POST MARKET

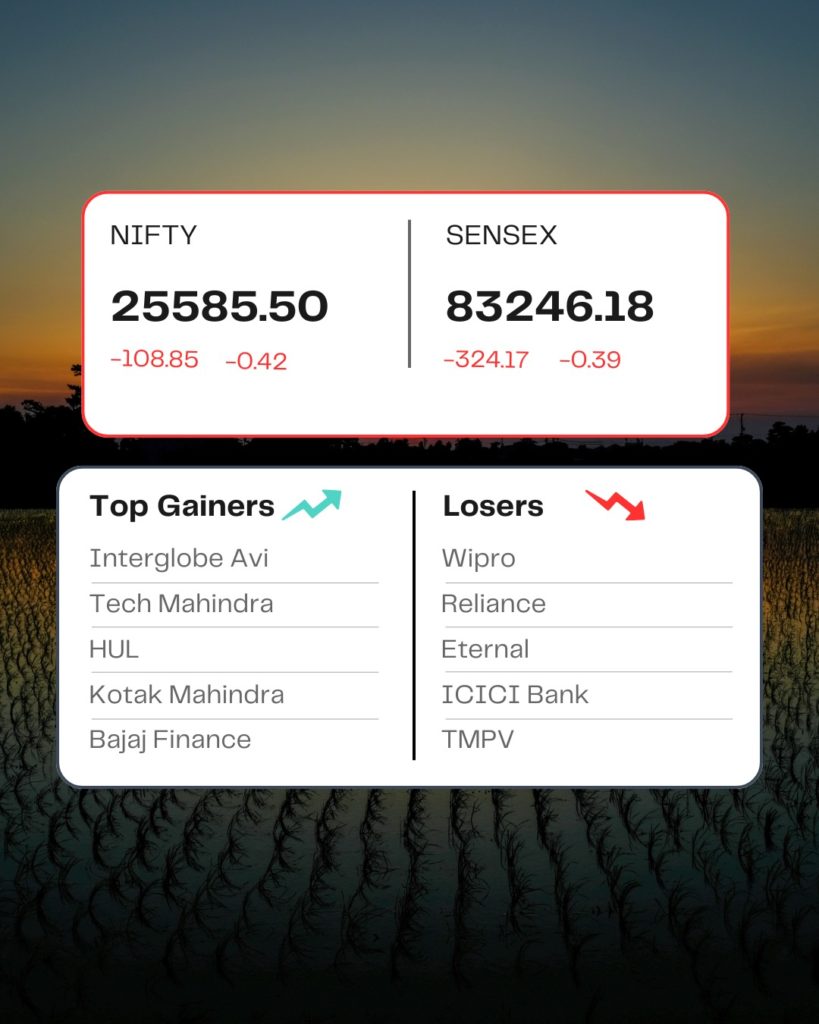

Indian equity indices ended on a negative note with Nifty below 25,600 on January 19.

At close, the Sensex was down 324.17 points or 0.39 percent at 83,246.18, and the Nifty was down 108.85 points or 0.42 percent at 25,585.50. About 1122 shares advanced, 2795 shares declined, and 169 shares were unchanged.

The biggest Nifty losers were Wipro, Eternal, Reliance Industries, Tata Motors Passenger Vehicles, Max Healthcare, while gainers included Interglobe Aviation, Tech Mahindra, Kotak Mahindra Bank, HUL, and Maruti Suzuki.

Except for FMCG, all other sectoral indices ended in the red with media, Oil & Gas, and Realty down 1.5-2 percent.

Among the broader market indices, the BSE midcap index shed 0.4 percent, and the smallcap index declined 1.2 percent.

STOCKS IN NEWS

Polycab

Polycab India shares snapped a six-session losing streak and rose over 4 percent after the company reported strong results for the December quarter. The wires and cables maker reported a 36 percent year-on-year rise in consolidated profit for the third quarter, while revenue jumped 46 percent.

RVNL

Rail Vikas Nigam share price is down 1.2 percent on January 19, despite the company receiving an order worth Rs 87 crore from South Eastern Railway for the installation and commissioning of an IP-based video surveillance system (VSS) in LHB coaches with 4 cameras version 3.1 or latest, including a Rugged Hand Held Terminal (HHT)/ Tablet along with 8 TB external SSD.

CG Power & Industrial Solutions

CG Power & Industrial Solutions’ share price rose over 4.5 percent after the company secured a landmark order worth Rs 900 crore (USD 99.2 million) from Tallgrass Integrated Logistics Solutions LLC, USA, for a large-scale data centre project in the United States. It is the largest single direct export order ever won by the company.

Indosolar

Indosolar share price slipped 4.32 percenton January 19 despite the company reporting a strong year-on-year performance, with net profit rising sharply to Rs 41.5 crore from Rs 10.2 crore in the corresponding period last year, supported by robust revenue growth and margin expansion. The board has also appointed a new CFO.

MRPL

Mangalore Refinery and Petrochemicals Ltd’s (MRPL) stock fell 5.59 percent to 142.80 per share after a company executive said the state-run oil refiner and fuel retailer is not importing Russian oil amid Western sanctions and is looking to buy Venezuelan oil.

Source – Moneycontrol