Shadowfax Technologies IPO is a bookbuilt issue of ₹1,907.27 crores. It combines a fresh issue of 8.06 crore shares aggregating to ₹1000.00 crore and an offer for sale of 7.32 crore shares aggregating to ₹907.27 crore.

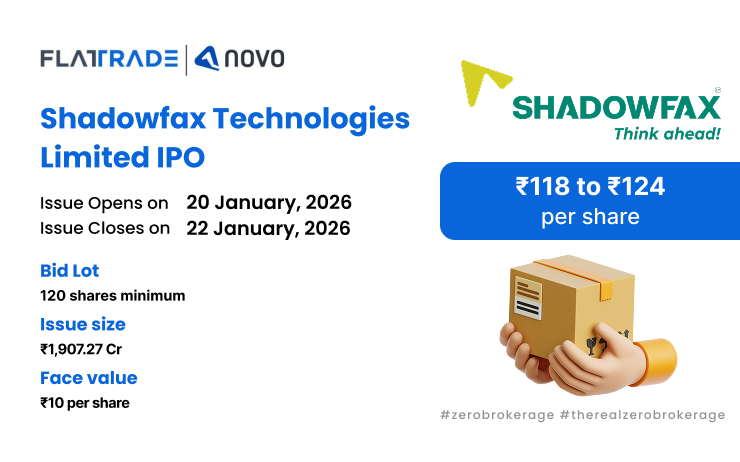

The IPO opens for subscription on January 20, 2026 and closes on January 22, 2026. The allotment is expected to be finalised on Friday, January 23, 2025. The price band for the IPO is set at ₹118 to ₹124 per share, and the minimum lot size for an application is 120 shares.

Company Summary

Incorporated in June 2016, Shadowfax Technologies Ltd is a logistics solution provider company in India. The company offers e-commerce express parcel delivery and a suite of value-added offerings.

Its service offerings include e-commerce and D2C delivery, hyperlocal & quick commerce within hours or same day, and SMS & personal courier services through Shadowfax’s Flash app.

The company’s nationwide logistics network includes 4,299 touchpoints across first- and last-mile centres and sort centres as of September 30, 2025, serving 14,758 pin codes. It is supported by over 3.50 million sq ft of operational space, including 53 sort centres covering 1.80 million sq ft, for shipment consolidation, sorting, and dispatch.

The company leases its logistics facilities and linehaul, owning automation and machinery for control.

It operates a dedicated fleet of over 3,000 trucks daily as part of its asset-light linehaul network.

As of September 30, 2025, the company’s platform had 205,864 Average Quarterly Unique Transacting Delivery Partners.

The company’s clients include Meesho, Flipkart, Myntra, Swiggy, Bigbasket, Zepto, Nykaa, Blinkit, Kartrocket, Zomato, Uber, Pincode, Purplle, Licious, ONDC, Magicpin, among others. This makes them the only large-scale provider for last-mile and end-to-end e-commerce delivery, as well as quick commerce, food delivery, and hyperlocal services.

By September 30, 2025, the company’s e-commerce logistics network spanned 14,758 pin codes throughout India.

As of September 30, 2025, the company had 4,472 permanent employees and 17,182 contract workers.

Company Strengths

- Agile and customisable logistics services that enable faster go-to-market for clients.

- Largest last-mile gig-based delivery partner infrastructure.

- Network infrastructure serves as the backbone of our efficient and scalable delivery system.

- Proprietary and agile technology capabilities.

- Proven business model, with focus on profitability, while delivering healthy growth.

- Experienced management team supported by entrepreneurial founders.

Company Financials

| Period Ended | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,453.16 | 1,259.26 | 786.14 | 442.73 |

| Total Income | 1,819.8 | 2,514.66 | 1,896.48 | 1,422.89 |

| Profit After Tax | 21.04 | 6.06 | -11.88 | -142.64 |

| EBITDA | 64.34 | 56.19 | 11.37 | -113.47 |

| Net Worth | 693.53 | 660.43 | 421.78 | 176.32 |

| Reserves and Surplus | 281.26 | 248.16 | 172.47 | 171.2 |

| Total Borrowing | 147.44 | 132.23 | 40.33 | 66.69 |

| Amount in ₹ Crore | ||||

Objectives of IPO

- Funding of capital expenditure requirements of the Company in relation to the network infrastructure

- Funding of lease payments for new first-mile centers, last-mile centers, and sort centers

- Funding of branding, marketing, and communication costs

- Unidentified inorganic acquisitions and general corporate purposes

Promoters of the company

The promoters of the Company are Abhishek Bansal and Vaibhav Khandelwal.

IPO Details

| IPO Date | January 20, 2026 to January 22, 2026 |

| Listing Date | January 28, 2026 |

| Face Value | ₹10 per share |

| Price Band | ₹118 to ₹124 per share |

| Lot size | 120 shares |

| Total Issue size | 15,38,12,096 shares (aggregating upto ₹1907.00 Cr ) |

| Fresh Issue | 8,06,45,161 shares (aggregating upto ₹1000.00 Cr ) |

| Offer for Sale | 7,31,66,935 shares of ₹10 (aggregating upto ₹907.00 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 49,74,88,085 shares |

| Share Holding Post Issue | 57,81,33,246 shares |

Category Reservation Table

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

| Only RII | Upto Rs 2 Lakhs | Yes |

| Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

| Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

| Only employee | Upto Rs 5 lakhs | Yes |

| Employee + RII/NII | 1. Employee limit: Upto Rs 5 lakhs (In certain cases, employees are given a discount if the bidding amount is upto Rs 2 Lakhs) 2. If applying as RII: Upto Rs 2 Lakhs 3. If using as NII: sNII > Rs 2 Lakhs and upto Rs 10 Lakhs, and bNII > Rs 10 lakhs | Yes for Employee and RII/NII |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 120 | ₹14,880.00 |

| Retail (Max) | 13 | 1,560 | ₹1,93,440.00 |

| S-HNI (Min) | 14 | 1,680 | ₹2,08,320.00 |

| S-HNI (Max) | 67 | 8,040 | ₹9,96,690.00 |

| B-HNI (Min) | 68 | 8,160 | ₹10,11,840.00 |

Allotment Schedule

| Basis of Allotment | Fri, 23 Jan, 2026 |

| Initiation of Refunds | Tue, 27 Jan, 2026 |

| Credit of Shares to Demat | Tue, 27 Jan, 2026 |

| Tentative Listing Date | Wed, 28 Jan, 2026 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Net Offer |

| Retail Shares Offered | Not more than 10% of the Net Offer |

| NII Shares Offered | Not more than 15% of the Net Offer |

Source – SEBI, Chittorgarh

To check allotment, click here