An NFO, or New Fund Offer, is the launch of a new mutual fund scheme by an Asset Management Company (AMC) to raise money from investors. During the NFO period, investors can subscribe to the fund at an initial offer price, usually ₹10 per unit. The subscription window is limited, typically open for a few days to a couple of weeks.

After the NFO closes, the fund begins investing according to its stated objective, and the Net Asset Value (NAV) starts moving based on market performance.

For example, if an AMC launches an AI-themed equity NFO, it may invest in companies linked to artificial intelligence and related technologies – giving investors exposure to a theme that may not be covered by their existing funds.

Important to note: A ₹10 NFO price does not mean the fund is “cheap.” It is simply a starting NAV – not a valuation signal.

Types of NFOs

Open-ended funds

These continue to allow purchases and redemptions even after the NFO period. Investors transact directly with the fund house at the prevailing NAV.

Close-ended funds

These issues are fixed in a fixed number of units during the NFO period and are later listed on exchanges. They typically have a defined maturity period, usually ranging from 3 to 5 years. Liquidity depends on exchange trading.

Interval funds

These combine the features of open and close-ended funds. Buying and redemption are allowed only during specific pre-announced intervals.

Why Investors Consider NFOs?

Strategy or theme access

NFOs sometimes introduce new strategies, sectors, or themes not available in existing schemes.

Portfolio diversification

They may help investors add exposure to a new category or asset mix.

Structured mandate

New funds often come with clearly defined mandates and allocation frameworks from day one.

What to Evaluate Before Investing in an NFO?

Fund house and manager track record

Since the fund itself has no performance history, review the AMC’s track record and the fund manager’s experience.

Fund objective and strategy

Read the Scheme Information Document (SID). Check asset allocation, benchmark, risk level, and investment approach.

Expense ratio

Costs directly affect returns. Compare expected expense ratios with similar existing funds in the same category.

Risk profile

Sectoral and thematic NFOs can be more volatile. Make sure the fund’s risk level matches your comfort and goals.

Liquidity and lock-ins

Check lock-in periods, exit loads, and redemption rules, especially for close-ended or interval funds.

Existing alternatives

Always compare the NFO with established funds in the same category. A new fund is not automatically a better fund.

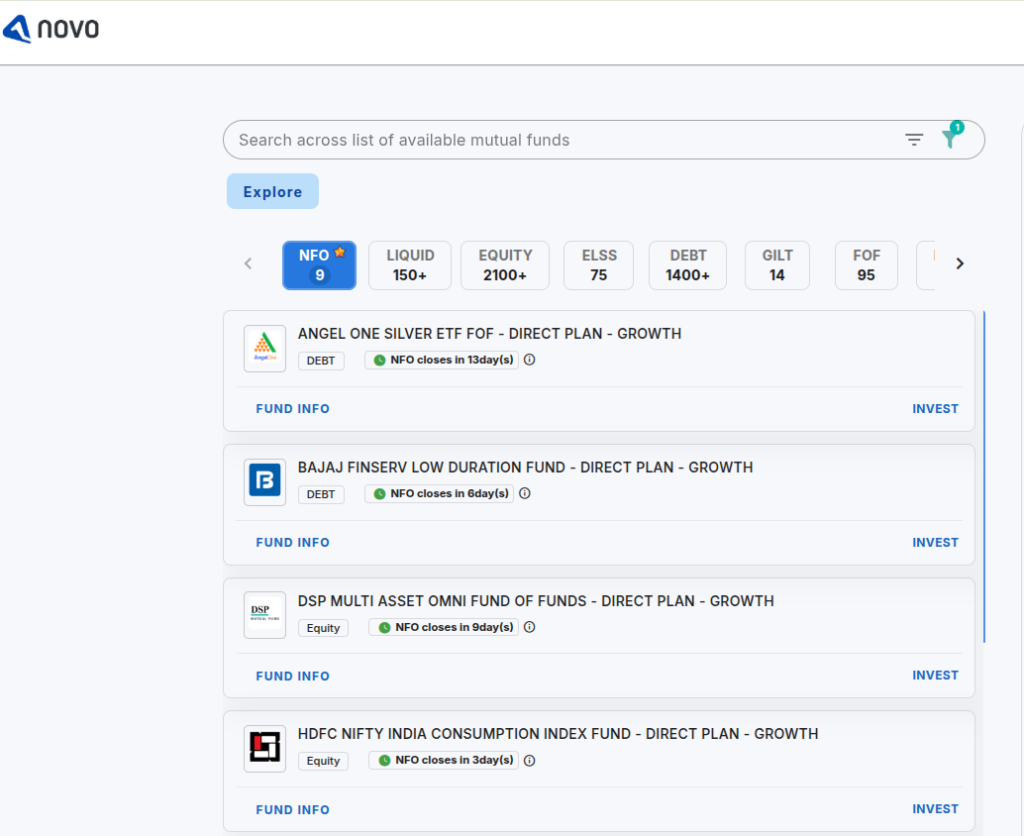

How to Invest in an NFO via Novo?

- Log in to the Novo app or web platform

- Use filters to view currently open NFOs

- Select your preferred scheme

- Invest via SIP or lump sum (if allowed by the scheme)

Important Notes for NFO Investors

- NFO units cannot be redeemed until allotment is completed

- NAV becomes active only after the fund deploys capital

- Minimum investment amounts vary by scheme

- Sectoral and thematic NFOs may carry a higher risk

- Always read scheme documents before investing

For more details, visit the Flattrade support page: https://flattrade.in/support/