Arjun grew up observing the stock market from a distance – not through apps and dashboards, but through conversations at home between his father and grandfather.

His grandfather invested cautiously and treated brokerage charges as a normal part of trading. His father traded more actively and understood costs better, but still accepted brokerage as unavoidable. Neither questioned it. It was simply how trading worked.

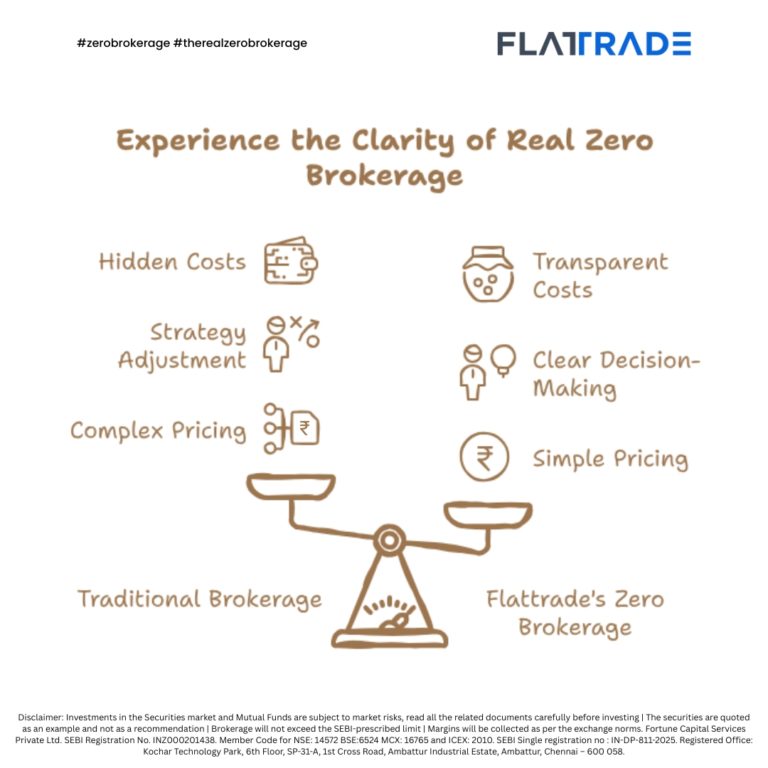

When Arjun began his own trading journey, he carried the same assumption forward. He focused on learning strategies, managing risk, and understanding market behaviour. Brokerage stayed in the background – present in every trade, every adjustment, every exit. Each charge looked small, but over time, they quietly added up.

When he first heard the phrase “zero brokerage,” he was skeptical. It sounded attractive, but experience had taught him that such claims often came with conditions. That same doubt persisted when he first encountered Flattrade’s zero brokerage model.

Instead of jumping in, he sifted through the pricing structure. He checked contract notes after his early trades, line by line. He expected brokerage to appear somewhere – after a threshold, under a clause, or in a segment-specific condition. It didn’t.

The consistency across segments and over time slowly built trust.

As his trading activity increased, the difference became more visible. Without brokerage charges on each trade, cost calculations became simpler. Decisions were based more on strategy and less on transaction overhead. The benefit was not dramatic day to day, but meaningful over weeks and months.

The platform experience also felt straightforward – clean order placement, essential tools, and predictable pricing.

It reminded him of how his father used to hesitate before making frequent adjustments because of cumulative charges, and how his grandfather treated brokerage as a fixed cost of participation. Their approach was shaped by the platforms available to them then. His environment felt different.

Real zero brokerage did not change Arjun’s trading outcomes overnight. What it changed was predictability. There was no need to second-guess pricing or recheck fine print after every trade.

Over time, he realised the bigger takeaway was transparency. The model was not presented as a limited-period offer or conditional benefit, but as a structural pricing choice. That clarity made planning easier and execution more confident.

For Arjun, zero brokerage stopped being a slogan. It became a simple description of how trading worked on his platform.