John was a disciplined and curious investor. He believed research and conviction could tame uncertainty. Early success only strengthened that belief, quietly planting the seeds for a lesson the market would insist on teaching later.

After weeks of reading annual reports and tracking price movements, John made his first big decision. He invested almost all his savings into one fast-growing company that everyone admired. For a while, it felt perfect. His portfolio climbed steadily, and every upward tick reinforced the idea that conviction mattered more than caution.

At that stage, investing felt like a long road toward financial freedom. The road seemed wide and smooth. One strong horse pulled the cart fast and efficiently. Momentum felt like mastery.

Then the weather changed.

Markets never announce storms in advance. A gradual interest-rate hike. A geopolitical tremor. An earnings miss that no one expected. Liquidity tightening at the wrong time. The same horse that once sprinted began to slow. Sometimes, it refused to move at all.

That’s when diversification entered the picture. Not as a bold voice demanding action, but as a quiet one asking harder questions. What if this sector underperforms for years, not months? What if conditions change in ways no model can predict? What if being right once is not enough to stay invested?

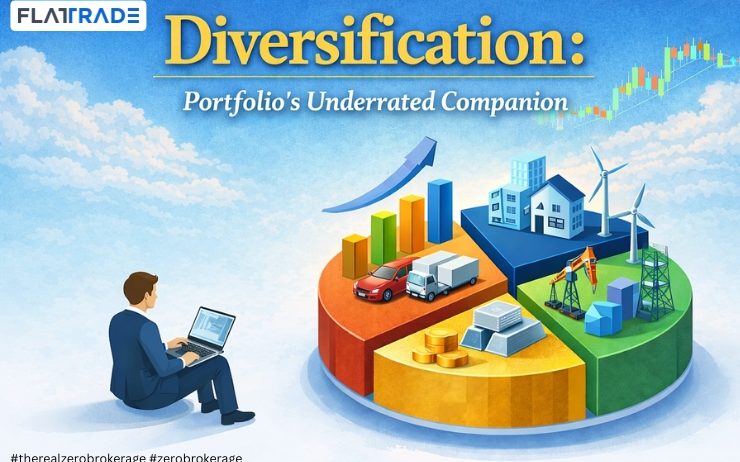

John rebuilt his portfolio with a different intent. Risk was spread, not avoided. Different assets were allowed to respond differently to the same event. When equities struggled, fixed income offered stability. When domestic growth slowed, global exposure added balance. When volatility spiked, liquidity preserved flexibility.

The returns were less dramatic. The thrill faded. But something better replaced it: consistency.

Over time, John realised that markets reward not just intelligence, but endurance. Many portfolios fail not because their owners lack insight, but because they are built on the assumption that the future will behave as expected.

Diversification became more than a strategy. It became a mindset. It taught him that sustainable wealth is not about being right once, but about staying invested long enough to be right eventually. Balance worked quietly, without applause. Stability rarely felt exciting in the moment.

Diversification never promised protection from loss. It was never meant to. It doesn’t stop the rain.

It simply spreads the weight.

And that’s how the story continues.

Building a diversified portfolio is easier when all asset classes, markets, and investment styles sit under one roof.

Platforms like Flattrade give investors the flexibility to diversify thoughtfully, without friction, so resilience isn’t an idea. It’s a habit.