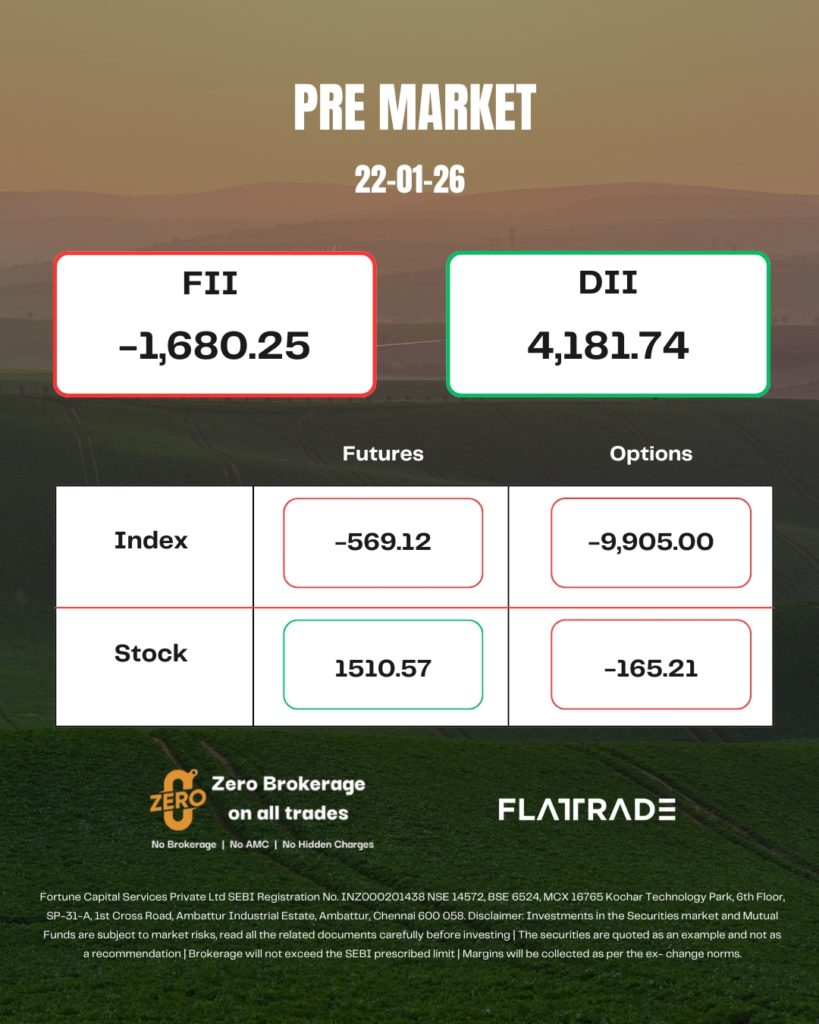

PRE MARKET

Gift Nifty indicates a positive start for the broader index in India, with a gain of 193 points or 0.77 percent. The Nifty futures were trading around the 25,368.50 level.

Wall Street ended higher on Wednesday, with the S&P 500 posting its biggest one-day percentage gain in two months, as investors were buoyed by news that a framework for an agreement on Greenland had been reached and the possibility of new U.S. tariffs on European allies had been averted. Both the Dow Jones Industrial Average and Nasdaq Composite also enjoyed milestone days, gaining the most in percentage terms since January 5 and December 19, respectively.

The Dow Jones Industrial Average rose 588.64 points, or 1.21%, to 49,077.23, the S&P 500 gained 78.76 points, or 1.16%, to 6,875.62, and the Nasdaq Composite gained 270.50 points, or 1.18%, to 23,224.83.

Asian stocks followed Wall Street higher after US President Donald Trump dropped his tariff threat against European partners, easing trade-war concerns.

Japan’s Nikkei, Hong Kong’s Hang Seng, and the Taiwanese weighted index went up +1.91, +0.27, and +1.83 percent, respectively.

STOCKS TODAY

Biocon

The company has completed the acquisition of the remaining 7.18 crore equity shares of Biocon Biologics from Mylan Inc. for $200 million. Following this acquisition, the company holds approximately a 98 per cent stake in Biocon Biologics on a fully diluted basis.

Lemon Tree Hotels

The company has signed a licence agreement for Lemon Tree Premier, Omkareshwar, Madhya Pradesh. The 85-room hotel property will be managed by the company’s subsidiary, Carnation Hotels.

CESC

The company’s subsidiary, CESC Green Power, has entered into a Memorandum of Understanding (MoU) with the Uttar Pradesh government for the establishment of a 3 GW solar cell and module plant, a 60 MW solar power plant, and ancillary units, including a research and development laboratory and other infrastructure facilities in Uttar Pradesh. The proposed investment is around Rs 3,800 crore.

Shriram Finance

Fitch Ratings has placed Shriram Finance’s Long-Term Foreign- and Local-Currency Issuer Default Ratings (IDRs) of ‘BB+’ and its Short-Term IDR of ‘B’ on Rating Watch Positive. The company’s medium-term note programme and debt ratings have also been placed on Rating Watch Positive. The Rating Watch Positive follows an agreement under which MUFG Bank, a subsidiary of Mitsubishi UFJ Financial Group, Inc., will acquire a 20 percent stake in Shriram Finance.

Source – Moneycontrol