

Adani Enterprises, Shriram Finance, NTPC, ICICI Bank, and Jio Financial were among the major losers on the Nifty, while gainers were Asian Paints, ONGC, Bharat Electronics, and HCL Technologies. Eternal.

Among sectors, except IT, PSU Bank, Oil & Gas, all other indices ended lower with auto, FMCG, realty, and consumer durables down 1-2 percent.

Among the broader market indices, the BSE Midcap index shed 0.9%, while the smallcap index fell 1.7%.

STOCKS TODAY

Apex Frozen Foods

Shares of the export company went down 5.28 percent along with other export firms ahead of a key ruling by the US Supreme Court on President Donald Trump’s use of emergency powers to impose tariffs. Analysts said export-linked stocks could see a rally if the court strikes down the tariffs, though they cautioned that alternative policy measures could limit the upside.

Mazagon Dock Shipbuilders

Mazagon Dock Shipbuilders share price ended over a percent higher on January 09. Despite overall weakness in benchmark indices, Sensex and Nifty, defence shares climbed up to 6% on January 9 due to various reasons.

Manappuram

Shares of Manappuram Finance Ltd fell 5.5 percent after the Reserve Bank of India raised objections to Bain Capital’s plan to acquire a controlling stake in the NBFC. Bain, which announced its planned investment in the gold loan firm last March, is exploring a phased divestment in Tyger Capital, a smaller firm, to address the RBI’s concerns.

Waaree Renewable Technologies

Shares went down 3.71 percent despite the fact that the company has received a Letter of Award for a revised project capacity of 704 MWac / 1,000 MWp. The commercial order value has been reduced from Rs 1,252.43 crore to Rs 1,039.60 crore, resulting in a reduction of Rs 212.83 crore. All other terms of the project remain unchanged.

Source – Money Control