PRE MARKET

Indian benchmark indices ended more than 1 percent lower, amid concerns over global trade tensions, mixed quarterly earnings, weak global cues, a falling rupee, broad-based selling, and continued FII outflows.

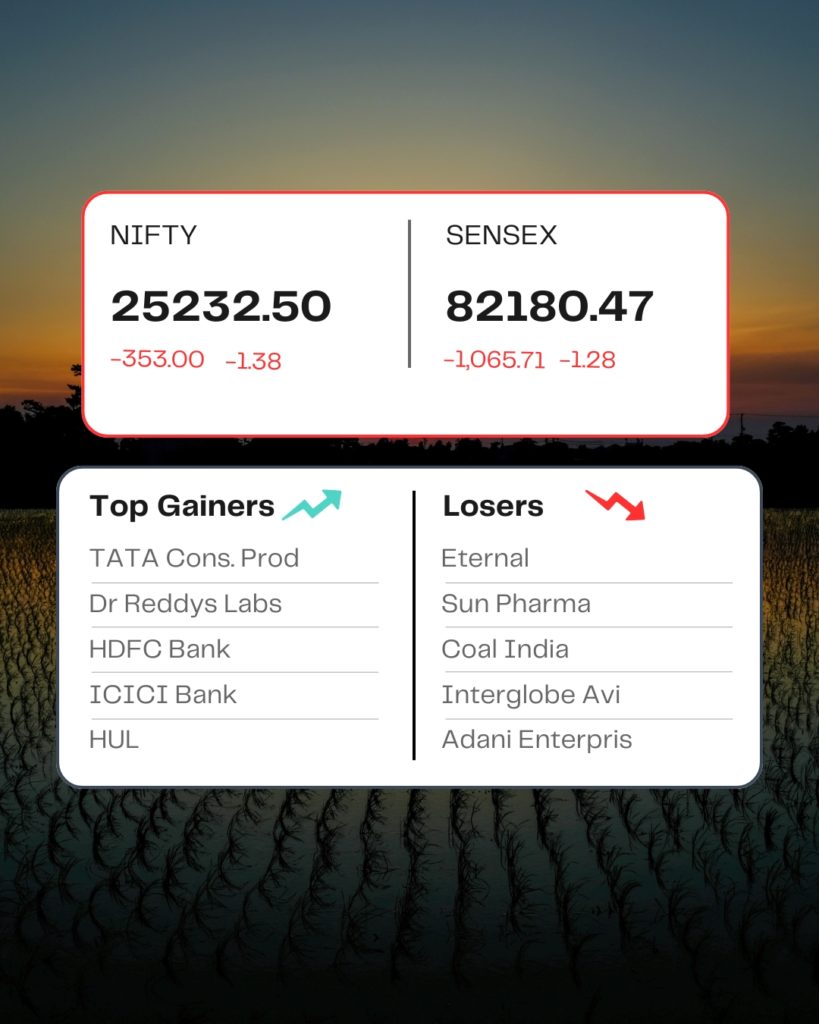

At close, the Sensex was down 1065.78 points or 1.28 percent at 82,180.47, and the Nifty was down 353 points or 1.38 percent at 25,232.50. About 748 shares advanced, 3146 shares declined, and 100 shares remained unchanged.

All the sectoral indices ended in the red with the Realty index falling 5%, while auto, IT, media, metal, PSU Bank, pharma, oil & gas, and consumer durables fell 1.5-2.5 percent.

The biggest Nifty losers were Eternal, Bajaj Finance, Coal India, Adani Enterprises, Jio Financial, while gainers included Tata Consumer Products, Dr Reddy’s Lab, and HDFC Bank.

The broader markets extended their losses in Tuesday’s session, mirroring the decline in the benchmark indices, Sensex and Nifty. The BSE Midcap and smallcap indices declined 2.5% each.

STOCKS TODAY

Oberoi Realty

The shares of real estate companies declined by over 7.6 percent, led by losses in Oberoi Realty as sentiment turned sour after the company’s Q3 results. The company marked a marginal rise of 0.69 percent from the Rs 618.38 crore net profit reported in Q3 FY25, but an 18 percent QoQ fall from the Rs 760.26 crore net profit reported in the previous quarter (Q2 FY26).

BHEL

Shares of Bharat Heavy Electricals Ltd’s (BHEL) fell 4.92 percent to Rs 250.15 per share on January 20 as brokerages said the firm missed estimates for third-quarter results. The shares are on track for their third straight session of losses.

Ola Electric Mobility

Shares of Ola Electric Mobility fell 8 percent, to its lowest in nearly a month, as the electric vehicle maker’s CFO Harish Abichandani resigned due to personal reasons. The company named Deepak Rastogi as the new CFO effective January 20.

LTIMindtree

Shares of LTIMindtree Ltd fell sharply on Tuesday, slipping over 7 percent, as investors reacted to mostly cautious brokerage reviews following the company’s Q3 FY26 results. Analysts flagged concerns around margins and near-term earnings visibility despite largely in-line performance.

Source – Moneycontrol