POST MARKET

The Indian equity market ended lower on January 12, with the Nifty slipping below 25,750 amid selling pressure in auto, consumer durables, pharma, and realty stocks.

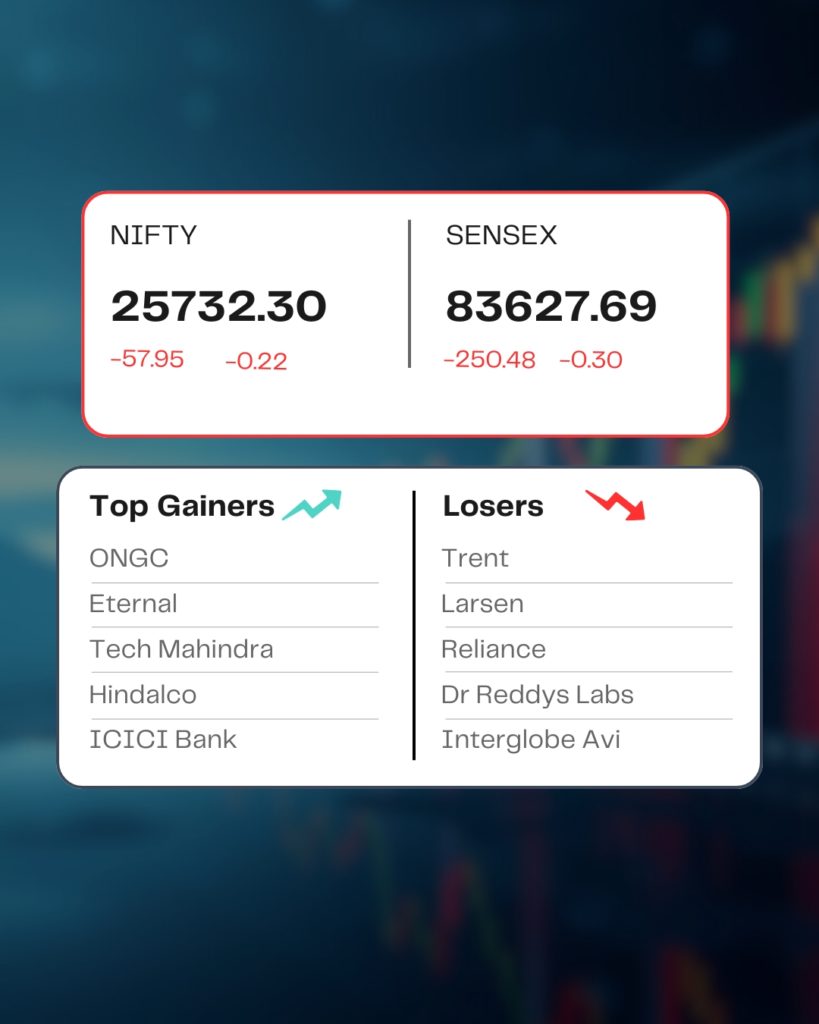

At close, the Sensex was down 250.48 points or 0.30 percent at 83,627.69, and the Nifty was down 57.95 points or 0.22 percent at 25,732.30. About 1870 shares advanced, 1942 shares declined, and 158 shares were unchanged.

Trent, L&T, Dr Reddy’s Labs, Reliance Industries, and Interglobe Aviation were among the major losers on the Nifty, while gainers were ONGC, Tech Mahindra, Eternal, ICICI Bank, and Hindalco Industries.

On the sectoral front, IT, media, PSU Bank, metal ended in the green, while FMCG, capital goods, consumer durables, pharma, and realty fell between 0.3-0.5 percent.

Among the broader market indices, the BSE Midcap index shed 0.2%, while the smallcap index rose 0.5%.

STOCKS TODAY

Eternal

Shares of Zomato parent company Eternal went up over 3 percent after reports said Union Labour Minister Mansukh Mandaviya held meetings over the past month with major quick commerce and delivery platforms, including Blinkit, Zepto, Zomato, and Swiggy, to discontinue the marketing and branding of 10-minute delivery services.

Cipla

The shares of Cipla dropped 1.17 percent after the US FDA granted its final approval to rival Aurobindo Pharma for a generic version of Advair Diskus, which is a key respiratory drug used to treat patients suffering from asthma and chronic obstructive pulmonary disease. Citi called the development a “marginal negative” for Cipla.

RedTape

Shares of footwear maker RedTape on Monday surged over 10 percent after a report said the company’s founders are exploring a sale of their stake and have reached out to private equity firms.

Larsen & Toubro

Larsen & Toubro (L&T) issued a clarification on January 13 after a report suggested that Kuwait is discussing plans to cancel oil project tenders worth $8.7 billion. The stock tumbled almost 4 percent following the reports. The company clarified that the projects referred to in the media reports were not part of the company’s order book, and it cannot comment on the status of tenders or commercial decisions of its clients.

Source – Moneycontrol