POST MARKET

Indian equity markets ended lower on February 12, snapping a four-day winning streak, amid fresh concerns over the impact of artificial intelligence on IT stocks.

At close,

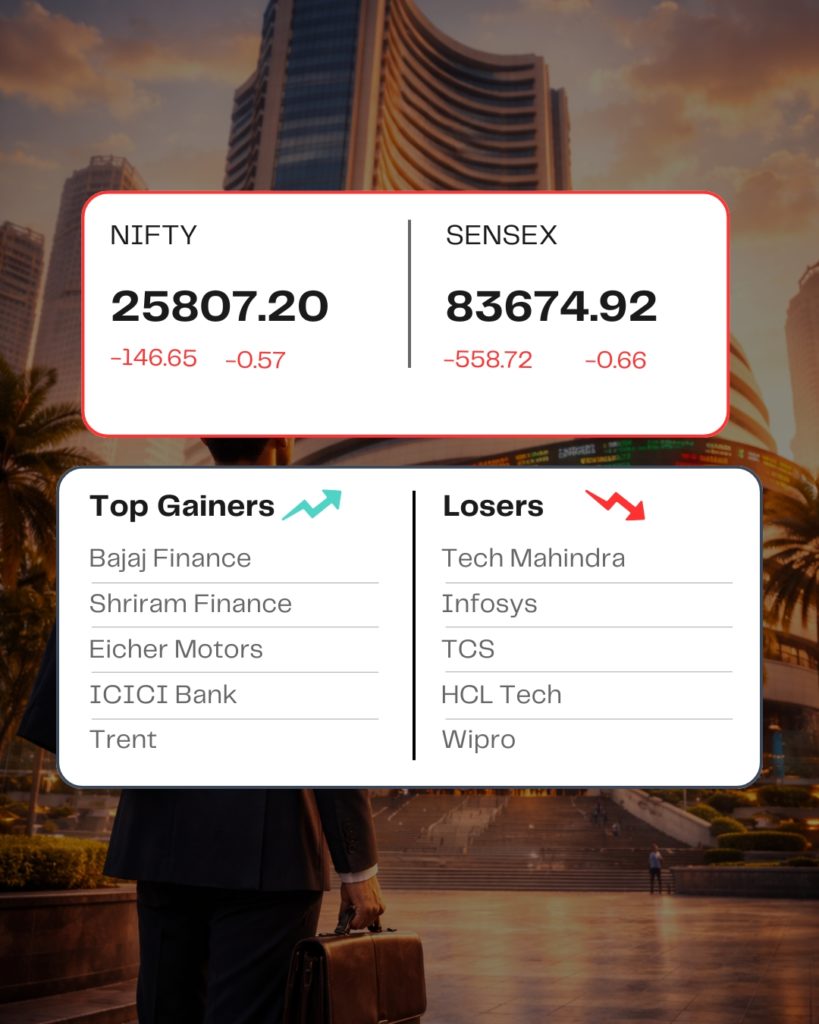

Sensex ↓↑ down 558.72 points or 0.66 percent at 83,674.92

Nifty ↓ down 146.65 points or 0.57 percent at 25,807.20.

About 1610 shares advanced, 2431 shares declined, and 141 shares were unchanged.

Top gainers – Bajaj Finance, Shriram Finance, Eicher Motors, ICICI Bank, Trent

Top losers – Infosys, TCS, Tech Mahindra, HCL Technologies, and Wipro.

Among sectors, except Consumer Durables (up 0.4%), all other indices ended in the red with the IT index sheds 5% and oil & gas, media, and realty down 1% each.

Among the broader market indices, the Nifty midcap and smallcap indices fell 0.5% each.

STOCKS IN NEWS

Infosys

The shares of the Indian IT company tumbled almost 6 percent along with other IT shares on February 12, accompanying Wall Street peers after the better-than-expected January jobs report failed to boost investor sentiment with unemployment rate falling unto 4.3%, and concerns around AI-led disruptions.

Shadowfax Technologies

Shares of Shadowfax Technologies hiked almost 5 percent after the company reported a consolidated net profit of Rs 34.86 crore for the October-December quarter of the ongoing financial year 2026 on February 12. This marks a whopping 440 percent year-on-year (YoY) increase from the Rs 6.46 crore net profit reported in the same period of the previous financial year.

LG Electronics India

Shares of LG Electronics India Ltd declined 3.21 percent after the company reported a 61.58 percent year-on-year fall in its net profit to Rs 89.67 crore for the December quarter of FY26. The company had posted a net profit of Rs 233.45 crore in the October-December quarter of the previous financial year, LG Electronics India Ltd said in an exchange filing.

Avanti Feeds

The shares of Avanti Feeds rallied up 20 percent on February 12 after the shrimp feeds company reported strong earnings for the October-December quarter of the ongoing financial year 2026. The company reported a consolidated net profit of Rs 149.38 crore for the third quarter of FY26, marking a 10.5 percent year-on-year (YoY) increase.

Eternal

Shares of delivery tech firm Eternal (parent of Zomato) fell up to 1.1 percent on February 12 as a report said IPO-bound e-commerce major Flipkart is exploring a food delivery launch, while trying to identify a differentiated positioning in the space.

Source – Moneycontrol