POST MARKET

Indian equity indices ended higher on January 22 after they soared amid a rebound in global equities following US President Donald Trump’s stepping back from threats to impose tariffs on eight European countries as leverage to seize Greenland and ruled out the use of force.

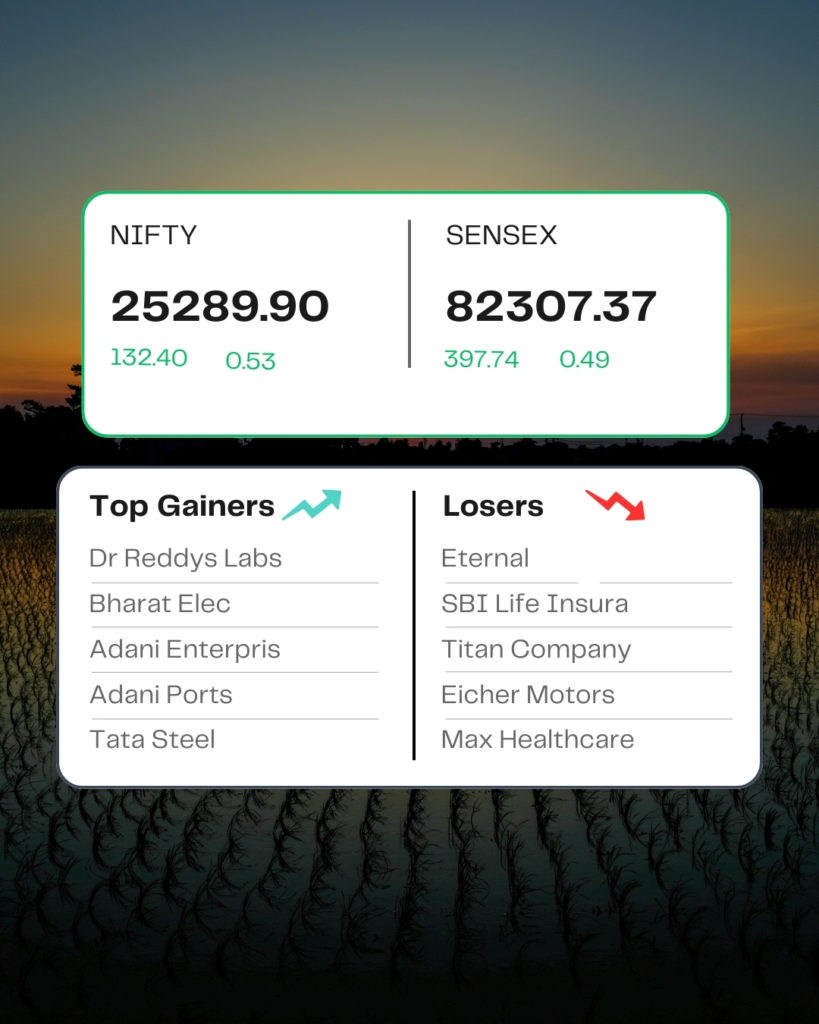

At close, the Sensex was up 397.74 points or 0.49 percent at 82,307.37, and the Nifty was up 132.40 points or 0.53 percent at 25,289.90. About 2803 shares advanced, 1235 shares declined, and 146 shares remained unchanged.

Dr Reddy’s Labs, Bharat Electronics, Adani Ports, Adani Enterprises, and Tata Steel were among the top gainers on the Nifty, while losers were SBI Life Insurance, Eternal, Eicher Motors, Titan Company, and Max Healthcare.

On the sectoral front, except realty, consumer durables, all other indices ended in the green with FMCG, power, metal, media, PSU Bank, and pharma gained 1-2%.

Among the broader market indices, the BSE midcap and smallcap indices added more than 1% each.

STOCKS TODAY

Adani Energy Solutions

The shares of Adani Energy Solutions gained more than 3 percent after the company released its results for the October-December quarter of the ongoing financial year 2026. The company reported a consolidated net profit of Rs 552.31 crore for the October-December quarter of the ongoing financial year 2026.

Eternal

The shares of Eternal fell more than 2.5 percent on January 22. This came as a surprise amidst Q3 results, and Dipinder Goyal’s step down and appointment of Albinder Dhindsa as CEO. The company reported a consolidated net profit of Rs 102 crore for the October-December quarter of the ongoing financial year 2026.

Canara HSBC Life Insurance

Shares of Canara HSBC Life Insurance Company rose 5.81 percent after the company reported strong earnings for the December quarter. The life insurer reported a 10 percent year-on-year rise in pre-tax profit for the third quarter. Net profit, however, edged lower as the company had availed a tax credit in the year-ago period.

PNB Housing Finance

The shares of PNB Housing Finance tumbled almost 8 percent on January 22 after the company released its results for the third quarter of the financial year 2026. The company reported a standalone net profit of Rs 520.96 crore for the October-December quarter of the ongoing financial year 2026.

IIFL Finance

Shares of IIFL Finance fell over 15 percent on January 22 as the NBFC got a notice from the Income Tax Department. The notice was regarding directing the Company to get its accounts audited for a specified block period under Section 142(2A) of the Income Tax Act, 1961, and appointing a Special Auditor for the said purpose.

Source – Moneycontrol