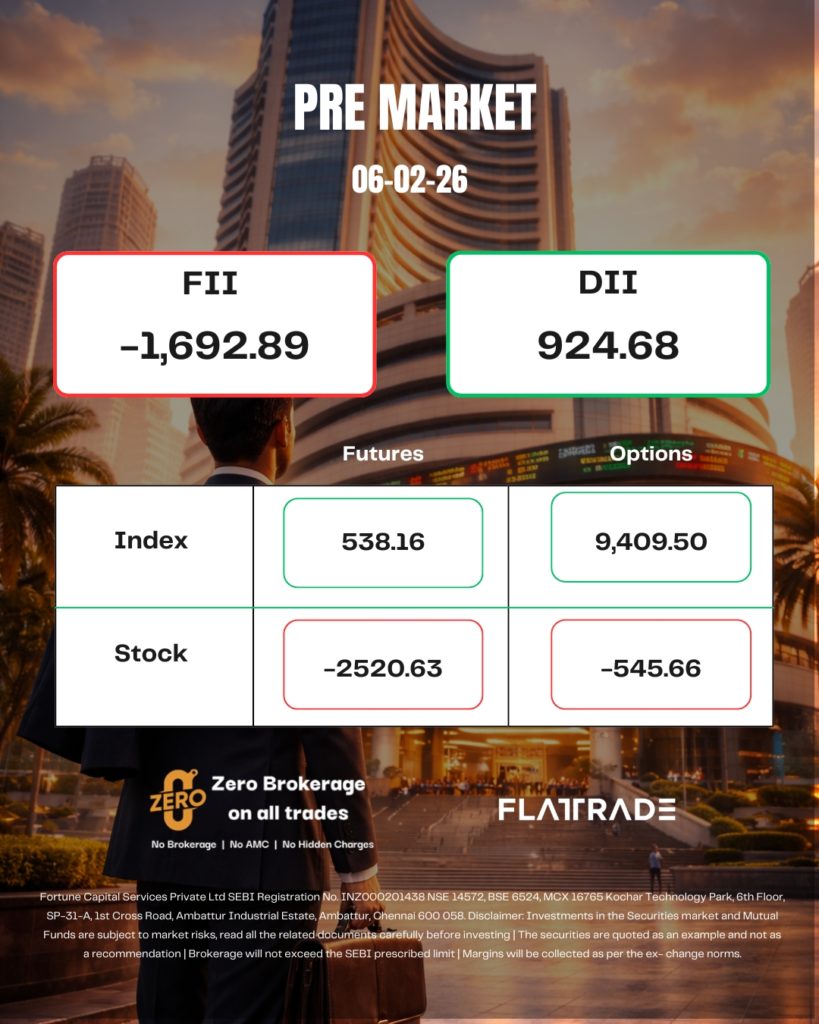

PRE MARKET

Gift Nifty indicates a negative start for the broader index in India, with a loss of 83.50 points or 0.33 percent. The Nifty futures were trading around the 25,617.50 level.

Wall Street ended sharply lower on Thursday, with the Nasdaq dragged to its lowest since November by losses in Microsoft, Amazon, and other tech heavyweights after Alphabet said it could double capital spending on AI in the race to dominate the emerging technology.

The S&P 500 declined 1.23% to end the session at 6,798.40 points. The Nasdaq declined 1.59% to 22,540.59 points, while the Dow Jones Industrial Average declined 1.20% to 48,908.72 points.

Asian stocks extended losses into a second day in early trading on Friday as a selloff on Wall Street intensified, with precious metals and cryptocurrencies gripped by wrenching volatility.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.9%, led by a 5% dive in South Korea’s Kospi, which triggered a brief trading halt shortly after the open.

STOCKS IN NEWS

Federal Bank

The Reserve Bank of India has approved Asia II TopCo XIII Pte to acquire an aggregate holding of up to 9.99 percent of the paid-up share capital or voting rights of Federal Bank.

UltraTech Cement

The company announced the commissioning of an additional grinding capacity of 2.7 mtpa at its Aligarh unit in Uttar Pradesh. With this commissioning, the total cement grinding capacity of the Aligarh unit now stands at 4.0 mtpa, increasing the company’s capacity in Uttar Pradesh to 13.1 mtpa. With this addition, UltraTech’s total domestic grey cement manufacturing capacity stands at 191.36 mtpa. Along with its overseas capacity of 5.4 mtpa, the company’s global capacity now stands at 196.76 mtpa.

Unicommerce Esolutions

SuperYou, the consumer nutrition brand co-founded by Ranveer Singh and Nikunj Biyani, has partnered with Unicommerce to streamline its e-commerce and quick commerce (Q-com) operations. As part of the partnership, the brand has adopted Unicommerce’s flagship platform, Uniware, to manage orders and inventory across Q-com platforms, marketplaces, and its own D2C website.

Cartrade Tech

Oaklane Capital Management LLP has acquired 3.8 lakh shares (0.79 percent stake) in CarTrade Tech at Rs 2,232.93 per share, amounting to Rs 84.85 crore. Meanwhile, Mobius Investment Trust Plc sold 2.42 lakh shares (0.5 percent stake) at Rs 2,176.59 per share, valued at Rs 52.67 crore.

Source – Moneycontrol