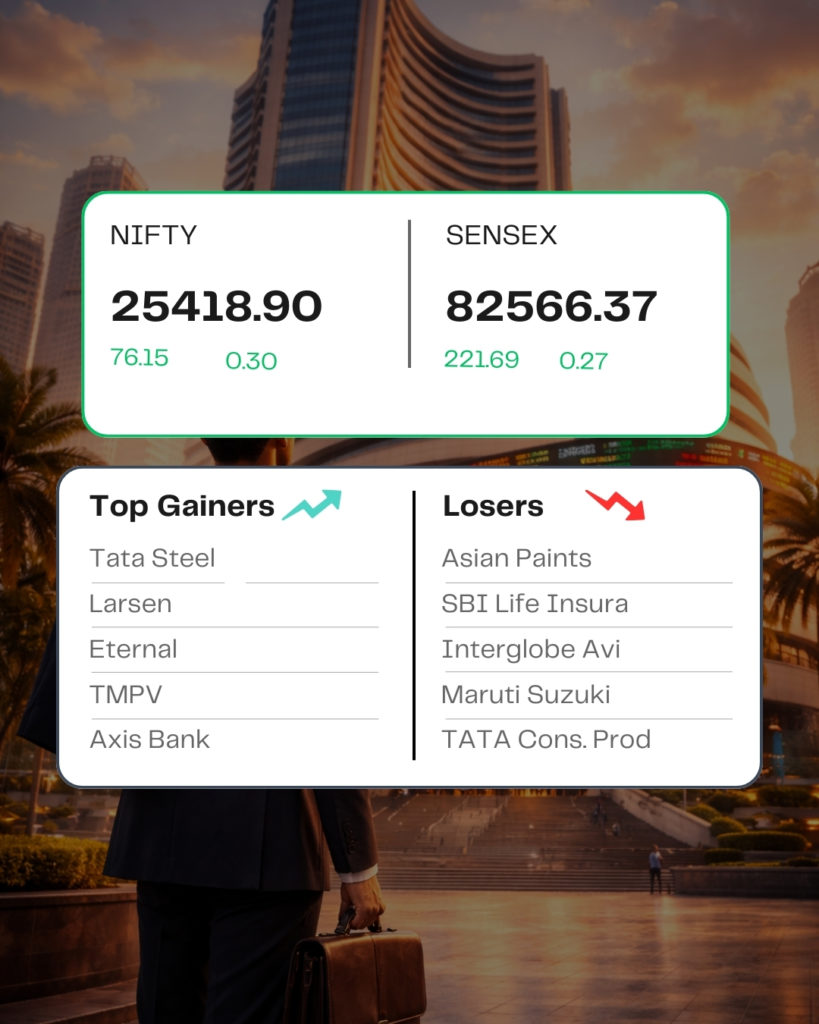

POST MARKET

Indian benchmark indices staged a strong rebound from intraday lows on January 29 to end with marginal gains in a volatile session, after the Economic Survey projected GDP growth of 6.8–7.2% for FY27, compared with an estimated 7.4% expansion in the current fiscal year.

At close, the Sensex was up 221.69 points or 0.27 percent at 82,566.37, and the Nifty was up 76.15 points or 0.30 percent at 25,418.90. About 1640 shares advanced, 2424 shares declined, and 138 shares unchanged.

Among sectors, pharma, PSU Bank, IT, FMCG, auto down 0.7-1%, while metal, realty, private bank, power, energy, oil & gas up 0.6-3%.

Top gainers – L&T, Tata Steel, Eternal, Axis Bank, Tata Motors Passenger Vehicles

Top losers – Asian Paints, SBI Life Insurance, Interglobe Aviation, Maruti Suzuki, and Tata Consumer.

Among the broader market indices, the Nifty midcap and smallcap indices ended with marginal gains.

STOCKS IN NEWS

Coal India

The shares of Coal India gained almost 2.5 percent in trade on January 29 after the government designated coking coal as a ‘Critical and Strategic Mineral’ under the Mines and Minerals (Development and Regulation) Act, 1957.

Maruti Suzuki

Maruti Suzuki India shares declined over 2.5 percent on Thursday after the country’s largest carmaker reported December quarter results that fell short of profit estimates, dragging the auto index lower. The company Reported that its consolidated profit for the December quarter rose 4 percent year-on-year to Rs 3,794 crore, impacted by higher costs and a one-time provision of Rs 594 crore related to the new Labour Codes.

Asian paints

The shares declined by 3.85 per cent, as the company’s revenue has fluctuated over the past five quarters, with a high of Rs 8,938.55 Crore in June 2025 and a low of Rs 8,358.91 Crore in March 2025. Net profit also varied, peaking at Rs 1,080.73 Crore in June 2025 and falling to Rs 677.78 Crore in March 2025.

BEL

Bharat Electronics Ltd (BEL) shares fell 1.71 percent on Thursday amid profit booking, despite the company reporting strong December quarter results. The defence PSU reported a 20.4 percent rise in consolidated net profit for the December quarter, while revenue from operations grew nearly 24 percent year-on-year.

Source – Moneycontrol