POST MARKET

Indian equity markets extended their winning streak for the second consecutive session on January 28, supported by buying interest in energy and metal names.

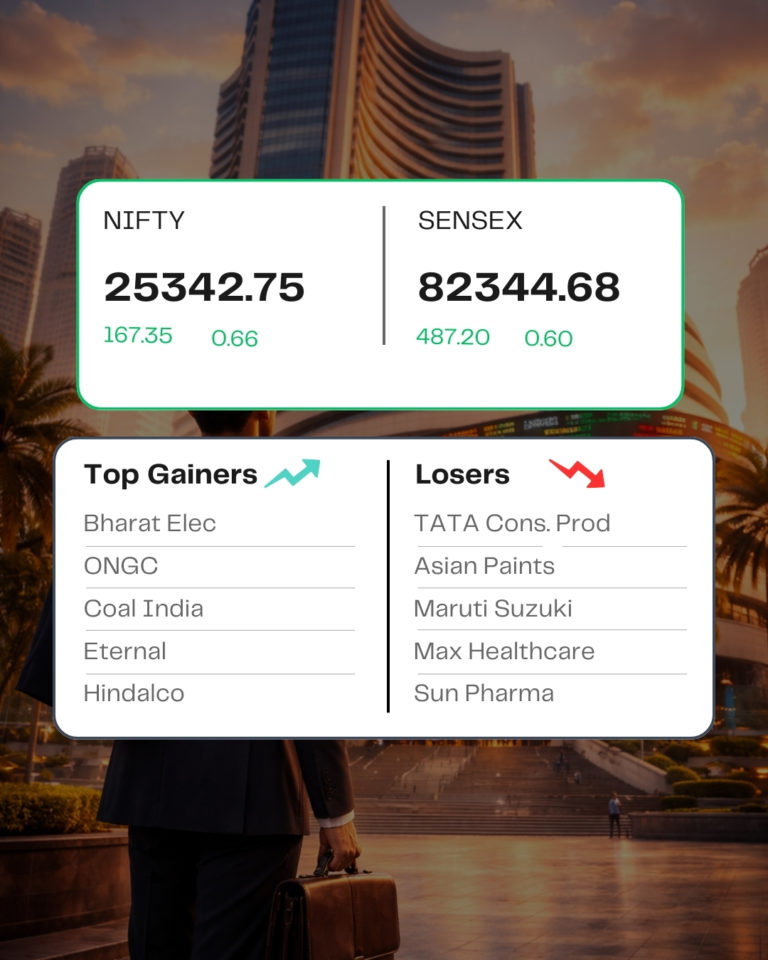

At close, the Sensex was up 487.20 points or 0.60 percent at 82,344.68, and the Nifty was up 167.35 points or 0.66 percent at 25,342.75. About 2844 shares advanced, 1226 shares declined, and 120 shares remained unchanged.

Among sectors, media, metal, energy, oil & gas, realty, PSU Bank up 1-4 percent, while FMCG, Consumer Durables, and pharma ended lower.

Bharat Electronics, ONGC, Eternal, Coal India, and Hindalco Industries were among the major gainers on the Nifty, while losers were Tata Consumer, Asian Paints, Maruti Suzuki, Max Healthcare, and Sun Pharma.

Among the broader market indices, the Nifty Midcap index added 1.6 percent, and the smallcap index rose 2.2 percent.

STOCKS IN NEWS

MIC Electronics

Shares of MIC Electronics on Wednesday hit the upper circuit limit after the company announced that it has bagged a fresh order worth over Rs 114 crore. The order involves designing, engineering, supply, construction, testing, commissioning, annual maintenance contract, and operation and maintenance of infrastructure works at the Common Facility Centre in Sector 22 of Nava Raipur Atal Nagar, Raipur.

TVS Motor Company

Two- and three-wheeler firm TVS Motor Company Ltd shares hiked almost 5 percent on January 28, reported 52% increase in standalone net profit at Rs 940 crore for the quarter ended December 31, 2025. It reported a standalone net profit of Rs 618 crore in the year-ago period.

ONGC

The shares of state-run Oil & Natural Gas Corporation (ONGC) jumped up 8.8 percent on January 28, tracking the sharp rise in oil prices. This comes amid supply concerns after a severe winter storm disrupted US crude output and exports.

BEL

Bharat Electronics Ltd shares rose 9.21 on January 28. The reasons for the upper momentum include the India-EU defence pact, the Pre-Budget rally and also the firm reported a 20.4 percent year-on-year rise in consolidated net profit for the December quarter.

Asian Paints

The shares of Asian Paints tumbled 4.22 percent on January 28 as brokerages analysed the company’s results for the October-December quarter of the ongoing financial year 2026. The company reported a consolidated net profit of Rs 1,060 crore for Q3 FY26, marking a 4.6 percent year-on-year (YoY) fall from the Rs 1,110.48 crore net profit reported in Q3 FY25

Source – Moneycontrol