Thematic investing is a future-focused form of investment that aims to indentify long term trends and the underlying investments to benefit from major structural changes, offering growth potential but higher risk due to concentration, often via ETFs or specialized funds. It aims to seize opportunities arising from beliefs about the future which are likely to shape the global economy in the decades ahead.

For example,

Rather than asking which stock will perform well this quarter, thematic investors ask:

‘Which trend is likely to shape economic growth over the next decade?’

This approach is particularly useful in markets where structural change, policy direction, and demographic shifts play a significant role in shaping long-term returns.

Importance of Thematic Investing in 2026

Markets are expected to operate in a volatile environment characterized by rapid technological change, improved global supply chains, and enhanced policy intervention. Conventional short-term strategies often struggle to fully understand the impact of long-term shifts.

Thematic investing matters because,

- It encourages long-term conviction over short-term speculation.

- Helps investors in aligning portfolios with structural growth drivers

- Reduces over-dependence on cyclical market movements

In countries like India, where policy-led growth initiatives and digital adoption are accelerating, thematic investing provides a framework to participate in transformation rather than react to volatility.

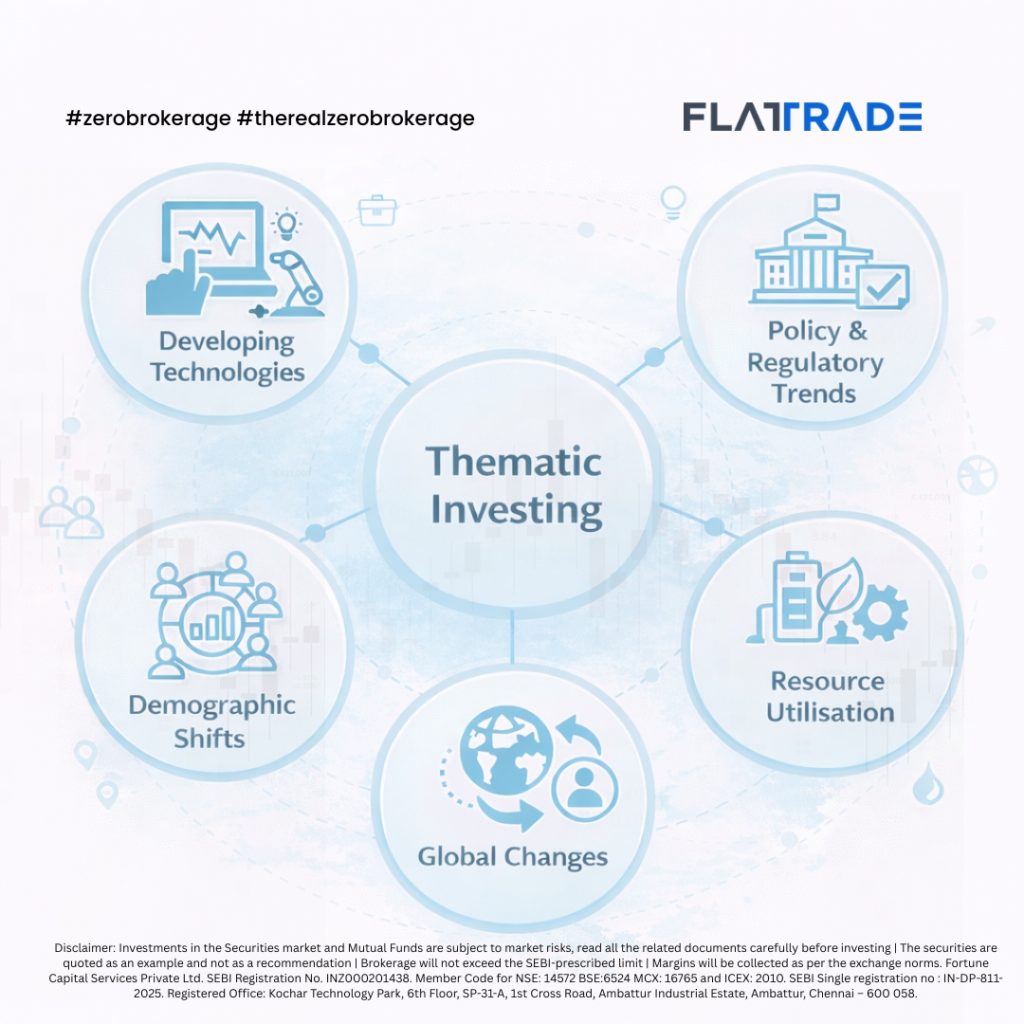

How investment themes are identified?

Identifying themes is less about predicting short-term market movements and more about observing long-term structural developments that influence the market and economies over long periods. Themes are usually recognised through a combination of data, policy direction, and real-world adoption trends.

- Economic Structure Shifts

Notable changes in how economies function are how themes often emerge. These include shifts in demographics, consumption patterns, urbanisation, technology adoption, or resource utilisation. Such changes are not confined to a single market, instead it is visibly spread across multiple regions.

- Policy and Regulatory Direction

Government policies and regulatory frameworks play an important role in shaping the long-term trends. When the policy support remains consistent for multiple years, the themes gain visibility. Public spending priorities, national development programs, and international agreements often provide insight into areas receiving sustained attention over time.

- Technology Adoption

Themes usually emerge when technologies advance beyond experimentation into broader adoption. This includes integration into business processes, public systems, or consumer services.

- Cross-Sector Impact

Themes are characterized by their capacity to impact several industries at the same time. Developments are less likely to be considered thematic in character if they solely impact a single, small segment. Themes often cut across traditional sector boundaries, influencing manufacturing, services, logistics, finance, and infrastructure together rather than in isolation.

- Longevity and Consistency

Long time periods and themes are positively correlated with each other. Investors frequently look for developments that are anticipated to be significant for a number of years, bolstered by sustained demand, policy continuity, or structural necessity.

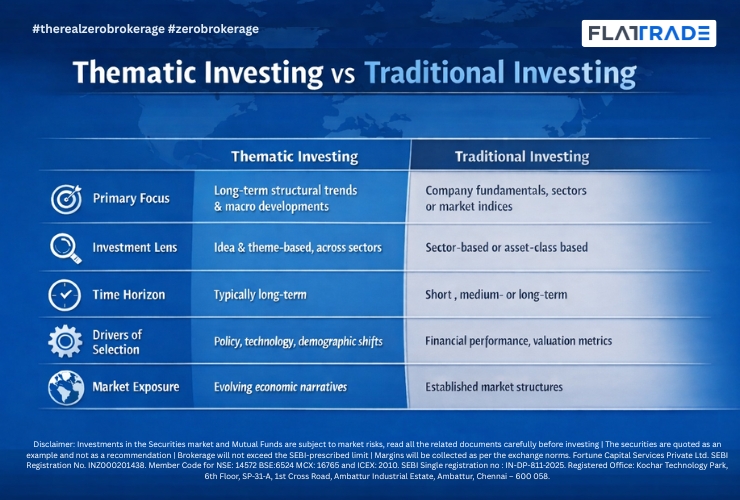

How Thematic Investing Differs from Traditional Investing?

Traditional investing often focuses on financial metrics or sector classifications. Thematic investing, by contrast, focuses on directional change.

Thematic investing is less about timing the market and more about understanding:

- Where policy support is flowing

- Where innovation is being adopted

- Where long-term demand is structurally increasing

This distinction makes thematic investing particularly relevant in markets transforming, including fast-growing economies like India.

Considerable Risks

- Many themes usually take long periods to turn into tangible outcomes, requiring investors to bear the volatility

- As thematic ideas gain traction, excessive investor interest can push valuations beyond fundamentals, increasing the risk of overvaluation.

- The trend may or may not turn into sustainable structural shifts.

- Successful thematic investing demands patience, portfolio diversification, and continuous reassessment of assumptions as new data, policy developments, and market signals emerge.

In 2026, thematic investing represents a shift from reactive decision-making to intentional long-term positioning. By focusing on enduring themes such as infrastructure development, artificial intelligence adoption, and strategic commodities, investors can align portfolios with the architecture of future economic growth.

As global trends increasingly intersect with domestic transformation stories, including those unfolding in India, thematic investing offers a thoughtful framework for navigating markets shaped by change rather than cycles.