POST MARKET

Indian equity benchmarks surrendered most of their intraday gains in late trade on Friday, with selling pressure intensifying across heavyweight stocks.

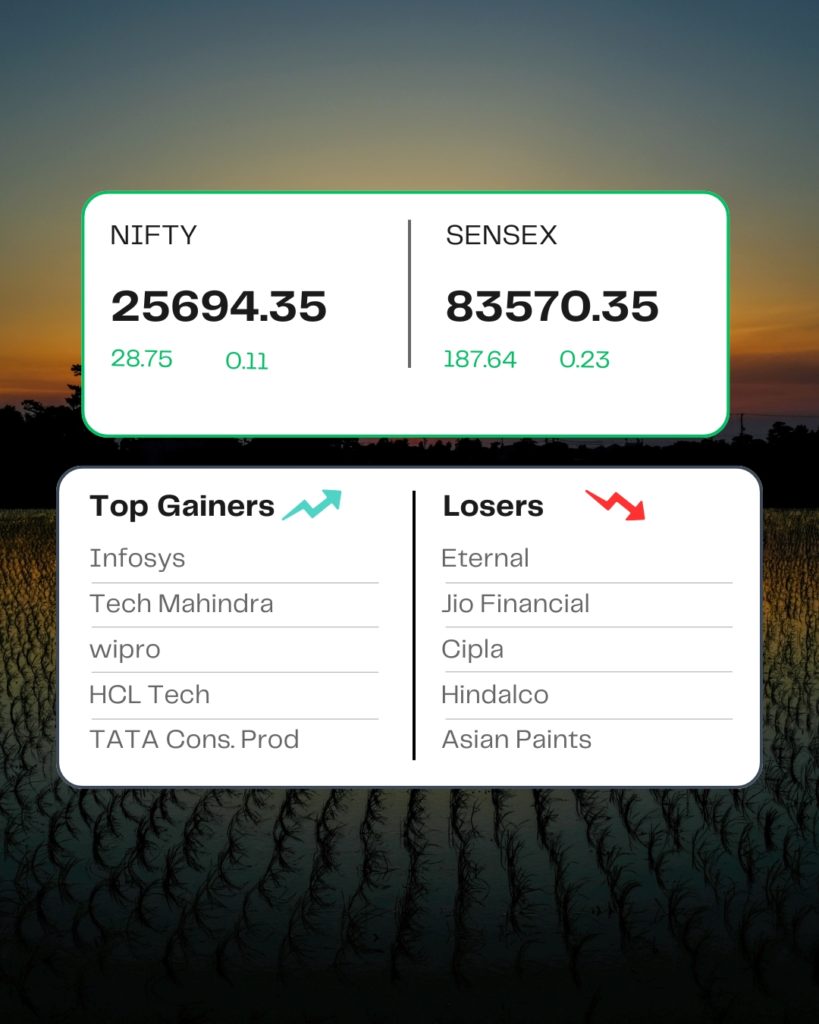

At close, the Sensex added 187 points or 0.23% at 83,570.35, and the Nifty was up 28.75 points or 0.11% at 25,694.35. About 1,770 shares advanced, 2,111 shares declined, and 132 shares were unchanged.

Cipla, Jio Financial, Eternal, Hindalco, and Asian Paints were among the major losers on the Nifty, while gainers were Infosys, Tech Mahindra, Wipro, HCL Tech, and TATA Consumer Products.

On the sectoral front, Software & IT, Finance, PSU Bank, and Realty ended in the green, while Capital goods, pharma, and auto fell.

Among the broader market indices, the BSE Midcap index added 0.15%, while the smallcap index shed -0.45%.

STOCKS IN NEWS

ICICI Prudential AMC

The shares of ICICI Prudential AMC jumped over 7 percent on January 16 after the asset management company reported strong results for FY26. The company reported a net profit of Rs 917.09 crore for the October-December quarter of the ongoing financial year 2026. This marks a 45 percent year-on-year (YoY) rise from the Rs 631.84 crore net profit reported in the corresponding quarter of the previous financial year.

Infosys

The shares of IT company Infosys jumped over 5.5 percent as strong Q3 earnings of Infosys boosted investor sentiment. The company reported a consolidated net profit of Rs 6,654 crore for Q3 FY26, marking a 2.2 percent year-on-year (YoY) fall from the Rs 6,806 crore net profit reported in Q3 FY25.

HPCL

The Indian oil-making company, Hindustan Petroleum Corporation Limited, shares shot up 3.7 percent as oil prices extended their decline after the US President signaled that he may hold off on attacking Iran for now. This came as concerns around supply risks eased amid lower expectations of a US strike on Iran.

Prestige Estates

The shares of real estate company Prestige Estate rose over 1.5 percent, pushing the Nifty Realty index into the green after a seven-session losing streak. This comes after the company announced that it has recorded pre-sales worth Rs 4,183.6 crore during the October-December quarter of the ongoing financial year 2026, marking a 30 percent YoY growth.

LTIMindtree

Shares of LTIMindtree rallied 4.47 percent upwards, after the IT services company announced a large, long-tenure government order linked to India’s tax administration modernisation programme. The company has been mandated to build an AI-powered programme for the modernisation of India’s national tax analytics platform.

Source – Moneycontrol