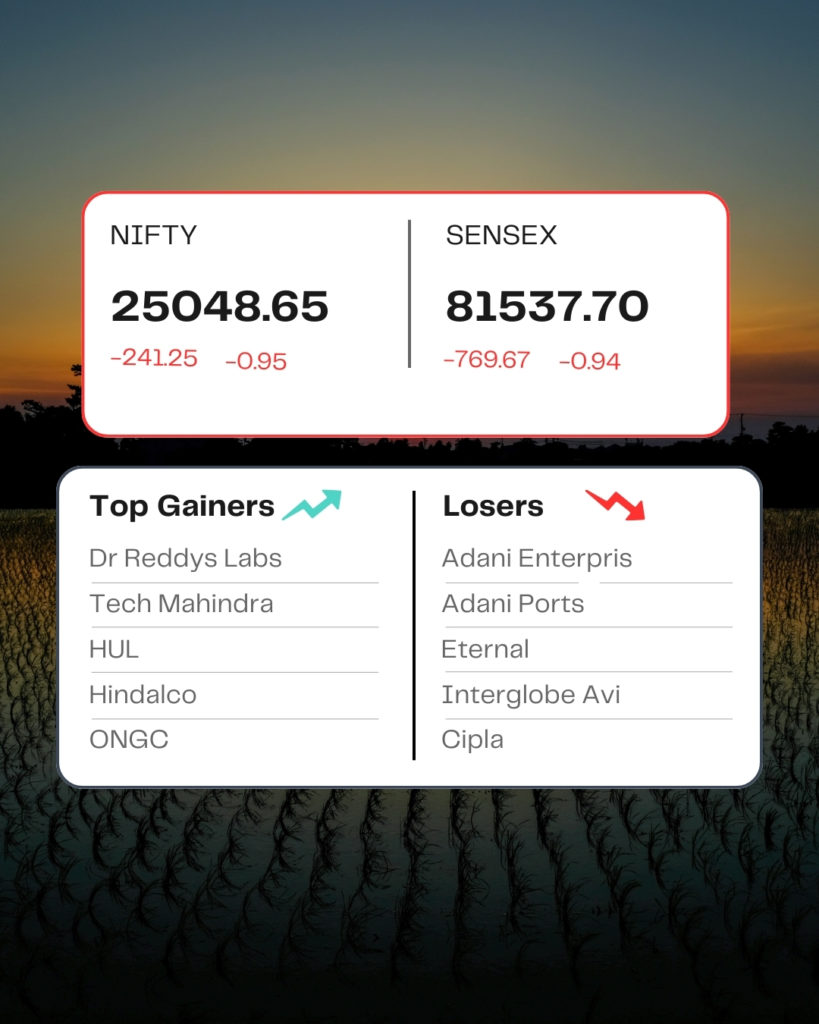

POST MARKET

Indian equity indices ended on a negative note on January 23, tracking sustained selling by foreign institutional investors

At close, the Sensex was down 769.67 points or 0.94 percent at 81,537.70, and the Nifty was down 241.25 points or 0.95 percent at 25,048.65. About 1295 shares advanced, 2736 shares declined, and 139 shares were unchanged.

Biggest Nifty losers were Adani Enterprises, Adani Ports, Eternal, Interglobe Aviation, Cipla, while gainers included Dr Reddy’s Labs, Tech Mahindra, ONGC, Hindalco, HUL.

All the sectoral indices ended in the red with capital goods, power, realty, PSU Bank, and media down 2-3%.

Among the broader market indices, the BSE midcap index shed 1.5 percent and the smallcap index fell 2 percent.

STOCKS IN NEWS

One 97 Communications Ltd

The shares of One 97 Communications Ltd, parent company of Paytm, dropped over 8 percent on January 23, falling to a three-month low level. The stock has now fallen around 15 percent in the past five days. The stock has now recorded the worst single-day drop since January 2025.

InterGlobe Aviation

Shares of IndiGo operator InterGlobe Aviation Ltd slipped almost 4 percent on Friday, with the stock down 1.96 percent at Rs 4,813, a day after the company reported its Q3 FY26 financial results. The airline’s market capitalisation stood at about Rs 1.86 lakh crore.

Bandhan Bank

The shares of Bandhan Bank jumped around 4.31 percent after the lender released its results for the October-December quarter of the ongoing financial year 2026. The company reported a net profit of Rs 205.59 crore for the third quarter of FY26, marking a 52 percent year-on-year (YoY) fall from the Rs 426.49 crore net profit reported in the same quarter of the previous financial year.

Adani Enterprises

Shares of Adani Enterprises fell over 10 percent amid reports that the US Securities and Exchange Commission has asked a US court for permission to personally email summons to billionaire Gautam Adani and group executive Sagar Adani over alleged fraud and a $265-million bribery scheme.

Hindustan Zinc

Hindustan Zinc shares rose 4.3 percent on January 23 to hit a fresh 52-week high as silver notched a new peak amid diminishing confidence in US assets on account of geopolitical tensions and economic uncertainty. The company is one of the biggest miners of silver in India.

Source – Moneycontrol